India has put GST rate changes on hold until inflation is under control

Most essentials in a 5% slab But the centre and the states agree that given India's high inflation, now may not be the right time for such an exercise. Fewer p

- by B2B Desk 2022-05-26 05:58:47

Simplification of the goods and services tax (GST) rates is likely to be delayed due to inflationary pressures and geopolitical tensions, a senior Treasury Department official said commenting on the economy, asset sales and the program. of government loans.

The centre obtained legal advice on the sale of Pawan Hans and Central Electronics Ltd (CEL), which ran into complications amid accusations against the winners, the official said.

The government's store is disorganized with a prêt plan on the market and exploration of other options to leverage funds in order to compensate for the loss of food subsidies and engrais and the loss of income due to measures to contain inflation these last days.

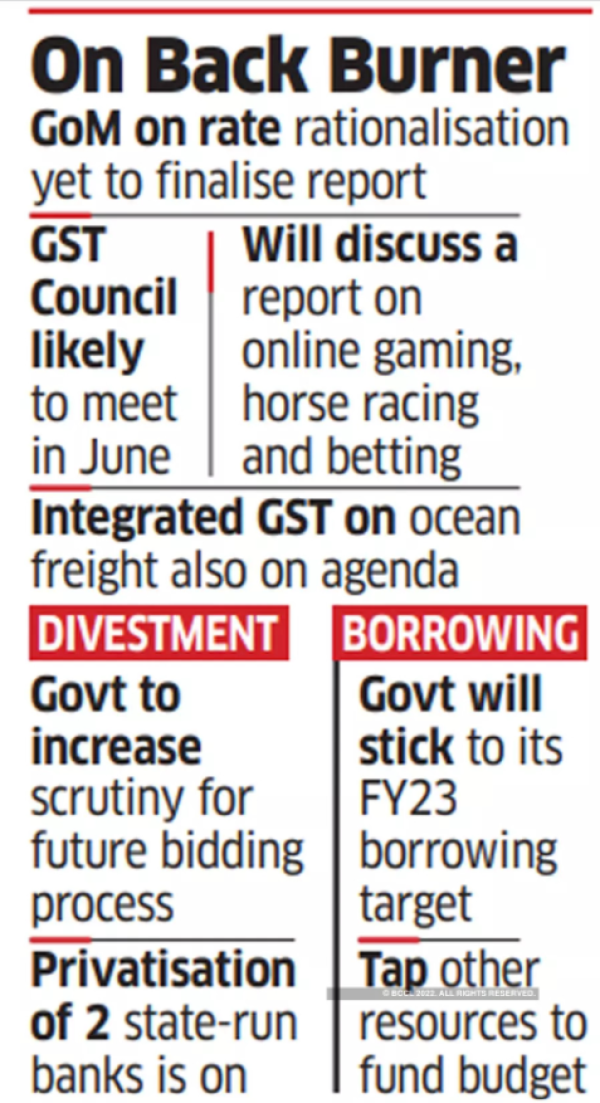

The Group of Ministers (GoM) set up by the GST Council to review tax rates has not yet finalized its report.

Most essentials in a 5% slab

But the centre and the states agree that given India's high inflation, now may not be the right time for such an exercise. Fewer plates would mean GST could rise on some items, making products more expensive at a time when consumer inflation has hit an eight-year high of 7.79 percent.

"Rationalizing rates is difficult with this inflation and we will have to wait for the situation to improve," the official said.

The GST Council should meet in June. It is expected to pick up on the report of another GoM headed by Meghalaya Chief Minister Conrad Sangma, who reportedly favors the higher rate of 28% for online gambling, racing and casinos. The Council is also expected to discuss the integrated GST for shipping, which was struck down by the Supreme Court in a recent decision.

Last year, the council set up a GoM headed by Basavaraj Bommai, the chief minister of Karnataka, to propose changes to the GST rate structure. He was tasked with proposing rate changes to correct reverse tax structures and reduce the number of GST plates to just three from the existing 5%, 12%, 18% and 28%.

ET had indicated that states preferred not to change interest rates due to high inflation. The most important things are included in the 5% plate.

Disinvestment

The Centre is investigating the divestments of Pawan Hans and CEL before deciding on its course of action.

“We are legally considering whether to restart the process or rehire existing bidders,” the person said, adding that the government was seeking input from the Justice Department.

The government will take a closer look at the divestment process to avoid similar situations. It will advance in the privatization project of two public banks and will seek to complete the process this fiscal year, which will allow it to have additional resources.

The government has budgeted Rs 65,000 crore for divestments in FY23. The centre will need all the resources it can muster to finance food and fertilizer subsidy bills, which may exceed the budget allocation of around 1,80 thousand million rupees.

The government will also lose tax revenue due to recent measures to contain inflation. The centre on Saturday announced a cut in excise duties on petrol and diesel that is expected to result in a loss of revenue of around Rs 1,000 crore a year. Cuts in import tariffs on steel and plastic inputs and the removal of tariffs on some cooking oils will also contribute to revenue losses.

Borrowing Plan

Officials have indicated that the government will stick to its FY23 borrowing target. It may turn to other resources to finance the budget and even borrow from the Consolidated Fund of India, courtesy of Parliament, to continue its infrastructure spending program, the cornerstone of its recovery. plan.

“We have discussed the impact on revenue and may opt for other resources including the India Consolidated Fund loan,” the official said, adding that the centre is within its GB Pound7.5bn budgeted capital expenditure not to cut the FY23. sources had indicated that the centre may need additional loans of Rs.1 lakh crore.

Also Read: The government is exempted from making an open offer to VIL shareholders by the Sebi

POPULAR POSTS

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

by Shan, 2025-12-05 11:49:44

Zoho Mail vs Gmail (2025): Which Email Platform Is Best for Businesses, Startups, and Students?

by Shan, 2025-10-09 12:17:26

PM Modi Launches GST Bachat Utsav: Lower Taxes, More Savings for Every Indian Household

by Shan, 2025-09-24 12:20:59

$100K H-1B Visa Fee Explained: Trump’s New Rule, Clarifications & Impact on Indian Tech Workers

by Shan, 2025-09-22 10:11:03

India-US Trade Deal Soon? Chief US Negotiator Arrives in Delhi as Talks Set to Begin Tomorrow

by Shan, 2025-09-15 11:54:28

Modi Meets Xi: Trump’s Tariffs, Strategic Autonomy, and the Future of Asia’s Power Balance

by Shan, 2025-09-03 06:40:06

RECENTLY PUBLISHED

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Best Silver Investment Platforms for 2025: From CFDs to Digital Vaults Explained

- by Shan, 2025-10-23 12:22:46

Subscribe now

Subscribe now