Impact of GST on Gold - Everything you need to know!

GST on gold, GST on gold jewellery and GST on gold coins Investment bars fall within the definition of "goods" under the GST Act. According to article 7 of the

- by B2B Desk 2022-05-16 08:51:49

Impact of GST on Gold and Gold Jewellery Prices

GST on gold in various forms can be discussed at length. GST includes VAT, Service Tax, Excise Tax and various other indirect taxes levied on domestic transactions. The gold jewellery crafting fee has been introduced as part of GST. On the other hand, the basic duty on gold imports from other countries and the IGST tax will continue to be levied.

Gold price comparison before and below GST

For comparison, the price of pure gold, bullion, or bullion includes the cost of mining and processing the gold and the profit margin, but not the manufacturing cost. However, the price of gold jewelry also comes with manufacturing costs. Until June 30, 2017, taxes such as VAT and service tax were added to the price. It was subsequently replaced by the GST.

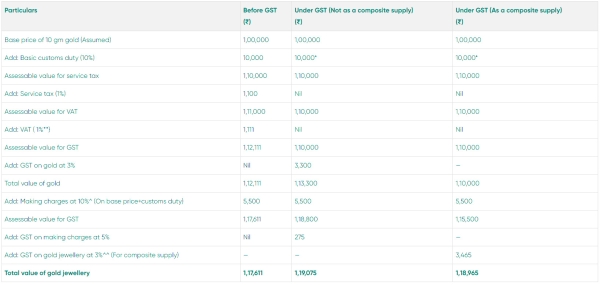

Let's take an example of importing gold jewellery and compare pre-GST and GST prices as follows:

- *The customs duty rate was increased to 12.5% from the earlier 10% vide Finance Act 2019.

- **Assuming to be 1%, may vary with the state/UT

- ^Making charges vary with every jeweller. We are assuming it to be 10% in this case.

- ^^If the supply of gold jewellery is considered a composite supply, then the GST rate chargeable on the gold jewellery, including making charges, is 3%. Supply of gold is considered as the principal supply.

From the above comparison between "before GST" and "under GST, as a composite delivery", we can see a price increase of Rs 1,354, an increase of about 1.1% with GST. The price increase is due to the increase in the tax rate from 2% to 3% under GST on pure gold or bullion.

Additionally, GST is newly levied on manufacturing costs and was previously not included in the old excise tax regime. These factors contributed to the price increase.

The 2019 budget also raised tariffs on imported gold bullion from outside India. It is 12.5% versus the previous rate of 10%.

GST on gold, GST on gold jewellery and GST on gold coins

Investment bars fall within the definition of "goods" under the GST Act. According to article 7 of the CGST law, the delivery of gold (excluding salaried work) is assimilated to the delivery of goods.

Under the terms of article 8 of the CGST law, the sale of gold ornaments or jewellery to ordinary mortals constitutes a delivery consisting of goods and services. The gold used is considered merchandise and the charge or valuation is for the work. Since the main service is the sale of gold, the GST rate of 3% instead of 5% will be applied to the total value of the jewelry, whether the charges are itemized or not. The CBIC has clarified this in their Industry FAQ.

The GST registration thresholds that generally apply to ordinary taxpayers also apply to companies engaged in gold mining and distribution. In addition, the composition under article 10 of the CGST law is available to companies that sell gold.

Many gold dealers or sellers or jewellers use the services of goldsmiths and specialists who perform contract work on the gold bars or gold biscuits they supply to create jewellery. It is considered a service. Goldsmiths charge 5% GST for their service known as fees. If these goldsmiths or specialists are not registered for GST, the gold dealer or jeweller must pay GST at 5% based on the reverse charge.

Consumers who contact the goldsmith themselves will also be charged 5% GST if the goldsmith is GST registered.

GST is not charged when unregistered persons sell gold jewellery or trade gold decorations for new ones at jewellery stores. It is not considered a commercial promotion and does not include GST. However, when gold dealers or companies like Attica Gold Company, Ashraya Gold Company or Manappuram Gold Loan etc. buying and selling used gold jewellery, GST will be charged on the value of that gold calculated in accordance with Rule 32(5) of the CGST Rules. , once the conditions are met.

Jewellery repair work is considered a manufacturing cost for which 5% GST will be charged separately.

What are the GST rates for gold jewellery?

Are there GST exemptions for gold?

A GST exemption was announced at the 31st GST Council meeting on December 22, 2018. Accordingly, no GST will be charged for the supply of gold manufactured by the Notified Body to jewelry exporters in GST registered gold. .

This decision reduced the GST burden for Indian gold jewelry exporters and likely made Indian gold exports more competitive in the global market. However, domestic buyers of gold jewelry are not affected.

E-Way invoicing rules for gold and its forms.

CGST Rule 138(14) states that an electronic bill of lading is not required for the transport of gold in any form, including jewellery, gold products and gold work (Chapter 71). Whether the gold supplier or recipient is GST registered or not, they can transport gold without an electronic guide.

Availability of pre-tax credits in the gold sector

The jeweler or gold dealer can claim the input tax credit (ITC) paid on the raw materials used, i.e. the gold incurred and other labor costs. Even if the gold dealer pays the tax on a reverse charge basis for providing an unregistered worker, he can claim ITC on that tax.

Gold, GST and the unorganized sector

With only 30% of the gold market organized in India, GST has been welcomed as a major player in the organized market. It was seen as a solid way to bring transparency to gold trading. The disorganized gold sector was looking for concrete reforms and the implementation of the GST provided a much better legal framework for buying gold.

It is worth noting here that while there appears to be a significant increase in the price of gold, GST also allows for the Input Tax Credit (ITC). This helped gold market participants receive tax credits for their external supplies, which ultimately reduced their liability and encouraged many unorganized players to switch to the organized market.

This decision will help these disorganized players attract soft loans and give them more authenticity to attract credible customers. The introduction of GST has opened up more opportunities for smaller gold companies to move up the organized value chain.

Also Read: Best Pharma Stocks in India

POPULAR POSTS

GST 2.0 Rollout Begins: New 5% & 18% Tax Slabs, Cheaper Essentials, and Helpline 1915 Explain

by Shan, 2025-09-22 10:20:19

GST Overhaul Explained: New 5% and 18% Slabs, 40% Tax on Luxury Goods

by Shan, 2025-09-04 11:53:34

Modi’s Diwali Gift: New GST Rates Slash Prices on Electronics, FMCG & More

by Shan, 2025-08-21 12:28:30

Jio Finance Launches Income Tax Filing at ₹24: How to File ITR Easily in 2025

by Shan, 2025-08-13 10:08:52

Income Tax Bill 2025: Lok Sabha Panel Backs Deductions for Late Filers

by Shan, 2025-07-22 12:28:58

Karnataka GST Crackdown: Why Shopkeepers Are Ditching UPI Payments

by Shan, 2025-07-16 12:14:56

GST Council Likely to Consider Lowering Tax on Online Food Delivery Fees

by B2B Desk, 2024-12-17 08:26:30

RECENTLY PUBLISHED

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

- by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

- by Shan, 2025-12-05 11:49:44

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Subscribe now

Subscribe now