The government is exempted from making an open offer to VIL shareholders by the Sebi

The regulator found that VIL has to pay a significant amount of money to the government, which could potentially weigh on the company's finances. In addition,

- by B2B Desk 2022-05-26 05:04:42

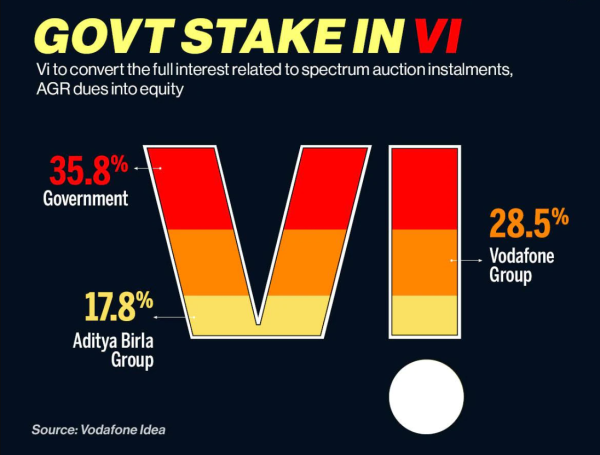

Market regulator Sebi on Wednesday exempted the government from making an open offer to shareholders of Vodafone Idea Ltd (VIL) in line with its plan to acquire more than 33% of the telecom operator's capital in a share-to-equity conversion. In a nine-page injunction, Sebi said it is proposing that the Government of India (GoI) take over the stake in VIL for the sole purpose of salvaging the general public interest.

“Furthermore, the Government of India does not intend to participate in the management or board of the VIL and there will be no change of control over the VIL. Furthermore, such participation in the Government of India is classified as a public participation.” Sebi said in making the waiver to make the open offer.

The regulator found that VIL has to pay a significant amount of money to the government, which could potentially weigh on the company's finances.

In addition, an open government tender obligation means huge sums of money are leaving the Indian government, S.K. Mohanty, the permanent member of Sebi, said in an executive order.

He also mentioned the public order and public interest involved in the whole transaction and discussed various measures taken by the Government of India to facilitate liquidity and cash flow of telecom service providers and to help various banks that operate in the telecom sector on a significant scale are. Sector.

Citing those reasons, he said, "I believe it appropriate to grant the acquirer an exemption from the open offer requirements as set out in the ... Acquisition Rules."

Under the rules, companies that acquire a 25% stake or more in a public company must make an open offer to the company's shareholders.

As part of the bailout of the indebted telecom sector, the government last September gave telecom operators a chance to pay interest on the 4-year deferral of AGR's deferred spectrum and license fees by converting shares into equity.

As part of the government bailout program, VIL decided to convert debt into equity.

On May 10, VIL filed an open offer waiver application for the government to acquire a stake in the company.

After the transaction, GoI would hold a 33.44% stake in the telecom operator.

Also Read: Top 10 Best Laptops for students in India 2022 (May)

POPULAR POSTS

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

by Shan, 2025-12-05 11:49:44

Zoho Mail vs Gmail (2025): Which Email Platform Is Best for Businesses, Startups, and Students?

by Shan, 2025-10-09 12:17:26

PM Modi Launches GST Bachat Utsav: Lower Taxes, More Savings for Every Indian Household

by Shan, 2025-09-24 12:20:59

$100K H-1B Visa Fee Explained: Trump’s New Rule, Clarifications & Impact on Indian Tech Workers

by Shan, 2025-09-22 10:11:03

India-US Trade Deal Soon? Chief US Negotiator Arrives in Delhi as Talks Set to Begin Tomorrow

by Shan, 2025-09-15 11:54:28

Modi Meets Xi: Trump’s Tariffs, Strategic Autonomy, and the Future of Asia’s Power Balance

by Shan, 2025-09-03 06:40:06

RECENTLY PUBLISHED

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Best Silver Investment Platforms for 2025: From CFDs to Digital Vaults Explained

- by Shan, 2025-10-23 12:22:46

Subscribe now

Subscribe now