From Seed to Scale: Understanding the 7 Startup Funding Stages

- by B2B Desk 2024-07-26 10:37:55

Launching a business is a complex and demanding endeavor. The first crucial step involves identifying a problem and crafting a solution that addresses the needs of a particular audience. However, even the most innovative ideas won't come to fruition without securing the necessary funding.

The financial requirements for starting a business can vary greatly depending on its nature. Without adequate funding in the early stages, covering essential expenses can become a major challenge, potentially leading to the failure of your venture.

In fact, a lack of financial resources was behind 47% of startup failures last year. For anyone leading a new venture, it's essential to understand the different Startup Funding stages to effectively manage this vital aspect of your business.

What is Startup Funding?

Startup funding is the financial support that a new business receives to either launch or expand its operations. This money typically comes from investors who are willing to back your venture with the hope of a substantial return if your business succeeds.

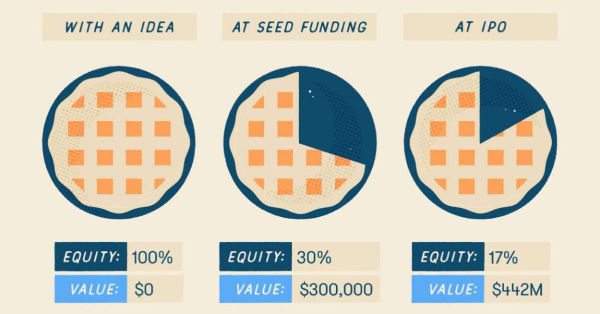

Investors provide capital upfront, betting on the future success of your startup. In exchange, they might gain some level of influence over key decisions that guide the company’s direction.

While some startups choose to self-fund to keep full control and avoid taking on debt, many opt for external funding, especially as they grow. Understanding the Startup Funding Stages is crucial for these businesses. The primary goal for most startups seeking funding is to scale their operations—this includes developing their products, hiring additional staff, and reaching a broader customer base.

Types of Funding for Startups

Choosing the right type of funding for your startup depends on your specific needs and objectives. Before diving into the stages of startup funding, let's explore some common sources of financial support available to new ventures:

Bootstrapping: This involves funding your startup using your own resources, such as personal savings, side jobs, or revenue from early customers. It’s a way to maintain complete control over your business without outside interference.

Angel Investors: These are wealthy individuals who invest their personal funds in startups in exchange for a potential return on their investment. They often bring valuable experience and networks to the table.

Friends and Family: Founders sometimes turn to friends and family for financial support, either as investments or loans. This can be a quick way to secure initial funds, though it can also bring personal relationships into the business equation.

Venture Capital: Professional investors provide venture capital to startups with high growth potential and a solid track record. This type of funding often involves giving up some equity in your company and may include significant involvement in strategic decisions.

Crowdfunding: This approach involves raising money from a large number of people, usually via online platforms. It’s an effective way to gather small contributions from many supporters and gauge market interest in your product or service.

How Funding Rounds Work

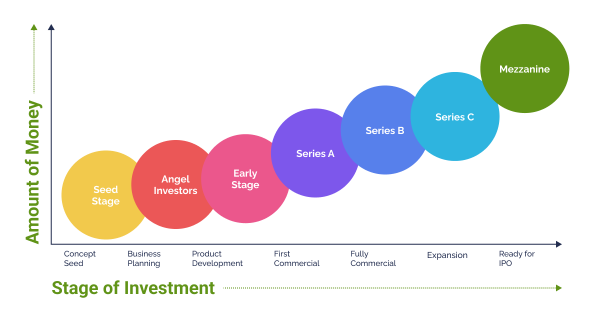

Startup funding is structured in various stages, each designed to help the business reach new milestones and support its growth. The typical phases of the funding process include:

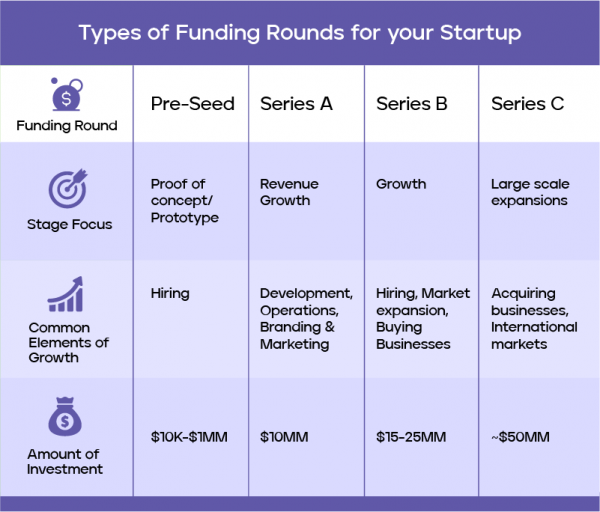

Pre-Seed: This is the initial stage where entrepreneurs often use personal funds or early support from close contacts to get their idea off the ground. At this point, the focus is usually on developing a prototype or business plan.

Seed: During this phase, startups seek capital to refine their product, establish market fit, and build a team. Seed funding often comes from angel investors or early-stage venture capitalists.

Series A: At this stage, the business has demonstrated some success and is looking for significant investment to scale operations, enhance the product, and expand its market reach. Series A funding typically involves professional venture capital firms.

Series B: This round is aimed at further scaling the business, optimizing its operations, and expanding into new markets. Series B investors are often looking for companies that have shown substantial growth and potential for continued success.

Series C: By the Series C stage, the company is usually well-established and seeking funds to accelerate its growth even further, such as through acquisitions, international expansion, or product diversification.

Series D and Beyond: If a company continues to grow and requires additional funding, it may enter Series D or later rounds. These rounds are often used for more strategic purposes, like preparing for an IPO or making significant capital investments.

In each funding round, the company’s valuation is typically negotiated with investors, and new shares are issued in exchange for their investment. As the startup proves its growth potential and attracts more investors, its valuation generally increases.

Startup Funding Stages You Should Know About

Essential Startup Funding Stages Every Entrepreneur Should Understand

Pre-Seed Funding: The Bootstrapping Stage

Pre-seed funding is the very beginning of a startup's financial journey. At this stage, the capital typically comes from the founders’ personal savings or contributions from family and friends. Since the startup is just an idea with no established track record, pre-seed funding is considered high risk. Nevertheless, it's a crucial step that helps get the business off the ground, paving the way for the next stage of funding to further develop the product.

Seed Funding: Product Development Stage

Seed funding follows the pre-seed phase and is the startup’s first formal equity investment. This round is crucial for transitioning from idea to tangible product. It provides the capital needed to build prototypes, attract initial customers, and start generating revenue. In exchange for their investment, seed investors receive equity in the company. This stage is essential for turning the concept into a market-ready product and establishing a foundation for growth.

Series A Funding

Series A funding marks the entry of venture capitalists into the startup’s financial journey. This stage involves substantial investment aimed at scaling operations, enhancing product offerings, expanding the team, and boosting marketing and sales efforts. The goal of Series A funding is to help the startup move from initial development to substantial growth, setting the stage for significant revenue generation and progress toward profitability.

Series B Funding

Following Series A, Series B funding provides additional capital to continue expanding the business. This phase focuses on accelerating growth, entering new markets, and investing in new product lines or initiatives. Series B funding is designed to help the startup achieve key milestones such as increased revenue and market penetration, supporting continued growth and operational scaling.

Series C Funding

Series C funding is sought by startups that have achieved a level of success and are ready for further expansion. This stage provides significant capital to support ongoing growth strategies, including entering new geographic markets, acquiring other companies, or launching new products. The aim of Series C funding is to scale operations effectively and achieve substantial, sustainable growth.

Series D Funding

Series D funding is typically pursued when a startup seeks additional resources beyond what was achieved in Series C. This round of funding is used to address specific opportunities or challenges, such as entering new markets or making strategic acquisitions. Series D provides the capital needed to support continued growth and capitalize on emerging business opportunities.

IPO: Stock Market Launch

An Initial Public Offering (IPO) is a major milestone in a startup’s evolution. During an IPO, the company offers shares to the public and lists them on a stock exchange. This process allows the startup to raise significant capital and provides liquidity for existing shareholders. Going public transforms the company from a privately-held entity to a publicly-traded one, offering broader financial opportunities and enhancing its market presence.

Sources of Startup Funding

Securing the right source of funding for your startup can be a complex process, but there are various options available throughout the different stages of your business's growth. Here’s a look at some common types of investors and funding sources you might encounter:

Friends, Family, and Relatives: Funding from personal connections usually involves less formal agreements, such as loans or investments made without official contracts. Even though these arrangements might seem casual, it's important to handle them with professionalism and clarity. Clearly outline and document all terms to ensure that everyone involved understands their roles and expectations, which helps maintain good relationships and avoid potential misunderstandings.

Venture Capitalists: Venture capitalists are discerning investors who look for high-growth potential in technology-driven startups. They often seek equity in return for their investment and might also require a role in the company's management or decision-making processes. Some startups engage investor matchmaking services to connect with suitable venture capitalists.

Angel Investors: Angel investors are affluent individuals who use their personal wealth to support startups in exchange for equity. Unlike venture capitalists, angel investors invest their own money and often provide mentorship and strategic advice. To understand the distinctions between angel investors and venture capitalists, you might consider resources like “Angel Investor vs. Venture Capitalist: What’s the Difference?”

Crowdfunding: Crowdfunding is a process where a startup raises funds by collecting small contributions from a large number of people, usually via online platforms. This approach not only provides the necessary capital but also helps validate the business idea and connect with potential customers. In exchange for their support, contributors may receive equity in the company or various rewards, depending on the structure of the campaign.

Investment Banks: Investment banks offer debt financing options, which involve borrowing funds that need to be repaid with interest. Banks usually prefer businesses with a solid credit history and financial stability. For insights into how investment banks differ from venture capitalists, you might explore resources like “Venture Capital vs. Investment Banking: Key Differences.”

Incubators and Accelerators: These organizations provide comprehensive support to startups, including funding, mentorship, and access to a network of industry contacts. Incubators and accelerators can help accelerate your business's growth by offering resources and guidance during critical early stages.

Corporate Venture Capitalists: Corporate venture capitalists work within larger companies and invest in startups that align with their parent company’s strategic interests. These investors can provide not only capital but also valuable industry connections and business opportunities.

Government Grants: Some startups can access funding through government grants, especially if they operate in certain industries or sectors. While this funding does not require repayment, the application process is often competitive and can involve extensive documentation and criteria.

Each funding source has its own set of requirements and expectations. By exploring these different options, you can find the best fit for your startup's needs and increase your chances of securing the necessary capital to achieve your business goals.

Conclusion

Understanding the various sources and stages of startup funding is vital for any entrepreneur aiming to transform an idea into a successful business. From the initial pre-seed phase where personal connections and early investments play a crucial role, to the more structured rounds of venture capital and corporate funding, each stage offers distinct opportunities and challenges. By carefully selecting the right type of funding and approaching each stage with professionalism and strategic planning, you can secure the financial support needed to grow and scale your startup effectively. Remember, successful navigation through the funding stages not only provides the capital necessary for growth but also strengthens your startup’s foundation, paving the way for long-term success.

FAQs

Q. What is the lifecycle of startup financing?

A. Generally, market participants agree on the major equity-funding stages as: Angel and Seed, Early Stage (Series A and B), Late Stage (Series C and D) and Growth Stage (Series E to Exit). Venture debt is most often utilized by Series B through Series D startups.

Q. What are the 5 phases of the startup growth lifecycle?

A. The startup lifecycle according to Morgan Brown. Morgan Brown defines the five phases of the startup life cycle as problem solution fit, MVP, product market fit, scale, and maturity.

Q. What are the 4 steps of funding?

A. There are typically four stages of startup funding: Seed, Series A, Series B, and Series C. Seed is your first investment to even get started. Series A funding is typically used to finance the initial product development and launch.

Q. How many rounds are in start up funding?

A. There are multiple stages of startup funding: Seed, Series A, Series B, Series C, and so forth. Startups should be conscientious about the funding rounds that they will go through, which are generally based on the current maturity and development of the company. Here's an overview of the major startup stages.

Also Read: Zero Investment Business Ideas in IndiaPOPULAR POSTS

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

by Shan, 2025-11-05 09:57:07

India’s Largest Unicorn Startups in 2025: Rankings, Valuations, and Trends

by Shan, 2025-09-18 10:32:48

Swiggy Launches Toing App in Pune to Serve Affordable Food Delivery — What It Means for the Market

by Shan, 2025-09-16 12:29:08

Trending Startup Ideas for 2025: Where Innovation Meets Opportunity

by Shan, 2025-09-05 11:56:43

19 Best Business Ideas to Start in India 2025: From Low Investment to High Demand

by Shan, 2025-09-03 10:58:15

Razorpay Business Model Explained: How the Fintech Giant Makes Money in India

by Shan, 2025-08-05 12:10:28

How CRED Reimagined Credit Card Rewards into a Billion-Dollar Fintech Empire

by Shan, 2025-08-04 12:28:03

RECENTLY PUBLISHED

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

- by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

- by Shan, 2025-12-05 11:49:44

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Best Silver Investment Platforms for 2025: From CFDs to Digital Vaults Explained

- by Shan, 2025-10-23 12:22:46

Subscribe now

Subscribe now