Decoding SIP Taxation Post-Budget 2024: What You Should Know

- by B2B Desk 2024-07-24 11:25:54

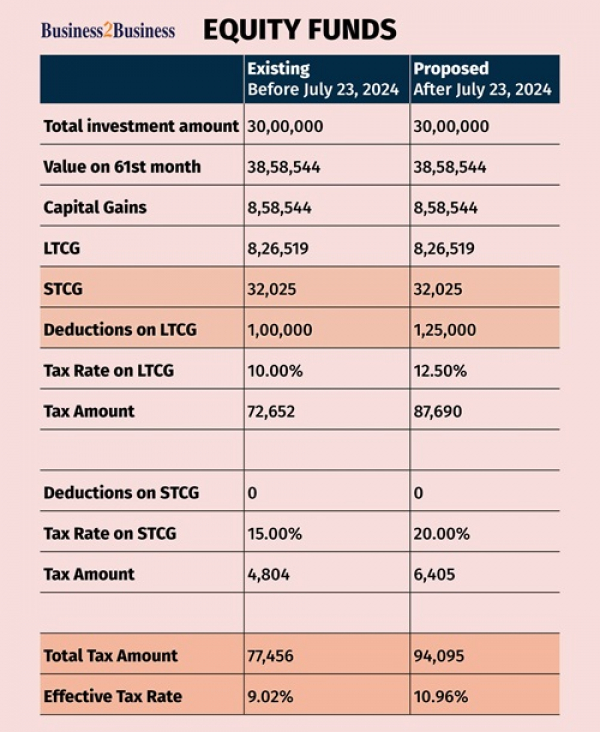

The latest Union Budget has introduced higher taxes on Short Term Capital Gains (STCG) and Long Term Capital Gains (LTCG) from equity-oriented funds. Consequently, an investor putting Rs 50,000 into equity funds every month for 60 months via a Systematic Investment Plan (SIP) would now face a capital gains tax bill of Rs 94,095, compared to the current Rs 77,456. This adjustment reflects a significant increase in tax obligations for SIP investors in equity funds following the budget revisions.

Mutual fund investors are facing a significant setback with the recent government decision to raise taxes on equity-oriented funds. In the Union Budget announced on July 23, the Short Term Capital Gains (STCG) tax on equity mutual funds has been increased from 15 percent to 20 percent. Additionally, the Long Term Capital Gains (LTCG) tax rate on equity funds has been raised to 12.5 percent, up from the previous 10 percent. This move represents a dual blow for investors in these funds.

On the positive side, the government has raised the exemption limit for Long Term Capital Gains (LTCG) tax from Rs 1 lakh to Rs 1.25 lakh in a financial year.

Mutual funds are highly favored among Indian investors seeking access to equity markets. Systematic Investment Plans (SIPs), which involve monthly investments, have consistently exceeded the Rs 20,000-crore mark since surpassing this milestone for the first time in April 2024.

Let's explore how the taxation of capital gains from SIPs in equity funds will be affected by the proposals in the 2024 Budget.

Taxation of mutual funds

In the context of mutual fund investments through Systematic Investment Plans (SIPs), each monthly instalment is treated individually for tax purposes. For instance, if you invest Rs 10,000 per month in an equity mutual fund via SIPs, each instalment is assessed separately to establish its holding period and the applicable tax rate.

It's important to note that mutual fund units are typically subject to the First-In-First-Out (FIFO) method when determining the tax implications upon redemption. This means that the units purchased first are considered the first ones sold for tax calculation purposes.

Taxation of equity funds

Despite the slight uptick in Long Term Capital Gains (LTCG) tax rates from 10 percent to 12.5 percent, long-term investors may experience a minor increase in their tax burden. However, the rise in the exemption limit to Rs 1.25 lakh will provide modest benefits to small investors. On the other hand, the hike in Short Term Capital Gains (STCG) tax from 15 percent to 20 percent will have a more pronounced impact on investors with shorter investment horizons in equity.

"Despite these marginal tax increases, equity mutual funds continue to present an attractive investment opportunity compared to other asset classes. Therefore, we expect that the adjustments in tax rates will not significantly alter the inflow of investments into equity mutual funds," said Feroze Azeez, Deputy CEO of Anand Rathi Wealth.

Let's consider how the redemption of an SIP with a monthly investment of Rs 50,000 will be taxed.

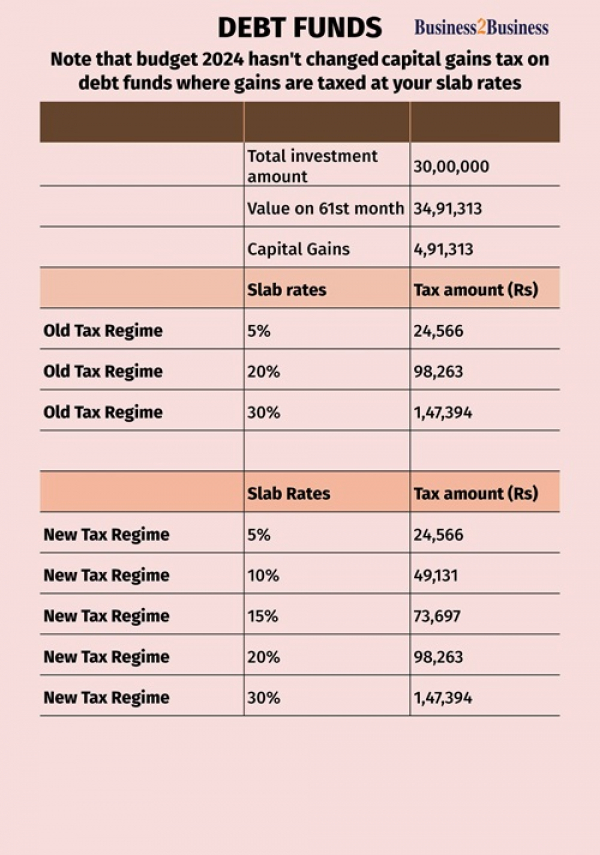

Status quo on debt funds

The Union Budget has maintained the status quo regarding the taxation of debt funds, which will continue to be subject to normal income tax rates. However, the budget has reduced the capital gains tax rate on specific categories like gold funds or gold exchange-traded funds (ETFs), overseas funds, and funds of funds (FoFs).

Under the new provisions, mutual funds investing more than 65 percent of their total proceeds in debt and money market instruments will fall under Section 50AA. This means that exchange-traded funds (ETFs), Gold Mutual Funds, and Gold ETFs will not be classified as specified mutual funds.

Let's delve into how Systematic Investment Plans (SIPs) in debt funds would be taxed at various slab rates as detailed in the table.

Conclusion

the Union Budget's amendments to capital gains tax rates have brought mixed implications for mutual fund investors. While equity investors face higher taxes on both short-term and long-term gains, the increased exemption limit for long-term gains offers some relief, particularly for smaller investors. Meanwhile, debt funds continue under the purview of normal income tax rates, maintaining stability in their taxation framework. Despite these changes, equity mutual funds remain an attractive avenue for investment, and the overall impact on investor sentiment is likely to be tempered by the broader benefits and opportunities they continue to offer.

Also Read: Prime Minister's Internship Program: Budget 2024 Overview

POPULAR POSTS

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

by Shan, 2025-12-05 11:49:44

Zoho Mail vs Gmail (2025): Which Email Platform Is Best for Businesses, Startups, and Students?

by Shan, 2025-10-09 12:17:26

PM Modi Launches GST Bachat Utsav: Lower Taxes, More Savings for Every Indian Household

by Shan, 2025-09-24 12:20:59

$100K H-1B Visa Fee Explained: Trump’s New Rule, Clarifications & Impact on Indian Tech Workers

by Shan, 2025-09-22 10:11:03

India-US Trade Deal Soon? Chief US Negotiator Arrives in Delhi as Talks Set to Begin Tomorrow

by Shan, 2025-09-15 11:54:28

Modi Meets Xi: Trump’s Tariffs, Strategic Autonomy, and the Future of Asia’s Power Balance

by Shan, 2025-09-03 06:40:06

Google Claims Gemini AI Uses Just ‘Five Drops of Water’ Per Prompt, Sparks Debate

by Shan, 2025-08-22 12:34:27

RECENTLY PUBLISHED

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Best Silver Investment Platforms for 2025: From CFDs to Digital Vaults Explained

- by Shan, 2025-10-23 12:22:46

Subscribe now

Subscribe now