Tata MF launches Tata Nifty India Tourism Index Fund, details

- by B2B Desk 2024-07-09 06:33:50

Tata Mutual Fund has launched the Tata Nifty India Tourism Index Fund, an open-ended equity scheme that focuses on a specific sector or theme related to tourism in India.

The fund became available for public investment on July 8, 2024, and will stop accepting subscriptions on July 19, 2024. It will resume normal operations for buying and selling shares on July 29, 2024.

What type of investment fund scheme is this?

This is an equity scheme that is open-ended and focuses on special situations.

During the launch of the index fund, Anand Vardarajan, Chief Business Officer at Tata Asset Management, highlighted the favorable conditions in the tourism sector. He mentioned that rising disposable incomes and improved infrastructure, including better highways, enhanced railway services, and increased number of airports, have significantly eased and secured travel. Vardarajan noted the substantial growth in domestic aviation, hotels, restaurants, and overall travel, which bodes well for the tourism industry. He emphasized the diverse opportunities in travel, including pilgrimage, business, medical, and leisure, all showing notable increases. Vardarajan concluded by stressing the potential for investing in tourism to capitalize on the sector's growth.

What is the primary goal of putting money into this fund?

The Tata Nifty India Tourism Index Fund aims to mirror the performance of the Nifty India Tourism Index (TRI), striving to generate returns that align with its movements, adjusted for tracking error. However, it's important to note that achieving this objective is not guaranteed, and the fund does not promise assured returns.

The launch of this fund coincides with a period of robust economic activity in India, characterized by strong investment and consumer spending. The expanding middle class is driving a notable increase in aspirational and experiential travel, supported by substantial investments in infrastructure. These developments have significantly enhanced air travel accessibility by expanding route capacities.

How may one invest in this scheme?

Investors can invest under the scheme with a minimum investment of Rs 5000 per plan/option and in multiples of Re 1. There is no upper limit for investment.

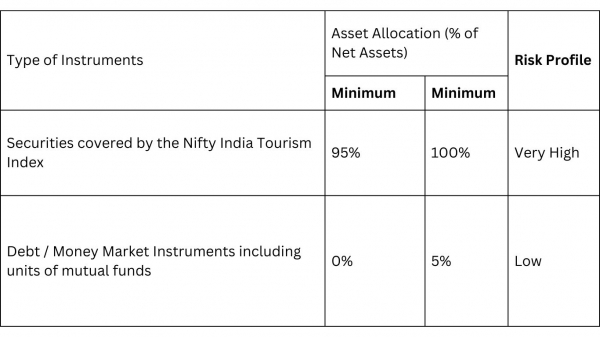

Following the investment allocation pattern, the scheme will invest in:

- Stocks and related derivatives.

- Bonds and other debt securities in the money market.

- Units of mutual funds based in India.

Usually, the investment range would be like this:

Are there comparable mutual funds available in the market?

As of now, no asset management company (AMC) has introduced any fund in this particular category.

What method will the scheme use to assess its performance?

The fund's performance is evaluated against the Nifty India Tourism Index (TRI). According to the scheme's investment objective, it primarily invests in securities included in the Nifty India Tourism Index. This index composition makes it well-suited for benchmarking the scheme's performance.

Are there any entry or exit loads to this scheme?

Investors in this scheme do not incur any "Entry Load," meaning there are no upfront fees when investing their funds. However, an "Exit Load" applies if units are redeemed within 15 days from the date of allotment, amounting to 0.25% of the applicable Net Asset Value (NAV).

The Exit Load, if imposed, will be deducted from the scheme's proceeds after deducting Goods & Services Tax (GST). Any GST applicable on the exit load will be paid from the exit load proceeds.

Is there any inherent risk within the fund?

According to the Scheme Information Document, this scheme carries a "Very High Risk" rating. It is most appropriate for investors who are fully aware that their principal investment is exposed to very high levels of risk. Investors are advised to seek guidance from their financial advisors if they have any concerns about whether this product is suitable for their investment needs.

Also Read: Budget 2024: FDI reforms in defence, insurance, plantation sectorsPOPULAR POSTS

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

by Shan, 2025-12-05 11:49:44

Zoho Mail vs Gmail (2025): Which Email Platform Is Best for Businesses, Startups, and Students?

by Shan, 2025-10-09 12:17:26

PM Modi Launches GST Bachat Utsav: Lower Taxes, More Savings for Every Indian Household

by Shan, 2025-09-24 12:20:59

$100K H-1B Visa Fee Explained: Trump’s New Rule, Clarifications & Impact on Indian Tech Workers

by Shan, 2025-09-22 10:11:03

India-US Trade Deal Soon? Chief US Negotiator Arrives in Delhi as Talks Set to Begin Tomorrow

by Shan, 2025-09-15 11:54:28

Modi Meets Xi: Trump’s Tariffs, Strategic Autonomy, and the Future of Asia’s Power Balance

by Shan, 2025-09-03 06:40:06

Google Claims Gemini AI Uses Just ‘Five Drops of Water’ Per Prompt, Sparks Debate

by Shan, 2025-08-22 12:34:27

RECENTLY PUBLISHED

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Best Silver Investment Platforms for 2025: From CFDs to Digital Vaults Explained

- by Shan, 2025-10-23 12:22:46

Subscribe now

Subscribe now