What Is an Exchange-Traded Fund (ETF)? A Complete Guide

- by B2B Desk 2024-06-25 12:32:34

ETFs, which were introduced in the early 1990s, have emerged as a resilient and widely favored investment option for numerous individuals. Consequently, they have significantly grown, both in quantity and in their areas of emphasis over the years.

An ETF and a mutual fund are similar, yet they have significant differences. Both help save you time by avoiding the work of analyzing companies and selecting individual stocks, with mutual funds generally being less efficient in terms of taxes and having higher management fees.

Here, we present you with information on ETFs, detail their popularity, examine the pros and cons associated with them, and outline key factors to consider when selecting ETFs for your investment portfolio.

How do ETFs work?

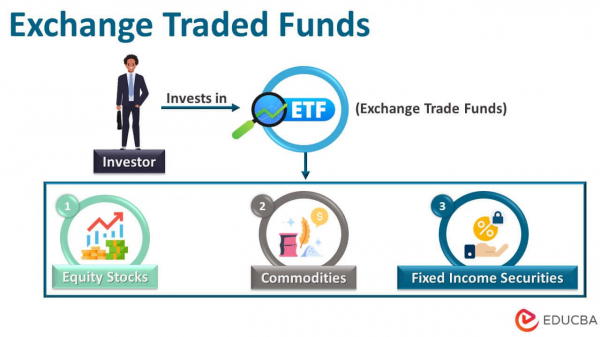

Exchange-traded funds operate in the following manner: The fund issuer holds the assets it is based on, creates a fund to mirror their performance, and subsequently offers shares of the fund to investors. Shareholders have a stake in an ETF, but they do not possess the underlying assets held by the fund. However, investors in an ETF that mirrors a stock index could still receive dividends from any dividend-yielding stocks in the index.

Even though ETFs are intended to follow the worth of a basic asset or index, like gold or a selection of stocks such as the S&P 500, they are bought and sold at prices set by the market which often vary from the actual asset. Additionally, due to factors such as costs, the long-term performance of an ETF may differ from that of its underlying asset.

Types of Exchange Traded Funds (ETFs)

There is a variety of ETFs designed to meet the needs of almost every investor. Here are some types available:

Inverse ETFs:

These funds aim to generate returns that are inversely related to those of the underlying market index. These funds cause share prices to move in the opposite direction of shares in inverse ETFs.

Currency ETFs

This investment option enables investors to engage in currency market trades without needing to buy a particular currency. The reason for making these investments is to monitor and take advantage of the changes in the value of a specific currency or a group of currencies.

Bond ETFs

These ETFs are standard and aim to offer access to various bond categories. Investing in bonds is an effective way to manage the fluctuations of investing and spread out risk in a portfolio.

Gold ETFs

These securities allow investors to have a stake in the bullion market without needing to buy actual gold. You also have the option to buy ETFs that concentrate on precious metals in a more broad sense.

Liquid ETFs

These funds aim to reduce price risks and boost returns by investing in a selection of short-term government securities, including money and money market instruments with brief maturities, all while focusing on liquidity.

Index ETFs

Index funds follow the results of the index they are based on. They are additionally categorized into replication and representative ETFs. ETFs that replicate the index by investing solely in the securities within it are known as replication ETFs. In contrast, representative ETFs primarily invest most of their fund in representative samples and allocate the rest to other securities like futures, options, and so on.

Advantages of investing in ETFs

Cost-effective

The fund manager monitors the adjustments of the index and mirrors them in the fund's portfolio. They are unable to opt for extra security measures or stray from the predetermined weights of current securities autonomously.

This results in reduced expenses for managing funds compared to actively managed funds, ultimately resulting in improved cost-effectiveness for investors.

Easy to understand

Indexes are typically characterized by being rule-based. They are mainly examined and considered during the planning stage. Some investors may find it easy and clear to comprehend indices and how they perform. Therefore, investors may find it simpler to comprehend ETFs as a viable investment choice. Moreover, as these ETFs are designed to constantly mimic indices, the profits from investments are expected to reflect the returns from the original index, taking into account tracking error and costs.

Reduction of unsystematic risks

Investment risks can be divided into two main categories; systematic and unsystematic. Systemic risks stem from external factors such as legal changes and macroeconomic shifts, while non-systemic risks can be linked to specific investment choices.

Although systematic risks affect everyone, unsystematic risks can stem from various causes. As ETFs are passive investment products and fund managers do not have discretion in managing the fund, they can help eliminate specific unsystematic risks from the investment approach.

Differences between ETFs and mutual funds

In general, ETFs typically have lower expenses compared to mutual funds, which is a significant factor in their popularity.

ETFs provide superior tax efficiency compared to mutual funds. Mutual funds, especially actively managed ones, typically have higher turnover than ETFs, leading to potential capital gains from frequent buying and selling. Likewise, if investors decide to liquidate a mutual fund, the fund manager must sell off securities to generate cash, potentially resulting in capital gains. In both cases, investors will be responsible for paying those taxes.

Both products have varying management structures; mutual funds are typically active, while ETFs are passive, although there are actively managed ETFs.

FAQs

Q. What is the definition of exchange-traded funds ETFs?

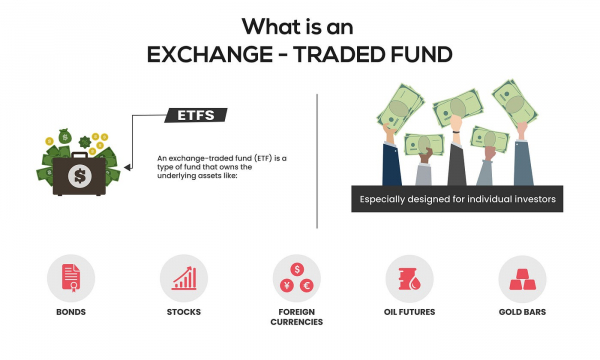

A. Exchange-traded funds (ETFs) are SEC-registered investment companies that offer investors a way to pool their money in a fund that invests in stocks, bonds, or other assets.

Q. How does ETF work?

A. ETFs or "exchange-traded funds" are exactly as the name implies: funds that trade on exchanges, generally tracking a specific index. When you invest in an ETF, you get a bundle of assets you can buy and sell during market hours—potentially lowering your risk and exposure, while helping to diversify your portfolio.

Q. Is ETF a good investment?

A. ETFs are considered to be low-risk investments because they are low-cost and hold a basket of stocks or other securities, increasing diversification. For most individual investors, ETFs represent an ideal type of asset with which to build a diversified portfolio.

Q. Is ETF better than MF?

A. ETFs have lower expense ratios. Mutual funds have higher management fees. ETFs are passively managed, mirroring a particular index, making them less risky and transparent. Mutual funds are actively managed, with fund managers investing based on analysis and market outlook.

Also Read: Adani Airports IPO: Adani group to list airport business by FY28

POPULAR POSTS

Rupee Forecast 2025: Key Drivers Behind INR Weakness Against the US Dollar

by Shan, 2025-08-11 07:32:23

August 2025 IPO Preview: Big Listings from JSW Cement, NSDL, Knowledge Realty & SME Stars

by Shan, 2025-07-30 11:51:27

Ola Electric Q1 Results FY26: Revenue Falls 61%, Net Loss at ₹870 Cr - MoveOS 5 in FocusOla

by Shan, 2025-07-14 12:22:55

HAL, BEL & Data Patterns: 3 Defence Stocks Riding India's ₹50,000 Cr Export Ambition

by Shan, 2025-06-26 10:00:16

India GDP Forecast 2025-26 Raised to 6.5% by S&P: Key Drivers & Global Risks Explained

by Shan, 2025-06-26 10:30:46

Dalal Street Outlook: 5 Key Market Triggers to Watch This Week

by Shan, 2025-06-16 12:32:04

What is the Bond Market & How Does It Impact Your Investments?

by B2B Desk, 2025-02-05 09:42:55

RECENTLY PUBLISHED

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

- by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

- by Shan, 2025-12-05 11:49:44

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Subscribe now

Subscribe now