What Is A Crossed Cheque And How It Works

- by B2B Desk 2024-05-29 08:16:48

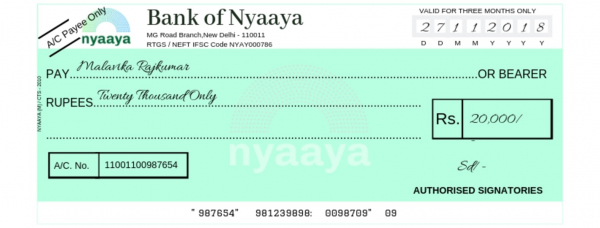

A crossed check is characterized by two parallel lines crossing either the entirety or the top left corner of the check. This double-line notation indicates that the check can only be deposited into a bank account. Banks or any other financial institution cannot cash such checks right away.

Types of Cross Cheques

Crossed cheques focus on instructions provided by the issuer of a particular check to the drawee banking institution. Crossed cheques must be paid at a bank teller and there must be strict guidelines to ensure that payment is made to the correct individual presented by the bank teller. Check crossing helps in tracking the individuals to whom money is paid through crossed cheques.

The various kinds of cross-cheques in India are as stated below:-

General Crossing

This type of check crossing requires two parallel transverse lines. There are no restrictions on placing these parallel lines in any specific area of the check, but they can be drawn anywhere. It's usually a good idea to write this in the top left corner of the check.

The utility of this crossing is that the check essentially has to be made payable to the bank.

Account Payee Crossing

Account payee crossing is another term for restrictive crossing. This type of check must include the phrases account payee or account payee only. The check must have specific or general crossing.

Special Crossing

A special type of crossed check does not require the banker's name. Only bankers should secure funds through these types of crossed checks. Remember that crossed checks of special cross type cannot be converted to crossed checks of regular cross type.

Not Negotiable Crossing

A non-negotiable cross is a type of cross check that must contain the words "non-negotiable" on the paper document. In addition, you can pass the check in general or specifically. A check cannot be endorsed and a transfer will not be better than a transfer of title.

What is the process of cross-check?

The cross-check process securely transfers funds between accounts. In this procedure, two parallel lines are marked on the check, showing that it can only be deposited into the designated payee's account. This will stop another person from depositing or signing your check.

Moreover, both the account holder and the bank must sign a crossed check for it to be processed. This provides extra security measures that decrease the chances of fraud or unauthorized actions.

Due to these extra security measures, it should be noted that cross-checks might require more time to verify compared to standard checks. Many financial institutions provide fast processing choices for crossed checks.

Don't overlook the extra protection that cross-examination can offer. Give this secure approach a try for moving money between accounts. Prior evaluations: There is no more effective method to ensure the safety of your funds than engaging in hopscotch while at the bank.

How a Crossed Check Works?

Crossed checks are mainly used in Mexico, Australia, and several European and Asian countries. This provides specific instructions to your financial institution on how to handle your funds. Crossed checks most commonly ensure that your bank deposits your funds correctly into your existing bank account.

The receiving bank is prohibited from immediately cashing the check upon initial receipt. This provides a level of security to the payer as the funds must be processed through a collecting bank.

The exact format may vary from country to country, but two parallel lines are the most frequently used symbol. This line is sometimes paired with the words "& Co." or “It’s non-negotiable.”

In rare cases, the phrase "Account Payable" may be written on the check as an alternative method of conveying the aforementioned cashing instructions.

FAQs

Q. How does a cross cheque work?

A. A crossed check is any check that is crossed with two parallel lines, either across the whole check or through the top left-hand corner of the check. This double-line notation signifies that the check may only be deposited directly into a bank account.

Q. What is the purpose of a cross check?

A. Cheque writers can use crossed cheques to protect the amount transmitted from being cashed by an unauthorized person or stolen. The nature of this format for crossed cheques may vary between countries in terms of its format or assertions.

Q. What is the law for crossed cheque?

A. Crossing a cheque is the instruction given to the paying banker to transfer the specified amount from the payer account to the payee account rather than paying it over the counter at the time of payment. The act of crossing a cheque serves as a protection against the misuse of cheques in financial transactions.

Q. How to withdraw a crossed cheque?

A. Crossed cheque is encashed through payee's account only. If you don't have a bank account, you may request the drawer to uncross it, so that cash payment across bank counter can be made.

Also Read: How Exports & Imports can Affect the Indian Stock Market?

POPULAR POSTS

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

by Shan, 2025-12-05 11:49:44

Zoho Mail vs Gmail (2025): Which Email Platform Is Best for Businesses, Startups, and Students?

by Shan, 2025-10-09 12:17:26

PM Modi Launches GST Bachat Utsav: Lower Taxes, More Savings for Every Indian Household

by Shan, 2025-09-24 12:20:59

$100K H-1B Visa Fee Explained: Trump’s New Rule, Clarifications & Impact on Indian Tech Workers

by Shan, 2025-09-22 10:11:03

India-US Trade Deal Soon? Chief US Negotiator Arrives in Delhi as Talks Set to Begin Tomorrow

by Shan, 2025-09-15 11:54:28

Modi Meets Xi: Trump’s Tariffs, Strategic Autonomy, and the Future of Asia’s Power Balance

by Shan, 2025-09-03 06:40:06

Google Claims Gemini AI Uses Just ‘Five Drops of Water’ Per Prompt, Sparks Debate

by Shan, 2025-08-22 12:34:27

RECENTLY PUBLISHED

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Best Silver Investment Platforms for 2025: From CFDs to Digital Vaults Explained

- by Shan, 2025-10-23 12:22:46

Subscribe now

Subscribe now