The Implications of Suspending the US Debt Ceiling

The US Debt Ceiling and its Historical Context: To comprehend the debt ceiling, one must first grasp how countries accumulate debt. Like individuals obtaining

- by B2B Desk 2023-06-08 05:46:42

In recent times, the United States faced a critical decision as Congress debated the suspension of the debt ceiling to avoid a potential catastrophic default. While the immediate crisis has been averted, it serves as a powerful indicator of the weakening US dollar and the underlying fragility of the US economy. This article delves into the significance of the debt ceiling, its importance in the context of the United States, the consequences of violating it, and the potential impact on the global economy. Understanding this macroeconomic situation is vital for students of business and anyone interested in the world economy.

To comprehend the debt ceiling, one must first grasp how countries accumulate debt. Like individuals obtaining home loans, nations also borrow to foster growth. The United States, for instance, secures loans through international financial institutions, commercial banks, bilateral loans, and bonds. Bonds play a crucial role, where the US government issues them to raise funds. Investors, both foreign and domestic, purchase these bonds, and the government promises to pay annual interest on them. The debt ceiling was introduced to set a limit on how much the US government can borrow, preventing the accumulation of unsustainable levels of debt.

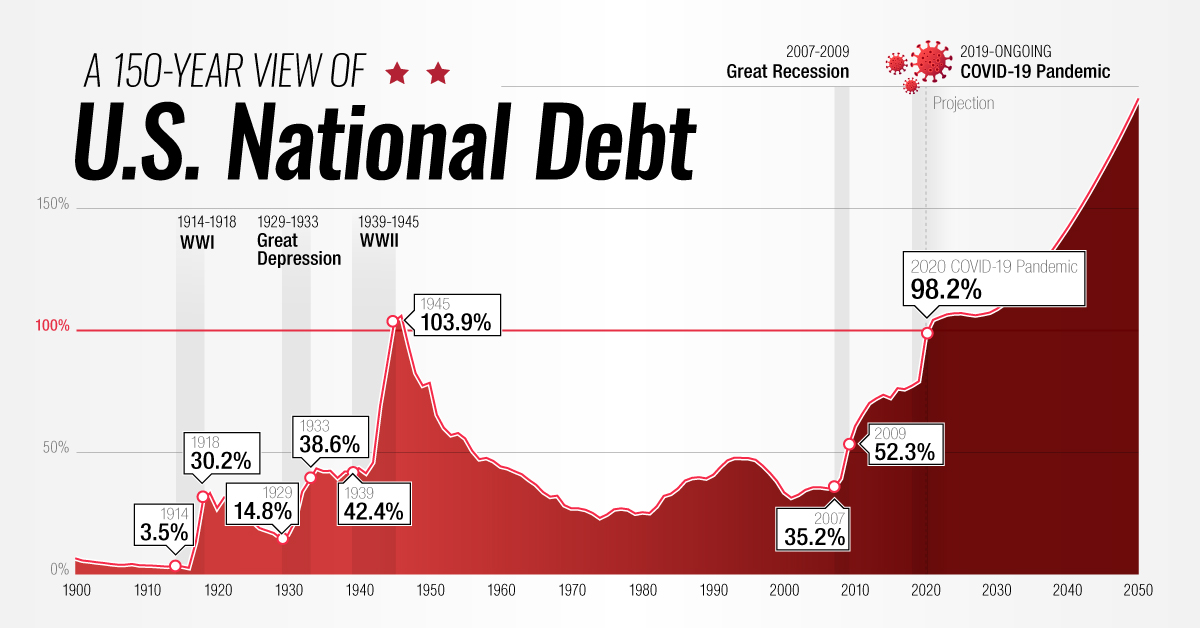

Analyzing the US debt-to-GDP ratio reveals the nation's precarious financial position. Currently standing at 134 percent, this ratio is the highest the US has experienced in the past 150 years. In comparison, the safety limit for debt-to-GDP ratio is considered to be 77 percent. Notably, the US has raised its debt ceiling 78 times since the 1960s, consistently increasing its debt burden. This growing debt poses a significant risk to the US economy, indicating a potential breakdown.

Although the United States has avoided defaulting on its debt thus far, the consequences of such an event would be severe. Defaulting on debt interest payments would lead to a credit rating downgrade, impacting the cost of borrowing for the US government. The last near-default situation in 2011 resulted in a credit rating downgrade, which increased the interest rates on new bonds. Consequently, borrowing costs surged, leaving the US with less capital for investment in crucial sectors such as infrastructure, education, and social programs.

Examining default cases from other countries provides valuable insights into the potential consequences. For instance, Sri Lanka defaulted in 2022, leading to a significant increase in bond interest rates. This economic crisis resulted in a deterioration of the economy, loss of jobs, reduced investment in public services, and a decline in the stock market. If the US were to default, similar negative effects would ripple through the global economy, impacting trade partners, causing a liquidity crisis, and potentially challenging the US dollar's dominance as the global reserve currency.

A US default would trigger a series of domino effects with global implications. Firstly, it would generate a crisis reminiscent of the 2008 financial downturn, destabilizing markets worldwide. Secondly, a liquidity crisis could emerge, hampering the availability of capital on a global scale. Thirdly, trade partners heavily reliant on the US market would experience reduced consumption, adversely affecting their economies. Lastly, countries using the US dollar as an alternative currency, like Argentina and Zimbabwe, would likely lose trust in the dollar, leading to a shift towards other currencies.

The US Debt Ceiling and its Historical Context:

To comprehend the debt ceiling, one must first grasp how countries accumulate debt. Like individuals obtaining home loans, nations also borrow to foster growth. The United States, for instance, secures loans through international financial institutions, commercial banks, bilateral loans, and bonds. Bonds play a crucial role, where the US government issues them to raise funds. Investors, both foreign and domestic, purchase these bonds, and the government promises to pay annual interest on them. The debt ceiling was introduced to set a limit on how much the US government can borrow, preventing the accumulation of unsustainable levels of debt.

The Alarming US Debt-to-GDP Ratio:

Analyzing the US debt-to-GDP ratio reveals the nation's precarious financial position. Currently standing at 134 percent, this ratio is the highest the US has experienced in the past 150 years. In comparison, the safety limit for debt-to-GDP ratio is considered to be 77 percent. Notably, the US has raised its debt ceiling 78 times since the 1960s, consistently increasing its debt burden. This growing debt poses a significant risk to the US economy, indicating a potential breakdown.

The Implications of Default:

Although the United States has avoided defaulting on its debt thus far, the consequences of such an event would be severe. Defaulting on debt interest payments would lead to a credit rating downgrade, impacting the cost of borrowing for the US government. The last near-default situation in 2011 resulted in a credit rating downgrade, which increased the interest rates on new bonds. Consequently, borrowing costs surged, leaving the US with less capital for investment in crucial sectors such as infrastructure, education, and social programs.

Lessons from International Default Cases:

Examining default cases from other countries provides valuable insights into the potential consequences. For instance, Sri Lanka defaulted in 2022, leading to a significant increase in bond interest rates. This economic crisis resulted in a deterioration of the economy, loss of jobs, reduced investment in public services, and a decline in the stock market. If the US were to default, similar negative effects would ripple through the global economy, impacting trade partners, causing a liquidity crisis, and potentially challenging the US dollar's dominance as the global reserve currency.

The Global Impact of a US Default:

A US default would trigger a series of domino effects with global implications. Firstly, it would generate a crisis reminiscent of the 2008 financial downturn, destabilizing markets worldwide. Secondly, a liquidity crisis could emerge, hampering the availability of capital on a global scale. Thirdly, trade partners heavily reliant on the US market would experience reduced consumption, adversely affecting their economies. Lastly, countries using the US dollar as an alternative currency, like Argentina and Zimbabwe, would likely lose trust in the dollar, leading to a shift towards other currencies.

While the recent suspension of the US debt ceiling prevented an immediate crisis, the underlying challenges facing the US economy and the dollar's stability remain. The high debt-to-GDP ratio, frequent increases in the debt ceiling, and the potential for a future default demand attention and analysis.

Also Read: How RBI prevented a liquidity crisis from becoming a solvency crisis for India Inc

POPULAR POSTS

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

by Shan, 2025-12-05 11:49:44

Zoho Mail vs Gmail (2025): Which Email Platform Is Best for Businesses, Startups, and Students?

by Shan, 2025-10-09 12:17:26

PM Modi Launches GST Bachat Utsav: Lower Taxes, More Savings for Every Indian Household

by Shan, 2025-09-24 12:20:59

$100K H-1B Visa Fee Explained: Trump’s New Rule, Clarifications & Impact on Indian Tech Workers

by Shan, 2025-09-22 10:11:03

India-US Trade Deal Soon? Chief US Negotiator Arrives in Delhi as Talks Set to Begin Tomorrow

by Shan, 2025-09-15 11:54:28

Modi Meets Xi: Trump’s Tariffs, Strategic Autonomy, and the Future of Asia’s Power Balance

by Shan, 2025-09-03 06:40:06

RECENTLY PUBLISHED

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Best Silver Investment Platforms for 2025: From CFDs to Digital Vaults Explained

- by Shan, 2025-10-23 12:22:46

Subscribe now

Subscribe now