FPIs continue to sell, with a total of $4.6 billion in May

After selling in May, net outflows from the secondary market rose to GBP 1.73 billion so far in 2022, compared to GBP 6.57 billion of purchases in the primary m

- by B2B Desk 2022-05-31 05:17:10

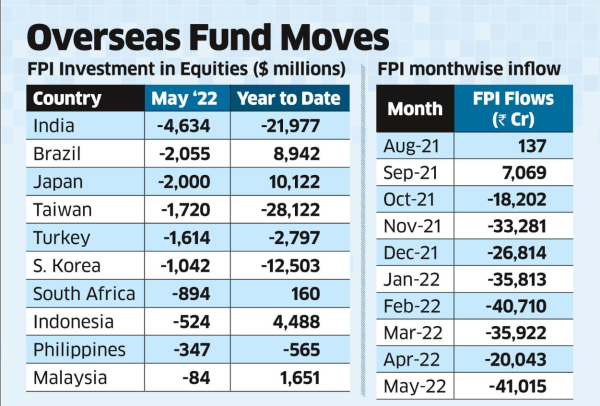

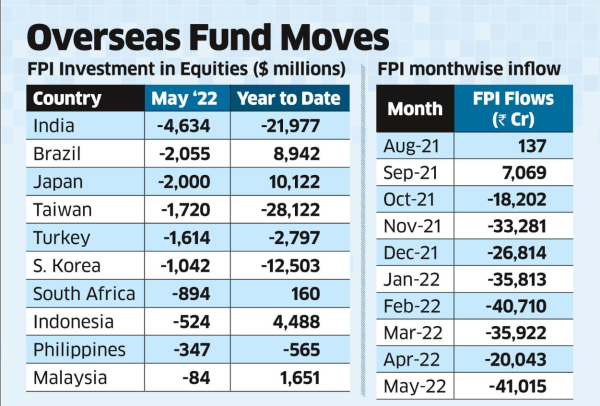

In May, over USD 4.6 billion (35,000 crore) worth of Indian stocks were sold by foreign investors, the highest in emerging markets, amid concerns over the possibility of a recession in markets in the United States, the rise in Interest rates and the strengthening of the dollar. This stream included its activities in both the secondary and primary markets.

On the bourses alone, foreign investors pulled more than Rs.41,000 from local stocks, the highest level in a month since March 2020, when they sold Rs.57,000 worth of shares in the pandemic-induced lockdown.

After selling in May, net outflows from the secondary market rose to GBP 1.73 billion so far in 2022, compared to GBP 6.57 billion of purchases in the primary market. In 2021, foreign portfolio investors (REITs) sold Rs.54,542 crore worth of shares in the secondary market but pumped 80,310 crore into the primary market.

After selling in May, net outflows from the secondary market rose to GBP 1.73 billion so far in 2022, compared to GBP 6.57 billion of purchases in the primary market. In 2021, foreign portfolio investors (REITs) sold Rs.54,542 crore worth of shares in the secondary market but pumped 80,310 crore into the primary market.

According to HSBC, current REIT outflows are just below the level (as a percentage of market cap) seen during the 2008-09 global financial crisis. “With the end of easy money, the market's risk tolerance is low and that's not likely to change any time soon. Rising inflation and its persistence is the biggest local factor that will continue to weigh on the investment case from India,” said Amit Sachdeva. , Indian Equity Strategist at HSBC.

Analysts expect REIT flows to remain volatile in the short term. “There's no question that emerging markets are starting to look more attractive for the money coming out from a positioning and valuation perspective, but until the underlying fundamentals change it won't be enough for volatility to drop or for people to take one again Interest in emerging markets investing,” said Sameer Goel, Global Head of Emerging Markets Research at Deutsche Bank.

Also Read: 3 mid cap funds with 3 years of SIP returns over 50%

On the bourses alone, foreign investors pulled more than Rs.41,000 from local stocks, the highest level in a month since March 2020, when they sold Rs.57,000 worth of shares in the pandemic-induced lockdown.

According to HSBC, current REIT outflows are just below the level (as a percentage of market cap) seen during the 2008-09 global financial crisis. “With the end of easy money, the market's risk tolerance is low and that's not likely to change any time soon. Rising inflation and its persistence is the biggest local factor that will continue to weigh on the investment case from India,” said Amit Sachdeva. , Indian Equity Strategist at HSBC.

Analysts expect REIT flows to remain volatile in the short term. “There's no question that emerging markets are starting to look more attractive for the money coming out from a positioning and valuation perspective, but until the underlying fundamentals change it won't be enough for volatility to drop or for people to take one again Interest in emerging markets investing,” said Sameer Goel, Global Head of Emerging Markets Research at Deutsche Bank.

Also Read: 3 mid cap funds with 3 years of SIP returns over 50%

POPULAR POSTS

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

by Shan, 2025-12-05 11:49:44

Zoho Mail vs Gmail (2025): Which Email Platform Is Best for Businesses, Startups, and Students?

by Shan, 2025-10-09 12:17:26

PM Modi Launches GST Bachat Utsav: Lower Taxes, More Savings for Every Indian Household

by Shan, 2025-09-24 12:20:59

$100K H-1B Visa Fee Explained: Trump’s New Rule, Clarifications & Impact on Indian Tech Workers

by Shan, 2025-09-22 10:11:03

India-US Trade Deal Soon? Chief US Negotiator Arrives in Delhi as Talks Set to Begin Tomorrow

by Shan, 2025-09-15 11:54:28

Modi Meets Xi: Trump’s Tariffs, Strategic Autonomy, and the Future of Asia’s Power Balance

by Shan, 2025-09-03 06:40:06

RECENTLY PUBLISHED

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Best Silver Investment Platforms for 2025: From CFDs to Digital Vaults Explained

- by Shan, 2025-10-23 12:22:46

Subscribe now

Subscribe now