LIC IPO GMP, Subscription, and Review; Last Chance to Invest Today

Subscription Status To date, QIB's stock has been subscribed 1.12 times on the final day of the subscription period with 4.43 million shares offered versus 3

- by B2B Desk 2022-05-09 09:38:56

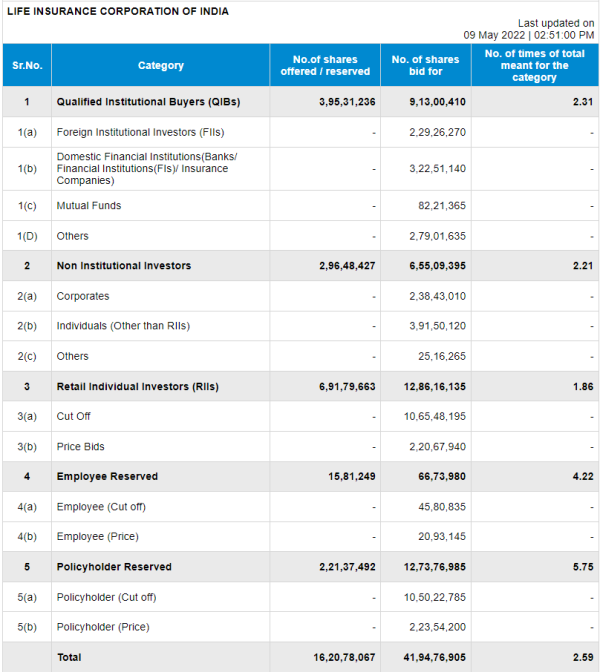

Life Insurance Corporation of India (LIC) IPO was oversubscribed by all investor classes Monday morning as the issue entered the last day of the 6-day offering period. The Rs 21,000 crore IPO was fully subscribed last week but Qualified Institutional Buyers (QIBs) had yet to bid for their fully shared share. LIC IPO has received bids for 32.35 million shares to date versus 16.2 million shares offered, bringing the total number of subscriptions to twice the issuance. The IPO of LIC gained momentum over the weekend after investors were allowed to bid on the mega issue over the weekend.

Subscription Status

To date, QIB's stock has been subscribed 1.12 times on the final day of the subscription period with 4.43 million shares offered versus 3.95 million shares reserved for QIB. Non-institutional investors (NIIs) subscribed their reserved shares 1.33 times, bidding 3.95 crores of shares against the 2.96 crores offered by them. The retail investor's part has been absorbed 1.69 times so far, with bids for Rs 11.68 crore shares. 6.91 million shares of the capital are reserved for private investors.

LIC employees and policyholders were among those who subscribed their shares the most. The number of employee subscriptions was 3.95 times with bids for 62.56 lact shares, while policyholders' share was bid 5.3 times when investors bid for 11.75 crore shares.

Grey Market Premium (GMP) LIC IPO

On the last day of the auction, the LIC gray market premium (GMP) fell. On Monday, LIC shares were trading at a premium of Rs 40 per share in the unlisted area. This was lower than the Rs 60 premium shares traded over the weekend.

Analysts are optimistic

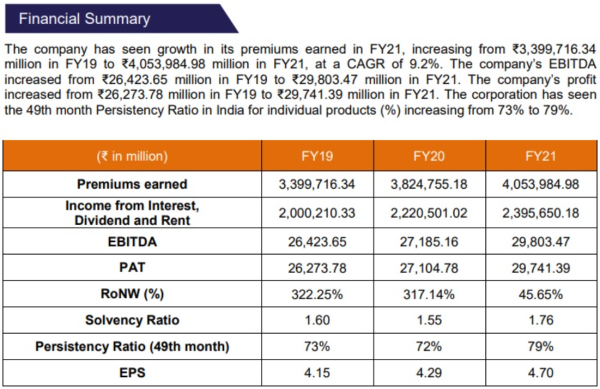

Stockbrokers were optimistic about LIC's IPO, with most investors advising to subscribe to the issue. Analysts noted that LIC's price was attractive. "In the upper price range of Rs.949, the issue is valued at 1.1x EV (21 Sep), a significant discount to private sector valuations," Nirmal Bang said in a report. Geojit Financial Services said that SBI Life Insurance Company is trading at a P/EVPS of 3.2x, while HDFC Life Insurance Company is trading at 3.9x and ICICI Prudential Life Insurance Company is trading at 2.5x.

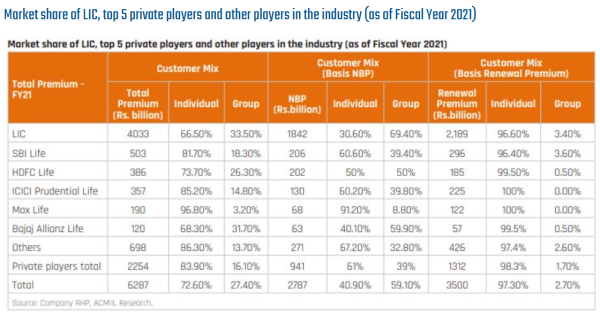

LIC currently owns 61.5% in terms of new business premium (or NBP), a 71.8% market share in terms of the number of individual policies issued, and an 88.8% market share in terms of the number of group policies issued for the nine months ended December 31, 2021 “While headwinds such as declining market share, declining near-term persistence ratios and below-expected margins typically require a discount for private players, the current valuation is attractive given its strong market presence and improved profitability due to changes in excess distribution standards . and strong growth prospects for the industry,” analysts at Geojit Financial Services wrote in the IPO announcement.

LIC IPO- Should you bet on listing pop or a long-term strategy?

Life Insurance Corporation's (LIC) initial public offering (IPO) continues to attract retail investors, including employees and policyholders, who have been among the highest bidders for the offering to date.

Despite falling premium in the grey market, intense selloff in the global markets, rate hike concerns and inflationary worries, LIC is holding its charm.

Majority of the market experts say that LIC is a long term play and investors should bid for the issue according to their funds and risk appetite. However, one should not bet on issues for listing gains only.

VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services, said that listing gains are possible in LIC IPO since valuation is attractive. Medium-term prospects also look good, he added.

“A lot of other stocks now look attractive after the correction. A key market trend is the preference for value stocks over growth stocks,” Vijaykumar said.

Even Ajit Mishra, vice president of research. Religare Broking supported the advice, adding that big issues are not profitable. You have to invest in good companies for the long term and LIC is one of them.

“Despite market pessimism, investors should bid as high as they can, funds permitting, as valuations favor the insurance giant,” he added.

The government values the LIC at Rs 6 lakh crore, which is 1.12 times its intrinsic value (EV) of Rs 5.4 lakh crore. Embedded value is a measure of the consolidated shareholder value of an insurance company.

Santosh Meena, head of research at Swastika Investmart, said LIC valuations were lower than their listed peers. "Investors need to understand that insurance is a long-term business and this issue is just a long-term game."

However, other experts are skeptical about the matter due to the current market conditions and the company's low profitability, which could affect its attractiveness among its peers.

Analysts said broader markets were experiencing a much-needed healthy correction and investors should look to buy dips. However, the current round of patches is not yet complete, according to the warning.

Some analysts are warning investors to be cautious on the issue of LICs. They say that given the current sentiment in the market, investors should not be in the dark. The issue must be subscribed taking into account the appetite for risk.

Astha Jain, senior research analyst at Hem Securities, said the issue was well received and should generate modest price gains. However, investors should lower their expectations amid the ongoing correction.

"We suggest investors bid on LIC, but it's time to watch their risk appetite as market conditions are no longer as attractive as they used to be."

LIC is the largest insurance provider in India. The government was previously expected to value the insurance giant at Rs 12-13 lakh crore, but global volatility weighed on earlier plans.

Also Read: Books Every Indian Marketer & Startup Founder Should Read

POPULAR POSTS

Best Silver Investment Platforms for 2025: From CFDs to Digital Vaults Explained

by Shan, 2025-10-23 12:22:46

Best Investment Plans in India for 2025: A Complete Guide to Grow and Protect Your Wealth

by Shan, 2025-09-18 10:20:46

Which venture capital firms are the most active in funding Indian startups in 2025

by Shan, 2025-08-06 10:42:11

Top 5 Apps to Buy Digital Gold in India (2025): Safe, Simple & Secure

by Shan, 2025-08-01 10:24:51

10 Highest Dividend Yield Stocks in August 2025

by Shan, 2025-07-28 09:31:02

Exchange-Traded Fund (ETF): A Practical Guide to Smart Investing

by Anmol Chitransh, 2025-04-17 10:18:20

The Ultimate Guide to Commodity Trading: Strategies, Risks, and Opportunities

by Anmol Chitransh, 2025-04-02 07:06:01

RECENTLY PUBLISHED

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

- by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

- by Shan, 2025-12-05 11:49:44

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Subscribe now

Subscribe now