LIC IPO - Deatils, Price Band, all that you need to know

ISSUE & CAPITAL DETAILS: In order to comply with the Indian government's divestment plan, listing the profits, LIC IPO is offering 2,213,749.20 shares at Rs 10

- by B2B Desk 2022-05-04 06:19:22

About LIC IPO:

LIC's IPO plans were announced in the 2020 budget, and fine-tuning of the regulatory framework, alignment of the accounting system to publicly traded companies, and a pandemic warning took just over two years to achieve the goal. By the way: This mega insurer with long-term and financial investors has now opened its doors to investors of all stripes. Given its financial game, it can't be compared to its publicly traded peers in any clear sum.The wait for the much-desired opening car from LIC is finally over. Well as we all know he became the talk of the town shortly after filing his DRHP and we witnessed a lot of gossip about his exhibition price, size, ratings etc. On these fragments the conglomerate charged Rs 68,000 cr. with his first Mega IPO with an expected price of around Rs 2000 based on its intrinsic value.

Thanks to the illiquid situation of world markets after the Russo-Ukrainian war and the slowdown of the economy with the increase in inflation. The company is now poised to justify the size and price of its offering, coming out with its first IPO at a much lower valuation and also with a token dilution of around 3.5%. The government has always been known to be investor-friendly and this time also showed the courage to take the hit and make a very lucrative bid to raise around Rs 21,000 or more. Still, it is a mega IPO in Indian history so far. (We do not consider here the mega rights issues of Voda Idea, Airtel and Reliance Industries which have already raised over Rs 24,000 Cr. In fact, Reliance has raised another Rs 52,000).

ABOUT THE COMPANY:

The Life Insurance Corporation of India (LIC) has been the only PSU life insurance company in India since 1956 and until recently operated under a special LIC law. But now it's come on board to pave the way for its first IPO under the IRDA regime. It has penetrated the domestic market and is the most trusted brand. It literally follows his mottos "Jindagi Ke Saath Bhi, Jindagi Ke Baad Bhi", "LIC who knows India best" and "Har Pal Aapke Saath".

LIC has been providing life insurance in India for over 65 years and is the largest life insurer in India with a 61.6% market share in terms of premiums (or GWP) and a 61.4% market share in terms of new business premium (or NBP ), a 71.8% market share in terms of the number of individual policies issued, an 88.8% market share in terms of the number of group policies issued for the nine months ended December 31, 2021, and the number of individual agent policies issued represented 55% of all single agents in India as of December 31, 2021.

LIC's market share in Indian life insurance industry for FY2021 was 64.1% in terms of GWP, 66.2% in terms of NBP, 74.6% in terms of number of individual policies issued and 81.1% in terms of the number of group policies. Released. Had the largest market share gap by life insurance GWP to India's second largest life insurer versus market leaders in the top seven global markets (in 2020 for other players and in FY2021 for LIC). According to CRISIL, this is due to LIC's large network of agents, its strong track record, its immense trust in the "LIC" brand and its 65-year heritage. LIC is ranked 5th globally by GWP Life Insurance (comparing its fiscal 2021 life insurance premium to its global peers' 2020 life insurance premium) and 10th worldwide for total assets (comparing your assets as of March 31, 2021). the assets of other life insurers as of December 31, 2020).

LIC is the largest wealth manager in India as of December 31, 2021 with an AUM (comprising policyholder investments, shareholder investments and assets held to meet related liabilities) of Rs 40.1 trillion on a stand-alone basis, i.e. (i) more than 3.2 times the total assets under management of all private life insurers in India and (ii) approximately 15.6 times the assets under management of the second largest player in the Indian insurance sector in India in terms of assets under management, (iii) more than 1.1 times the assets under management of the entire Indian mutual fund industry and (iv) 17.0% of the estimated GDP of the India for the financial year 2022.

According to the CRISIL report, as of December 31, 2021, LIC's investments in publicly traded equities represented approximately 4% of NSE's total market capitalization at that time. LIC was established by the merger and nationalization of 245 private life insurance companies in India on September 1, 1956 with an initial capital of Rs. LIC has been identified by IRDAI as a National Systemically Important Insurer (“D-SII") in September 2020 based on its size, market importance and national and global interconnection. Its LIC brand has been recognized as the third strongest global insurance brand and the tenth most valuable according to the "Insurance 100 Report 2021" published by Brand Finance. Brand strength means the effectiveness of a brand's performance in terms of intangible measures relative to its competitors and is determined by examining the brand's marketing investments, stakeholder capital and their impact on brand performance. the company.

LIC's individual product portfolio in India consists of 32 individual products (16 participating products and 16 non-participating products) and seven individual pilots. Its group products include (i) group term insurance products, (ii) group savings insurance products; (iii) collective savings products; and (iv) group annuity products. The product portfolio of LIC Group in India consists of 11 products of the group.

As of December 31, 2021, LIC had 2,048 branches and 1,559 branches in India, covering 91% of all districts in India. Its multi-channel distribution platform for group products includes (i) its group product sales force, (ii) individual agents, (iii) bancassurance partners and (iv) alternative distribution partners (other corporate agents and brokers).

In addition to its operations in India, the company has offices in Fiji, Mauritius and the United Kingdom respectively, and subsidiaries in Bahrain (with offices in Qatar, Kuwait, Oman and the United Arab Emirates), Bangladesh, Nepal, Singapore and Sri Lanka. in the life insurance sector. For fiscal year 2019, fiscal year 2020, fiscal year 2021 and the nine months ending December 31, 2021, the premium outside India on a consolidated basis was 0.93%, 0.99%, 0.73%, respectively. and 0.69% of the total premium. .

Although competing with private players, it remains and will remain the leading life insurer in India in all respects given its role.

ISSUE & CAPITAL DETAILS:

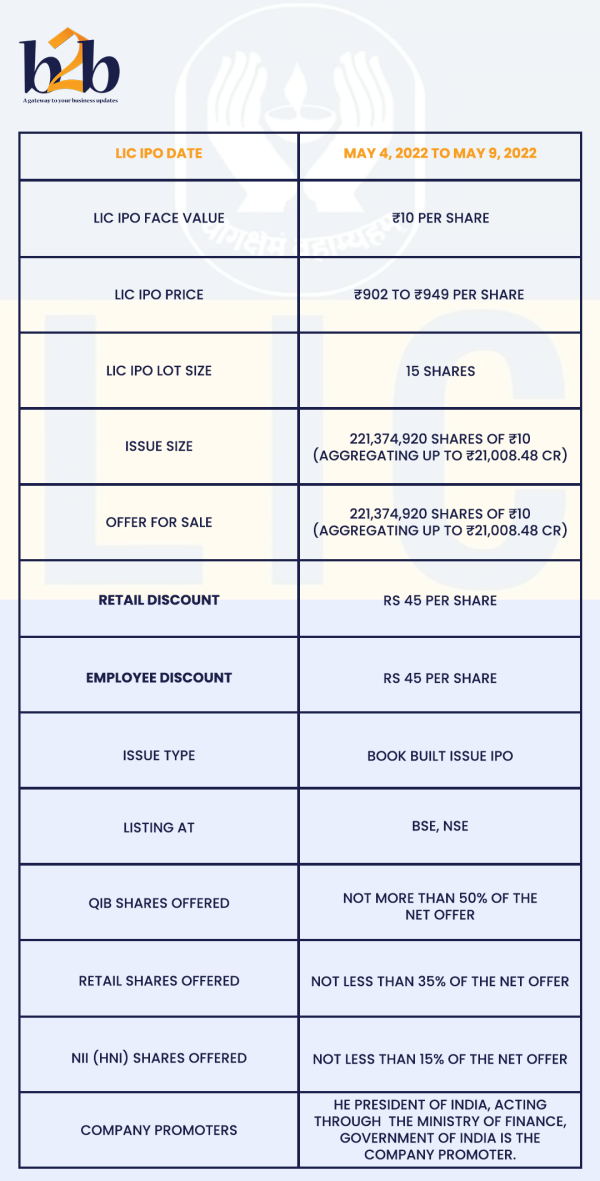

In order to comply with the Indian government's divestment plan, listing the profits, LIC IPO is offering 2,213,749.20 shares at Rs 10 each via the bookmaking route. He fixed the price range from Rs. 902 to Rs. 949 and considering raising Rs. 21008.48cr. in the upper price segment. The minimum demand is 15 shares and then in multiples. The issue will be open for subscription on May 4, 2022 and will end on May 9, 2022.The corporation has reserved 22137492 shares for policyholders (who are the original pillars of the corporation) and offer them a rebate of Rs 60 per share. 1,581,249 shares are reserved for eligible employees. For the retail and staff category, it offers a discount of Rs 45 per share. Of the remaining quota, 50% was awarded to QIB, 15% to HNI (for the two newly created categories) and 35% to private investors. After the allotment, the shares will be listed on the BSE and the NSE. The issue represents 3.50% of the capital paid up after the company's IPO.

The lead co-managers of this offering are Kotak Mahindra Capital Co. Ltd., Axis Capital Ltd., BofA Securities India Ltd., Citigroup Global Markets India Pvt. Ltd., Goldman Sachs (India) Securities Pvt. Ltd., ICICI Securities Ltd., JM Financial Ltd., J.P. Morgan India Pvt. Ltd., Nomura Financial Advisory and Securities (India) Pvt. Limited. and SBI Capital Markets Ltd. and KFin Technologies Ltd. is the registrar of the fair.

Upon issuance of the first shares at par, LIC converted fiscal 2020 dividends into shares and also issued bonus shares at a ratio of 6.227 to 1 (9.85% pre-offer) and 7.751 to 1 (88.57% pre-offer). basis) in September 2021. The average acquisition cost of shares by the Government of India is Rs 0.16 per share.

After the IPO, the paid-up share capital of LIC remains unchanged at Rs 6,325.00 cr. as it is a secondary offering only. At the high end of the LIC IPO price, the company is targeting a market capitalization of Rs 600,242.28.

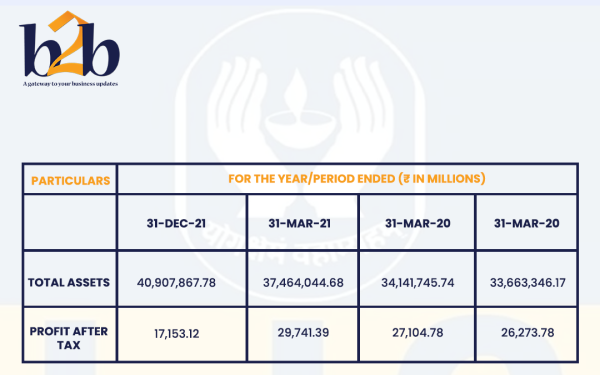

FINANCIAL PERFORMANCE:

In terms of financial performance, LIC has recorded a total net profit/surplus (deficit) of Rs 570809.57 for the past three financial years (on a consolidated basis). /Rs. - (2416.10) kr. (FY 2019), Rs 645,605.47 cr./Rs. - (10148.93) credit. (FY20) and Rs 703709.45 cr./Rs. 3861.82 cr. (Exercise 21). In the first nine months of FY22 ended 31 December 2021, it achieved a net profit of Rs 1,642.81 Cr. with a total income of Rs 512279.21 cr.

The total surplus for all these periods was Rs 52,971.19, Rs 49,728.67, Rs 61,698.91. and Rs 6,337.94 cr. It should be considered that according to historical data, the activities and maximum earnings of all insurance companies in the last quarter of the year and thus the annualization of the first nine months of work will never present a true picture.

For the past three financial years, LIC has posted average earnings per share of Rs.4.47 and average RoNW of 182.25%. The issue is valued at a P/BV of 72.94 based on its NAV of Rs 13.01 per share as of December 31, 2021 and post-IPO.

Based on FY21 results, the issue price is around 201.91 (at the cap), making it a premium issue at first glance. But given the size of the company and its leading position in its field with an enterprise market share, we can call it a full-price offer. In terms of other metrics, it can be treated as a cheap issue as LIC holds a leadership position compared to the second best in the industry, which valuations should reflect.

INTEGRATED VALUE:

Integrated insurer ratings were not known to us until discussions about the LIC IPO started. According to the investment banking lobby, globally integrated valuation is the key parameter for insurance companies and they have therefore started raising awareness of this aspect. The integrated value of listed life insurers SBI Life, HDFC Life and ICICI Prudential fluctuates between 2.4 and 4.05 compared to 1.1 for LIC at its profit price.

Now that the LIC is subject to SEBI and IRDA regulations, it must match the parameters like the other pairs listed. The company aims to change the payment policy from 95%/5% to 90%/10% within two years. You may experience some discomfort from those initial hiccups, but once you're fully on board, you'll regain your lead and increase your integrated rating for years to come.

DIVIDEND POLICY:

LIC was the dividend paying company and declared dividends of 42.10% for FY19 and 42.70% for FY20. In fact, the FY20 dividend was converted into shares. Throughout the period up to FY21, the Government of India (GoI) was the sole taker. Although the Indian government paid a dividend, it continued to distribute a large part of the profits to its policyholders (the main pillars).

After listing, LIC will follow a prudent dividend policy based on its financial performance and future prospects.

COMPARISON WITH PHONE LIST:

According to the offering documents, LIC included SBI Life, HDFC Life and ICICI Prudential among its listed competitors. They are currently trading at P/E ratios of 73.61, 101.84 and 100.25 (as of April 29, 2022). However, they are not really comparable from apple to apple.

COMMERCIAL BANK PERFORMANCE RECORDS:

The history of ten BRLMs linked to this issue is as follows:

1. Kotak Mahindra: This is Kotak Mahindra's 26th term in the past three years (including the current one). Of the last 10 registrations, 4 were opened with a discount and the rest with premiums ranging from 0.04% to 79.38% on the day of registration.

2. Axis Capital: This is Axis Cap's 37th mandate over the past three years (including the current one). Of the last 10 registrations, 3 were opened with a discount and the rest with premiums ranging from 1.16% to 169.04% on the day of registration.

3. BofA Securities: This is BofA Securities' tenth term in the last four years (including the current one). Of the last 9 registrations, 4 were opened at a reduced price and the others with premiums ranging from 0.04% to 79.38% on the day of registration.

4. Citigroup: This is Citigroup's 12th term in the last three years (including the current one). Of the last 10 registrations, 5 were opened with a discount and the rest with premiums ranging from 0.04% to 79.38% on the day of registration.

5. Goldman Sachs: This is Goldman Sachs' third tenure in the last three years (including the current one). Of the last 2 listings, 1 opened with a discount and 1 opened with a premium of 4.32% on the day of listing.

6. ICICI Securities: This is ICICI Securities' 41st term in office over the past three fiscal years (including the current one). Of the last 10 registrations, 4 were opened with a discount and the rest with premiums ranging from 0.06% to 169.04% on the day of registration.

7. JM Financial: This is JM Financials’ 26th term in the last three years (including the current one). On the last 10 quotations, all open with premiums ranging from 0.04% to 79.38% on the day of quotation.

8. J.P. Morgan: This is J.P. Morgan's sixth term. Morgan for the past three years (including the current one). Of the last 5 quotations, 4 were opened with a discount and 1 with a premium of 3.92% on the day of quotation.

9. Nomura: This is Nomura's 12th term in the last three years (including the current one). Of the last 10 registrations, 4 were opened with a discount and the rest with premiums ranging from 3.92% to 80.74% on the day of registration.

10. SBI Cap: This is SBI Cap's 18th term in the past three fiscal years (including the current one). Of the last 10 registrations, 5 were opened with a discount and the rest with premiums ranging from 0.04% to 103.11% on the day of registration.

Reasons to apply for LIC IPO

1] Market leader: LIC IPO looks attractive as it has around 30 million policyholders and 13,000 agents, which represents 55% of the total agent network. The insurance giant has a market share of approximately 64% of the industry's total insurance premiums in FY21. Life insurance has been one of the fastest growing segments of the Indian insurance market, reporting more than USD 5.7 billion in premium income in FY2020, the amount LIC had booked Approximately USD 33.8 billion in premiums. As of September 30, 2021, India's LIC was the largest wealth manager in India with assets under management (AUM) of USD39.55 trillion, more than 3.3 times the combined assets under management of all private life insurers in India and more than that 1.1x the assets under management of the entire Indian mutual fund industry. LIC's investments in publicly traded shares accounted for approximately 4% of NSE's total market capitalization as of September 21.

2] India's insurance industry has long been the least penetrated: India's insurance penetration was estimated at 4.2% in FY21, life insurance penetration at 3.2% and non-life insurance penetration at 1.0%. In terms of insurance density, India's overall density was USD 78 in FY21. These low penetration rates and low density demonstrate the uninsured nature of large sections of the population in India and the existence of an insurance gap. The record-low penetration is expected to spur growth for Life Insurance Corporation of India, which is already the market leader. LIC, which controls about two-thirds of the market, performs well in terms of agent productivity and cost/premium ratio. The insurer has the highest commission-to-premium ratio of 5.5%, compared to 4.4% for the top five private players.

3] Dividend-paying stocks allow investors to earn profits in two ways: through stock price appreciation and through dividends from the company. In addition to offering steady income, many dividend stocks are in defensive sectors that can weather economic downturns with less volatility. Life Insurance Corporation of India is wholly owned and controlled by the Government of India. After the Indian government stake dilution, the main shareholder remains in the company and investors can expect a healthy dividend from the company after the listing.

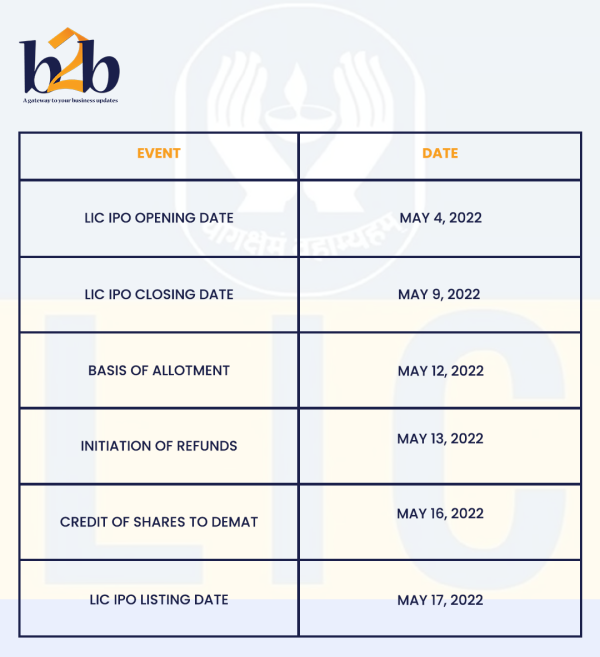

The country's largest initial public offering (IPO) by the life insurance company (LIC) is set to open on May 4 and close on May 9.

While the price range for the sale of the shares has been set between Rs.902 and Rs.949 per share, the shares of the insurance giant are available today (May 2) on the gray market at a premium of Rs.75, according to market-watching brokers.

What is the grey market?

Grey Market is the unofficial platform where shares of companies that have announced their IPOs are traded.

However, as the name suggests, it is not a legit platform and all transactions conducted there are at the risk of the investor.

At the same time, however, the grey market premium (GMP) on a company's stock gives an indication of the demand or popularity of an upcoming IPO.

The allocation of shares to the LIC IPO bidders demat account is expected to be completed around May 16, with the shares to be listed on May 17, 2022.

The government plans to sell a 3.5% stake in LIC (after reducing the size of the initial 5% stake due to prevailing market conditions) and LIC's initial public offering will be a full offer to sell (FSO).

The Minister of Ministry of Investment and Public Assets Management (DIPAM), Tuhin Kanta Pandey, said last week that the listing of LIC is part of the government's long-term strategic vision and will significantly increase the value long-term business.

"This LIC-IPO is appropriately sized given the capital market environment and will not crowd out capital supply given the current market environment," Pandey said April 27. .

Even after the reduced size of around Rs 20,557 crore, LIC's IPO will be the largest IPO ever in the country, he added.

The employee reserve share is 5% of the share capital after the offer and the policyholder reserve share is 10% of the offer size.

Also Read: Inherited house bought by father and want to sell it? Income tax rules explained

POPULAR POSTS

Rupee Forecast 2025: Key Drivers Behind INR Weakness Against the US Dollar

by Shan, 2025-08-11 07:32:23

August 2025 IPO Preview: Big Listings from JSW Cement, NSDL, Knowledge Realty & SME Stars

by Shan, 2025-07-30 11:51:27

Ola Electric Q1 Results FY26: Revenue Falls 61%, Net Loss at ₹870 Cr - MoveOS 5 in FocusOla

by Shan, 2025-07-14 12:22:55

HAL, BEL & Data Patterns: 3 Defence Stocks Riding India's ₹50,000 Cr Export Ambition

by Shan, 2025-06-26 10:00:16

India GDP Forecast 2025-26 Raised to 6.5% by S&P: Key Drivers & Global Risks Explained

by Shan, 2025-06-26 10:30:46

Dalal Street Outlook: 5 Key Market Triggers to Watch This Week

by Shan, 2025-06-16 12:32:04

What is the Bond Market & How Does It Impact Your Investments?

by B2B Desk, 2025-02-05 09:42:55

RECENTLY PUBLISHED

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

- by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

- by Shan, 2025-12-05 11:49:44

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Subscribe now

Subscribe now