Ratings of payment services and SBI Card News: Purchase; Motilal Oswal says the reviews are attractive

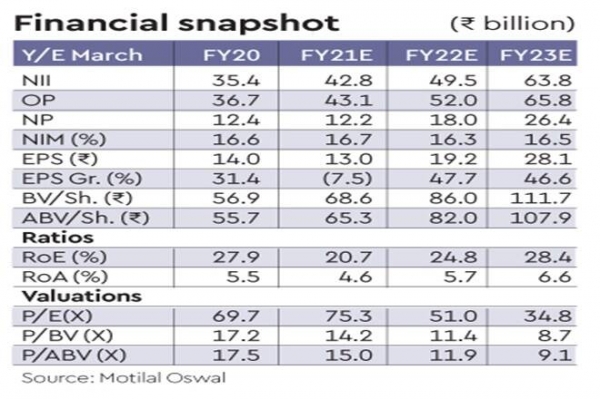

We estimate loan Payment / earning growth at a compound annual growth rate of 27% / 47% during fiscal 21-23e (return on assets / return on equity at 6.6% / 28

- by Gaurav Grover 2021-03-23 06:50:25

We recently began to cover SBI card news and Payments Services (SBICARD), highlighting the history of structural growth and unique play on growing retail credit introduced by the company. It consolidated its position as the second-largest card player in India, with a market share of ~ 19% in outstanding cards and ~ 20% in total spending. It has an outstanding card base of around 11.5 million and has doubled its card base in the last three years with an average additional market share of 23%.

We estimate loan Payment / earning growth at a compound annual growth rate of 27% / 47% during fiscal 21-23e (return on assets / return on equity at 6.6% / 28.4% in FY23e). However, we started coverage of this SBI card news with a neutral rating due to exorbitant valuations and the limited profit-taking advantage of Rs 1,200. The stock has corrected nearly 11% since its inception and is trading at 35 times its FY23 earnings, which is attractive given its strong fundamentals, earnings growth, and long-term structural history. At the CMP, the stock is showing an almost 23% rise to unchanged TP from Rs 1,200 (43x FY23e EPS). Accordingly, we are updating our rating to "Buy". Our earnings estimates have not changed.

Acceleration of growth momentum; Offers unique gameplay in a growing retail mix

According to the latest SBI card news, SBICARD's spending rate has touched pre-COVID levels (over 100% in retail spending), while gaining around 50bp of market share in outstanding cards. A continued rise in the economy, combined with a greater mix of retail and online spending, will accelerate the momentum of growth. SBICARD is the only company included in its field that offers direct play in the credit card industry. We expect the credit card/accounts receivable compound annual growth rate to be 22% / 27% during the industry's FY21-23e. The same for SBICARD would be higher 27% / 32% CAGR.

Strong basic profitability to absorb the cost of credit; PCR remains healthy at 72%.

The core profitability of the business remains strong, absorbing asset quality shocks. Although the cost of credit increased approximately 9% during FY2020, the return on assets/return on equity was strong at 5.5% / 28%. Even during the nine months of fiscal year 21, the cost of credit remained high at 10.5%, however, the performance ratios remained stable at 4.3% / 18.5%. While we expect delinquencies to remain high, given the unsecured nature of the book, which would keep the cost of credit high, return ratios are likely to remain intact and gradually improve as the cost of credit declines. We expect NNPA to decrease to 1.2% for FY23e, while PCR will maintain ~ 72%. This SBI card news can help many entrepreneurs out there.

ROE to revive to 28% in FY23e

Strong national insurance and a superior margin profile, coupled with health fee income, have resulted in strong operating performance for SBICARD, according to the latest SBI card news. During fiscal year 2015-2020, SBICARD reported a PPoP / PAT compound annual growth rate of 49% / 36% and an average RoA / RoE of around 5% / 29%. A higher percentage of the interest earnings book, along with higher free income, will continue to be the main driver of earnings. We expect SBICARD to report a compound annual earnings growth rate of 47% during FY21-23, with a higher rate of return on assets/return on equity of 6.6% / 28.4% for FY23e.

Also Read: Not everyone in India will get a coronavirus vaccine: Harsh Vardhan explains

POPULAR POSTS

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

by Shan, 2025-12-05 11:49:44

Zoho Mail vs Gmail (2025): Which Email Platform Is Best for Businesses, Startups, and Students?

by Shan, 2025-10-09 12:17:26

PM Modi Launches GST Bachat Utsav: Lower Taxes, More Savings for Every Indian Household

by Shan, 2025-09-24 12:20:59

$100K H-1B Visa Fee Explained: Trump’s New Rule, Clarifications & Impact on Indian Tech Workers

by Shan, 2025-09-22 10:11:03

India-US Trade Deal Soon? Chief US Negotiator Arrives in Delhi as Talks Set to Begin Tomorrow

by Shan, 2025-09-15 11:54:28

Modi Meets Xi: Trump’s Tariffs, Strategic Autonomy, and the Future of Asia’s Power Balance

by Shan, 2025-09-03 06:40:06

RECENTLY PUBLISHED

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Best Silver Investment Platforms for 2025: From CFDs to Digital Vaults Explained

- by Shan, 2025-10-23 12:22:46

Subscribe now

Subscribe now