How private sector employees can avail tax benefit in LTC Cash Voucher Scheme

Given the difficult economic environment, and in order to incentivize people to use unclaimed LTA amounts and to boost consumer demand, the government has issue

- by B2B Desk 2020-12-16 06:53:56

The COVID-19 pandemic and the ensuing nationwide lockdown have disrupted people's travel plans. This means that many cannot use the licensed travel allowance (LTA) available in their pay structures.

Given the difficult economic environment, and in order to incentivize people to use unclaimed LTA amounts and to boost consumer demand, the government has issued favorable guidelines. The guidelines considered paying a cash allowance equivalent to the considered LTC rate for central government employees instead of the LTA when introducing the LTC cash voucher system on October 12, 2020. The LTC scheme was extended to employees from the decentralized government on October 29, 2020 followed by multiple set of FAQs providing similar Exemption from income tax, bringing convenience to private sector employees as well

How can private sector employees benefit from LTC's cash voucher system?

The employee must meet the following conditions to be able to benefit from the benefits of the system:

- The LTC Scheme requires employees to spend three times the amount of the nominal LTC fee on the purchase of goods / services, with a GST rate of 12 percent or more;

- The amount must be spent during the period from October 12, 2020 to March 31, 2021;

Payment must be made through digital mode that includes checks, UPI, debit / credit card, etc. And the

- Employees must provide a copy of the invoices to the business owner, which contains the seller's GST number and the GST amount paid. Employees also have the option of submitting a self-certified copy of invoices should they wish to keep the originals for future reference.

If the conditions of the LTC scheme are met, the LTC fee paid to employees will be tax deductible, which definitely eliminates the mandatory travel requirement.

As stated in the FAQ, employees also have the option of billing on behalf of their family members.

Tax benefits available under the LTC scheme

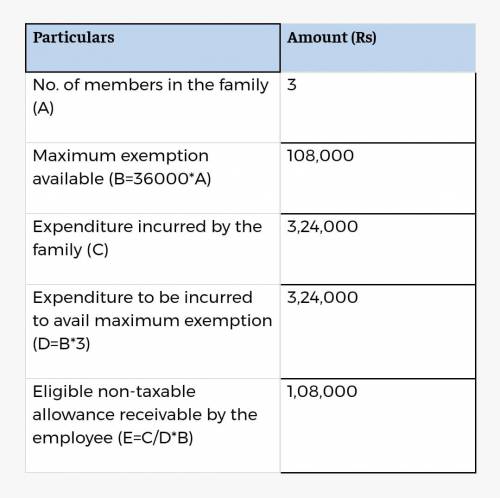

The LTC scheme guidelines provide private sector employees with a maximum benefit of Rs 36,000 per person.

To clarify, for a family of 3, the considered value of the LTC exemption would be the following:

In the event that the amount spent is less than 3 times the qualifying amount, the exemption will be allowed on a pro rata basis. The LTC scheme was introduced for the benefit of central government employees and later expanded to cover private sector employees.

However, private sector employers generally introduce an LTA policy for travel expenses as part of their salary structure and it is unclear how they can adopt the new LTC scheme in the current form. Also, there are no common questions specifically issued to address implementation aspects, for example: Once the scheme has been submitted, whether the remaining unbilled amount will be paid to the employee as a taxable component, as opposed to a central government employee where it is only payable when Actually employed according to the LTC system is spent.

The CBDT recently published a publication dated December 3, 2020, on compliance with withholding at source, which states that an employer must allow exemption from income tax only when the conditions specified in the LTC scheme on this expense. The post did not specifically address implementation aspects as discussed above.

Although the LTC scheme has been extended to the private sector for more than a month, private sector employees face a dilemma regarding this approach as most organizations are still figuring out the way forward and waiting for a legislative amendment. by the government.

With less than four months to go to the end of the fiscal year, many organizations are expecting the government to speed up the legislative amendment process and provide additional clarity so that employees can better utilize the LTC scheme and meet withholding tax obligations smoothly. by the employer.

Employees expect organizations to consider their existing LTA policy and circulate employee communication to take advantage of the recently announced LTC scheme.

Certainly the LTC scheme is a welcome step, as it fulfills the dual objective of releasing the existing LTA exemption and stimulating consumption. Employers and employees must work together for an employer to introduce the LTC plan and eligible employees to take advantage of the plan's benefits.Also Read: 3 Ways Small Business Retail Can Survive And Thrive With Technology

POPULAR POSTS

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

by Shan, 2025-12-05 11:49:44

Zoho Mail vs Gmail (2025): Which Email Platform Is Best for Businesses, Startups, and Students?

by Shan, 2025-10-09 12:17:26

PM Modi Launches GST Bachat Utsav: Lower Taxes, More Savings for Every Indian Household

by Shan, 2025-09-24 12:20:59

$100K H-1B Visa Fee Explained: Trump’s New Rule, Clarifications & Impact on Indian Tech Workers

by Shan, 2025-09-22 10:11:03

India-US Trade Deal Soon? Chief US Negotiator Arrives in Delhi as Talks Set to Begin Tomorrow

by Shan, 2025-09-15 11:54:28

Modi Meets Xi: Trump’s Tariffs, Strategic Autonomy, and the Future of Asia’s Power Balance

by Shan, 2025-09-03 06:40:06

Google Claims Gemini AI Uses Just ‘Five Drops of Water’ Per Prompt, Sparks Debate

by Shan, 2025-08-22 12:34:27

RECENTLY PUBLISHED

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Best Silver Investment Platforms for 2025: From CFDs to Digital Vaults Explained

- by Shan, 2025-10-23 12:22:46

Subscribe now

Subscribe now