What is Tick Trading? How Does It Work

- by B2B Desk 2024-08-07 11:05:22

Tick size refers to the smallest amount that a price in a market can change. In the US, this is typically measured in dollars or cents, meaning stock prices often adjust by at least one cent at a time. In India, tick size is measured in rupees and paisa, so stock prices there move in increments of at least one paisa. Traders closely monitor these tick changes because they can offer insights into shifts in market sentiment and trading trends.

How Is Tick Size Measured?

Tick size has evolved significantly over time. Before the 2000s, US stock markets used fractional pricing, where stocks moved in increments like one-sixteenth of a dollar, equivalent to $0.0625. Some stocks even had smaller increments, such as one-eighth or one-thirty-second of a dollar.

In 2005, the Securities and Exchange Commission (SEC) implemented Rule 612, also known as the Sub Penny Rule. This rule mandated that stock prices be quoted in decimal form rather than fractions. As a result, stocks now typically move in one-cent increments if priced over $1. For stocks priced below $1, the tick size is even smaller, at $0.0001.

Today, US exchanges use this decimal system, simplifying trading and making it easier for investors to understand price movements. However, the SEC may permit larger tick sizes for less frequently traded stocks.

In futures markets, tick sizes vary by the specific contract. For example, in the crude oil futures market, the tick size is 0.01, meaning prices move in increments of 0.01 points. If a crude oil contract is priced at $75.32 and a trader wants to place a higher bid, they must bid at least $75.33.

What is Tick Trading

Tick trading is a strategy focused on profiting from minor price movements, or "ticks," in financial markets. Traders who use this method aim to capitalize on these small fluctuations by executing numerous trades within short periods. They often rely on technical analysis and sophisticated algorithms to spot and exploit these tiny price changes.

The objective of tick trading is to gather small, quick profits throughout the trading day by taking advantage of minute price differentials. This approach demands rapid decision-making, a keen grasp of market behavior, and typically involves the use of automated trading systems to ensure trades are executed efficiently and without delay.

How Tick Trading Works

Tick trading operates by focusing on the smallest price changes, or "ticks," allowed for various investments. Each type of investment has its own tick size, which dictates the minimum amount by which its price can fluctuate. For example, the Emini S&P 500 futures contract has a tick size of $0.25, while gold futures have a tick size of $0.10.

This means that if the Emini S&P 500 futures contract is priced at $20, it can only move in increments of $0.25. Therefore, it might shift from $20 to $20.25 but not from $20 to $20.10, as $0.10 is smaller than the minimum tick size.

In 2015, the Securities and Exchange Commission launched a pilot program to explore the impact of larger tick sizes on approximately 1,200 small-cap stocks—companies with market caps around $3 billion and average daily trading volumes under one million shares. The goal was to assess how increasing tick sizes could influence trading and liquidity for these smaller stocks.

The program, which began in October 2016 and ran for two years, was part of broader research aimed at improving trading conditions for smaller companies in the stock market.

Components of Tick Trading

Precision and Speed: Tick trading requires both speed and precision. Traders make numerous trades in quick succession to capitalize on rapid price changes that might be missed by those focused on longer-term strategies.

Tick Size as a Measurement Unit: The tick size is the core unit of measurement in tick trading. Traders watch how prices move in these small increments to profit from minor market fluctuations.

Scalping Opportunities: Scalping is a common strategy used in tick trading. Traders seek to make quick profits by exploiting the difference between buying and selling prices, executing trades rapidly to capture these small gains.

Algorithmic and High-Frequency Trading: Modern tick trading often involves algorithmic and high-frequency trading systems. These sophisticated computer programs execute trades at very high speeds, using pre-set rules to exploit small price differences and maximize profits.

Dependency of Tick Trading on Tick Size

Quantifying Returns and Risks: Tick size plays a crucial role in measuring potential returns and assessing risks. It helps traders gauge how profitable each trade might be and maintain a balanced risk-reward ratio.

Adaptability to Market Conditions: Tick trading strategies are flexible and can adjust to various market conditions. Tick size helps traders navigate rapid price movements in volatile markets and capture smaller fluctuations in calmer markets.

Precision in Decision-Making: The precise value of each tick allows traders to make quick and accurate decisions. They rely on these increments to time their entries and exits effectively.

Setting Profit Targets and Stop Losses: Tick size is essential for setting profit targets and stop loss levels. Traders determine these thresholds based on tick size to effectively manage their gains and limit losses.

Characteristics of Tick Size

Impact on Liquidity: Tick size significantly influences a security’s liquidity. Smaller tick sizes enable more precise price movements, potentially increasing trading activity and enhancing liquidity. Larger tick sizes may reduce trading volume, especially for smaller or less frequently traded securities.

Bid-Ask Spread: The tick size affects the bid-ask spread—the difference between the highest price buyers are willing to pay and the lowest price sellers will accept. Smaller tick sizes usually lead to narrower bid-ask spreads, making it less costly for investors to trade.

Price Discovery: Tick size plays a role in the price discovery process, where market prices are determined based on supply and demand. Smaller tick sizes allow for more frequent price changes, which can lead to a more accurate reflection of market conditions.

Market Efficiency: In markets with smaller tick sizes and high liquidity, prices can adjust quickly to new information, enhancing market efficiency. Conversely, in less liquid markets or with larger tick sizes, price adjustments may be slower, potentially leading to less efficient price discovery.

Regulated Minimum Tick sizes are set by stock exchanges and financial regulators to define the smallest price increment for trading securities. This regulation helps maintain orderly trading and supports market liquidity.

Standardization: Tick sizes are standardized within the same exchange but may vary between different exchanges or markets. This standardization reflects the trading norms and types of securities in each venue.

Trading Strategies: The tick size can influence trading strategies. For example, high-frequency traders often benefit from smaller tick sizes as they can capitalize on minor price movements more effectively.

Market Fragmentation: Differences in tick size regulations across various trading venues can lead to market fragmentation. This fragmentation can affect trading practices and overall market efficiency.

FAQs

Q. How much is 1 tick in trading?

A. For most stocks, the tick size is $0.01, but fractions of a cent may also occur. "Pips" and basis points (bps) are tick sizes used in currency and fixed-income markets.

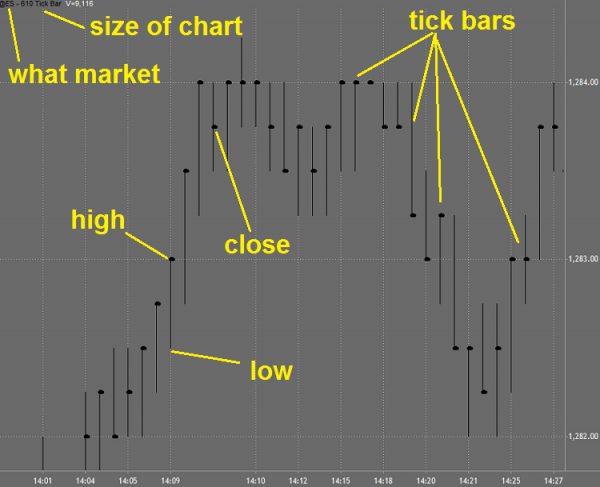

Q. How long is 1000 ticks in trading?

A. A tick chart displays the number of trades or transactions for each bar or candlestick, representing a specific amount of trades regardless of their duration. Example: A 1,000 tick chart generates a new bar after every 1,000 transactions.

Q. How are ticks calculated in trading?

A. For stocks, tick sizes are fairly straightforward. Basically, it's dollars and cents times the number of shares. But for stock index futures based on the S&P 500® index (SPX) and other benchmarks, it's a different sort of game.

Q. Which tick chart is best?

A. If you prefer to scalp, charts with 34 or 50 ticks will probably suit you. For day trading, 1000 ticks and 2000 ticks are the most common used. There is no best number of ticks to trade with. Different traders use different strategies on tick charts that suits them best.

Also Read: Cryptocurrency Scams: How to Avoid Them. rewrite this titlePOPULAR POSTS

Rupee Forecast 2025: Key Drivers Behind INR Weakness Against the US Dollar

by Shan, 2025-08-11 07:32:23

August 2025 IPO Preview: Big Listings from JSW Cement, NSDL, Knowledge Realty & SME Stars

by Shan, 2025-07-30 11:51:27

Ola Electric Q1 Results FY26: Revenue Falls 61%, Net Loss at ₹870 Cr - MoveOS 5 in FocusOla

by Shan, 2025-07-14 12:22:55

HAL, BEL & Data Patterns: 3 Defence Stocks Riding India's ₹50,000 Cr Export Ambition

by Shan, 2025-06-26 10:00:16

India GDP Forecast 2025-26 Raised to 6.5% by S&P: Key Drivers & Global Risks Explained

by Shan, 2025-06-26 10:30:46

Dalal Street Outlook: 5 Key Market Triggers to Watch This Week

by Shan, 2025-06-16 12:32:04

What is the Bond Market & How Does It Impact Your Investments?

by B2B Desk, 2025-02-05 09:42:55

RECENTLY PUBLISHED

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

- by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

- by Shan, 2025-12-05 11:49:44

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Subscribe now

Subscribe now