Paytm Unveils NFC Soundbox for Card and QR Code Mobile Payments

- by B2B Desk 2024-07-30 07:35:45

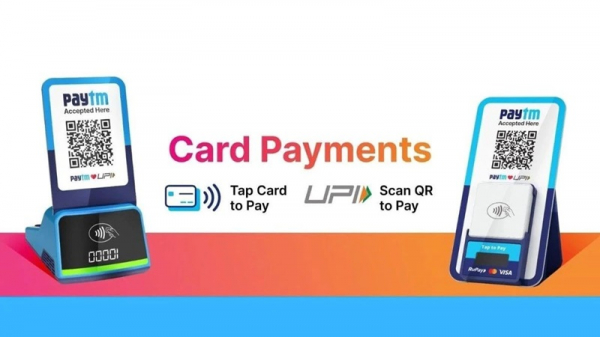

One 97 Communications Limited (OCL), the company behind Paytm, has launched the 'Paytm NFC Card Soundbox,' a multifunctional device aimed at simplifying payment processes for merchants. This cutting-edge tool enables businesses to accept payments through Tap-and-Pay card transactions, mobile payments using QR codes, and also serves as a sound box to provide audible payment notifications.

By integrating these three functions into a single device, merchants no longer need to manage separate EDC card machines, QR codes, or sound boxes. The Paytm NFC Card Soundbox utilizes NFC technology for card transactions, simplifying the payment experience.

During a virtual launch event, founder Vijay Shekhar Sharma highlighted the challenges associated with traditional EDC machines, such as maintenance issues and connectivity problems. He noted that these machines are often costly for merchants and that, given the prevalence of mobile payments, having a dedicated device for card acceptance is not always practical. This new device aims to address these concerns by consolidating multiple functions into one affordable solution.

He added, “This device addresses the issue by integrating all three functionalities into one solution.”

Sharma, along with Ripunjai Gaur, Chief Business Officer for Offline Payments, engaged with merchants from various states to gather feedback on the new device.

The company highlighted that the Paytm NFC Card Soundbox boasts an enhanced battery life of up to 10 days, reducing the need for frequent recharging. Besides its core features—instant audio notifications and a display screen for transaction amounts—this innovation is designed to help merchants streamline their daily operations. Additionally, the sound box now offers notifications in 11 different languages.

Merchant Revenue Update

Paytm's revenue from its payments business dropped to Rs 900 crore in the first quarter of the financial year, largely due to the closure of Paytm Payment Bank Limited (PPBL) accounts as per RBI directives. This compares to Rs 2,342 crore in the same period last year. The company's net payment margin fell to Rs 383 crore for the quarter, down from Rs 853 crore in the previous quarter.

Payment margins are influenced by earnings from non-UPI payment methods such as post-paid services, EMI, and credit cards, as well as subscription fees from devices sold to merchants.

Although new merchant signups have returned to levels seen in January 2024, Paytm reported a drop in revenue from device subscriptions for Q1 FY25. By June 2024, the number of Paytm Soundbox device subscribers had increased to 1.09 crore, up from 79 lakh in June 2023.

Looking ahead, the management expects to see growth in device subscriptions as they focus on acquiring new signups, reactivating dormant merchants, and redeploying devices from inactive merchants.

Also Read: Discover the Best Indicators for Option Trading to Optimize Your Strategy

POPULAR POSTS

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

by Shan, 2025-12-05 11:49:44

Zoho Mail vs Gmail (2025): Which Email Platform Is Best for Businesses, Startups, and Students?

by Shan, 2025-10-09 12:17:26

PM Modi Launches GST Bachat Utsav: Lower Taxes, More Savings for Every Indian Household

by Shan, 2025-09-24 12:20:59

$100K H-1B Visa Fee Explained: Trump’s New Rule, Clarifications & Impact on Indian Tech Workers

by Shan, 2025-09-22 10:11:03

India-US Trade Deal Soon? Chief US Negotiator Arrives in Delhi as Talks Set to Begin Tomorrow

by Shan, 2025-09-15 11:54:28

Modi Meets Xi: Trump’s Tariffs, Strategic Autonomy, and the Future of Asia’s Power Balance

by Shan, 2025-09-03 06:40:06

RECENTLY PUBLISHED

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Best Silver Investment Platforms for 2025: From CFDs to Digital Vaults Explained

- by Shan, 2025-10-23 12:22:46

Subscribe now

Subscribe now