Understanding Government Securities: An Overview of G-Secs

- by B2B Desk 2024-07-22 08:36:25

Government securities are fundamental to the financial market, serving as a vital avenue through which governments raise funds from the public. These securities are highly regarded for their safety, backed by the government's stable creditworthiness. Beyond their security, they are essential instruments that help governments finance various developmental and infrastructural initiatives. In India, government securities encompass various types, including treasury bills and dated securities, each tailored to meet different financing needs and investment preferences. Investors value these securities not only for their stability but also for their predictable returns and the liquidity they offer in the market.

What are Government Securities in India?

Government securities, commonly referred to as "G-Secs" or "government bonds," are integral components of the financial market and play a crucial role in a country's economy. These securities are debt instruments issued by the government to raise funds for various purposes, such as financing infrastructure projects, managing national debts, and addressing budgetary gaps.

Investing in government securities ensures that investors receive the full repayment of their principal amount when the security matures. Some government securities also provide regular interest payments, akin to corporate bonds. This feature makes them appealing to investors seeking stable returns backed by the government's creditworthiness.

For instance, Sovereign Savings Bonds issued by the central bank exemplify how these instruments serve diverse investment needs while supporting government funding initiatives.

Types Of Government Securities in India

In India, government securities come in the forms of Treasury Bills (T-Bills) that have short-term maturities of up to 364 days, and dated securities such as government bonds that offer fixed interest rates and maturities lasting from 5 to 40 years.

Treasury Bills (T-Bills)

Treasury Bills are short-term debt instruments issued by the Indian government, offering maturities of 91 days, 182 days, or 364 days. These bills are sold at a discount to their face value and provide investors with a safe and liquid option for parking short-term funds.

Government Bonds (Dated Securities)

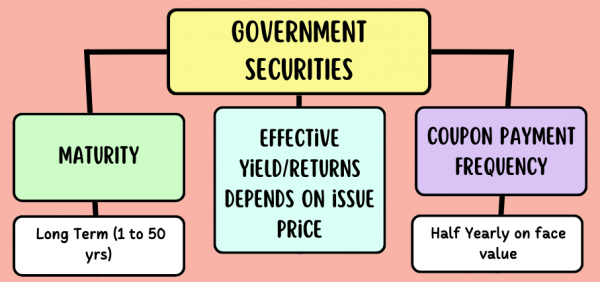

Government Bonds, or dated securities, are long-term investments issued by the Indian government with fixed interest rates and maturities ranging from 5 to 40 years. These bonds offer regular interest payments (coupons) and are backed by the government's commitment to repayment, making them a low-risk investment choice.

Cash Management Bills (CMBs)

Cash Management Bills are short-term debt instruments issued for durations typically less than 90 days. They serve as temporary funding solutions for the government and operate similarly to Treasury Bills, providing security and liquidity for surplus funds.

State Development Loans (SDLs)

State Development Loans are long-term securities issued by state governments in India. SDLs offer fixed interest rates and specific maturity periods, similar to central government bonds. They are utilized to finance state-specific projects and activities, presenting an alternative investment avenue within the government securities market.

Inflation-Indexed Bonds (IIBs)

Inflation-Indexed Bonds are designed to safeguard investors against inflation by linking returns to inflation rates. Both principal and interest payments adjust according to changes in inflation, ensuring that the purchasing power of the investment is maintained over time. IIBs are particularly attractive during periods of inflationary pressure, offering investors a reliable hedge against rising prices.

What are the Benefits & Drawbackss of Investing in Government Securities?

Investing in government securities offers a promising opportunity for investors looking to balance safety with consistent returns in their financial endeavors. However, like any investment option, government securities also have their own set of advantages and disadvantages. Let's delve into these in greater detail:

Benefits of Government Securities:

Security and Stability: Government securities are among the safest investments due to the backing of the government's creditworthiness and taxing authority.

Reliable Returns: Most government securities offer fixed interest rates or returns, ensuring a consistent and predictable income stream.

Diversification Potential: Integrating government securities into an investment portfolio can enhance diversification, reducing overall risk exposure.

Tax Advantages: Certain types of government securities, such as tax-free bonds or specific savings bonds, provide attractive tax benefits, enhancing after-tax returns.

High Liquidity: Government securities issued by the central government are highly liquid, allowing for easy buying or selling in the secondary market.

Drawbacks of Government Securities:

Lower Yield Potential: While government securities offer safety, they often yield lower returns compared to riskier assets like stocks or corporate bonds.

Interest Rate Sensitivity: Government securities are sensitive to changes in interest rates. Increases in rates can lead to a decline in the market value of existing bonds, potentially resulting in capital losses.

Inflation Risk: Fixed-income investments like government bonds are vulnerable to inflation, which can erode the purchasing power of returns over time.

Market Volatility: Although generally stable, government securities are still subject to market fluctuations that can affect their prices and overall performance.

How Do Government Securities Work?

Government securities are fundamental tools governments use to raise funds. These securities, essentially debt instruments, are issued by governments to investors, acting as a means of borrowing money. Investors buy these securities, effectively lending money to the government. In return, they receive regular interest payments and get their principal back when the security matures.

The appeal of government securities lies in their perceived safety, backed by the government's creditworthiness. Because of this low risk, the interest rates on these securities are typically lower compared to riskier investments.

Government securities are valued by investors for their stability and are often included in diversified investment portfolios to balance risk and potential returns. Understanding their role is crucial for anyone interested in gaining a comprehensive understanding of financial markets and investment opportunities.

FAQs

Q. What is meant by government securities?

A. A government security is a bond or other type of debt obligation that is issued by a government with a promise of repayment upon the security's maturity date. Government securities are usually considered low-risk investments because they are backed by the taxing power of a government.

Q. What are the benefits of G-SEC?

A. G-Secs carry practically no risk of default and, hence, are called risk-free gilt-edged instruments. 1.3 Treasury bills or T-bills, which are money market instruments, are short term debt instruments issued by the Government of India and are presently issued in three tenors, namely, 91 day, 182 day and 364 day.

Q. How to buy government bonds in India?

A. In India, government bonds can be bought through banks, post offices, brokerage houses, gilt mutual funds, ETFs, RBI Retail Direct, and NSE goBID/BSE Direct.

Q. Can I buy GSEC directly from RBI?

A. The RBI launched retail direct portal in November 2021 to facilitate retail investors to open their Retail Direct Gilt accounts with the Reserve Bank of India under the Retail Direct Scheme.

Also Read: Budget 2024: How Mutual Fund Investors Can Gain from 80C RaisePOPULAR POSTS

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

by Shan, 2025-12-05 11:49:44

Zoho Mail vs Gmail (2025): Which Email Platform Is Best for Businesses, Startups, and Students?

by Shan, 2025-10-09 12:17:26

PM Modi Launches GST Bachat Utsav: Lower Taxes, More Savings for Every Indian Household

by Shan, 2025-09-24 12:20:59

$100K H-1B Visa Fee Explained: Trump’s New Rule, Clarifications & Impact on Indian Tech Workers

by Shan, 2025-09-22 10:11:03

India-US Trade Deal Soon? Chief US Negotiator Arrives in Delhi as Talks Set to Begin Tomorrow

by Shan, 2025-09-15 11:54:28

Modi Meets Xi: Trump’s Tariffs, Strategic Autonomy, and the Future of Asia’s Power Balance

by Shan, 2025-09-03 06:40:06

RECENTLY PUBLISHED

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Best Silver Investment Platforms for 2025: From CFDs to Digital Vaults Explained

- by Shan, 2025-10-23 12:22:46

Subscribe now

Subscribe now