How do Credit Card companies generate revenue?

- by B2B Desk 2024-06-27 08:16:37

Knowing how credit card companies generate profit is essential for smart financial planning. This article discusses how they make money and highlights the importance of using credit wisely to lower expenses. We will discover how to navigate this situation and save more money for you.

How do credit cards works?

From the perspective of the cardholder, credit cards can be seen as a form of borrowing. Each time you make a purchase with your card, you are essentially borrowing money from the issuer. You can choose to either clear your entire balance every billing cycle or carry it forward to the following month and incur interest on the outstanding amount.

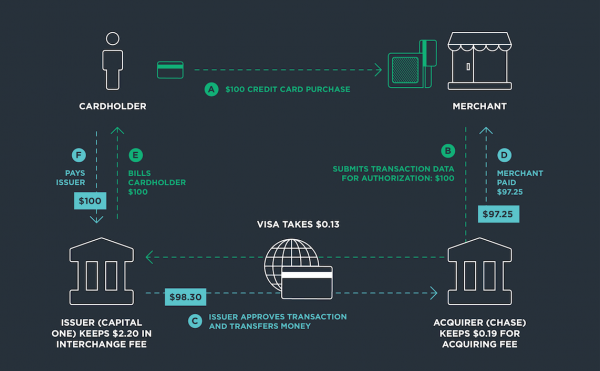

The situation becomes more intricate when talking about the specifics of what happens during each credit card purchase.

Different types of credit card companies

Initially, it is important to understand that there are two primary categories of credit card companies: credit card issuers and credit card networks. Some key individuals hold dual positions:

Credit card issuers

Credit card issuers refer to the financial institutions, such as banks and credit unions, that provide credit cards to consumers. Credit card fees are charged by lenders who provide cardholders with the money they use on their cards. Interest is applied by credit card companies for carrying a balance, as they establish the terms and conditions for your credit card deal. American Express, Chase, Citi, Capital One, Discover, and Wells Fargo are some instances of credit card issuers.

Credit card networks

Credit card networks monitor the transactions between credit card issuers and merchants by controlling digital networks that process payments. Merchants are charged a fee known as an "interchange fee" for providing this service. The networks guarantee that expenses are assigned correctly to the correct cardholder in order for the issuer to bill them correctly. American Express, Discover, Mastercard, and Visa are all examples of credit card networks.

American Express and Discover stand out because they not only provide their own credit cards but also function as credit card networks. This implies that they offer their cards to customers and help with the transactions between these cards and businesses.

How Do Credit Card Companies Make Money?

Credit card companies make money and maintain their operations by applying the following fees:

Interest

One way banks make money from their credit card customers is through interest charges, especially on payments that are missed or made late. It is the primary source of their income.

However, this does not indicate that their systems are created to deceive cardholders. Credit card companies provide automatic payment options and send reminders before due dates to assist their customers in preventing debt.

Interchange fees

Although you may consistently pay off your credit card debts monthly and avoid interest fees, creditors are still profiting from your transactions. This is because the merchant incurs a fee each time you make a purchase with your card to cover transaction processing costs. This fee is known as an interchange fee or swipe fee.

Interchange fees are used to handle the expenses associated with communicating with the issuer, verifying for fraud and card validity, and ultimately processing the payment. They are inevitable for merchants desiring to take credit or debit cards as payment methods. Various factors, such as the type of card and merchant, play a role in determining the fees.

Annual and other fees

Several credit cards require an annual fee in order to have the card, which serves as an added source of income for the companies that issue them. There are many great no-annual-fee credit cards available, but for certain cardholders who can take advantage of the perks, features, rewards, and benefits that come with an annual fee, these cards can be worth it. In this scenario, cardholders receive benefits in exchange for the fee, while issuers still make money.

However, credit card companies can charge various additional fees to generate revenue, many of which can be prevented by cardholders. Fees that can be avoided are charges for late payment, cash advance, balance transfer, and foreign transactions. By comprehending the terms and conditions of their credit cards and using them responsibly, cardholders can completely avoid paying these fees, even though they can provide substantial income for credit card companies.

Penalty fees

When you open a credit card account, you are entering into a contract with the issuer. If you don't follow the agreement's terms, you will likely be charged a fee by the issuer. Failing to pay your bill promptly will probably result in you being charged a late fee. Similarly, exceeding your credit limit can result in having to pay an additional fee for going over the limit.

final thought

The credit card industry is massive, generating billions of dollars in revenue. Credit card companies profit significantly from consumers, often more than people realize they spend. However, it's crucial not to rely solely on credit cards for managing expenses.

There are various payment methods that can help you save and spend money wisely. A key strategy is to pay your bills on time and avoid common pitfalls associated with credit card use. By adopting a smarter approach, you can effectively use credit cards over the long term without straining your finances.

FAQs

Q. How do credit card companies make money if you pay in full?

A. Yes, credit card issuers can make money from your card account even if you pay in full every month. Every time you use your card, the merchant is charged a fee by the issuer to process the transaction. This is called an interchange fee. Interchange fees typically range from 1% to 3% of the transaction amount.

Q. How much money do credit card processing companies make?

A. On average, credit card processors make between 0.5% and 5% of the total transaction amount in fees. However, this percentage can vary depending on factors such as the type of card used (credit or debit), the volume of transactions processed, and the pricing model used by the credit card processor.

Q. Who pays merchant fees?

A. Credit card processing fees are paid by the merchant, not by the consumer. Businesses and their acquiring banks pay credit card processing fees to the consumer's credit card issuer, credit card network and payment processor. On average, credit card processing fees can range between 1.5% and 3.5% of the transaction.

Q. Do credit card companies lose money if you pay on time?

A. While credit card issuers don't make money through credit card interest if you pay your balance in full each month, they make money through credit card fees and miscellaneous charges. Credit card networks also charge merchants interchange fees for every purchase you make.

Also Read: What is margin trading facility? A Comprehensive Guide

POPULAR POSTS

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

by Shan, 2025-12-05 11:49:44

Zoho Mail vs Gmail (2025): Which Email Platform Is Best for Businesses, Startups, and Students?

by Shan, 2025-10-09 12:17:26

PM Modi Launches GST Bachat Utsav: Lower Taxes, More Savings for Every Indian Household

by Shan, 2025-09-24 12:20:59

$100K H-1B Visa Fee Explained: Trump’s New Rule, Clarifications & Impact on Indian Tech Workers

by Shan, 2025-09-22 10:11:03

India-US Trade Deal Soon? Chief US Negotiator Arrives in Delhi as Talks Set to Begin Tomorrow

by Shan, 2025-09-15 11:54:28

Modi Meets Xi: Trump’s Tariffs, Strategic Autonomy, and the Future of Asia’s Power Balance

by Shan, 2025-09-03 06:40:06

RECENTLY PUBLISHED

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Best Silver Investment Platforms for 2025: From CFDs to Digital Vaults Explained

- by Shan, 2025-10-23 12:22:46

Subscribe now

Subscribe now