How to verify ITR? Here are 6 ways to verify income tax return

Using Net-banking The second way to verify the ITR is through the Net Banking facility of your bank account. The Income Tax Portal offers a list of banks

- by B2B Desk 2023-08-01 06:00:47

The Central Board of Direct Taxes (CBDT) has reduced the time limit to verify the income statement to 30 days from the earlier limit of 120 days. The change came into effect on August 1, 2022. Thus, for ITRs that are being filed now, one must ensure that the ITR is verified within 30 days from the date it was filed on the portal. If the ITR is not verified, it will be assumed that the taxpayer has not filed the ITR.

An individual can verify their income tax return using any of six methods. Of the six ways, five are electronic and one is a physical ITR verification method.

Here's a look at six ways you can verify your tax return

- Using Aadhaar OTP

To verify your ITR using your Aadhaar-based Time Password (OTP), your mobile number must be linked with your Aadhaar and registered in the Unique Identification Authority of India (UIDAI) database and your number PAN must be linked with your Aadhaar.

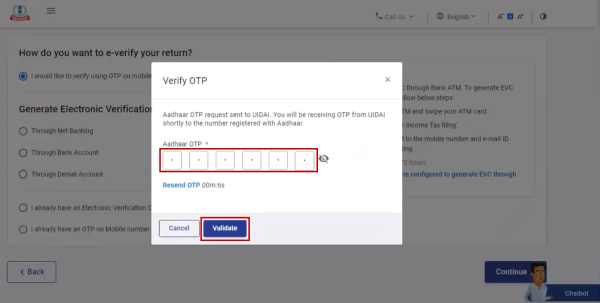

On the “e-Verify” page, select “I would like to verify using OTP on the mobile phone number registered with Aadhaar” and click “Continue”. A popup window will appear on your screen. You will be prompted to select the "I agree to validate my Aadhaar details" checkbox and click on "Generate Aadhaar OTP".

An SMS containing your 6-digit One Time Password (OTP) will be sent to your registered mobile phone number.

Enter the OTP received in the box where it is required and click Submit. On successful submission, your ITR will be verified. OTP is only valid for 15 minutes.

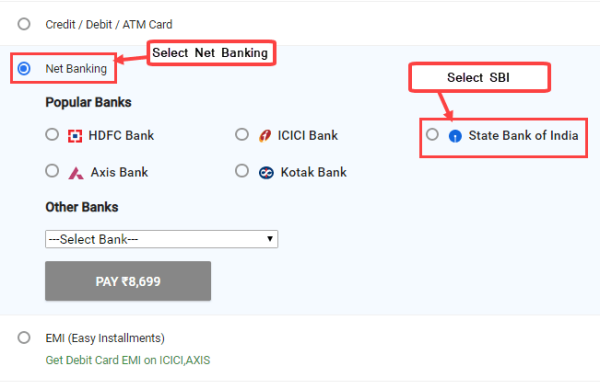

- Using Net-banking

The second way to verify the ITR is through the Net Banking facility of your bank account. The Income Tax Portal offers a list of banks where you can use the Net Banking service for verification of income tax returns.

On the e-Verify page, select Via Net Banking and click Continue. Select the bank through which you want to verify your ITR and click Continue. A pop-up window will appear on your screen containing a disclaimer. Read and click Continue. You will then be prompted to log in to Net Banking for your bank account. Select the "e-Verify" option, usually found under the "Tax" tab. You will be redirected to the online filing website of the Income Tax Department. Go to the respective ITR form and click on e-Verify. Your tax return will be e-verified successfully.

Prerequisites for different ITR verifications methods

|

e-Verification Method |

Prerequisite |

|

Digital Signature Certificate |

· Valid and active DSC · Emsigner utility installed and running on your PC · Plugged-in DSC USB token in your PC · DSC USB token procured from a Certifying Authority provider · The DSC USB token is a Class 2 or Class 3 certificate. |

|

OTP on the mobile number registered with Aadhaar |

· PAN is linked with Aadhaar |

|

Bank Account EVC / Demat Account EVC |

· Pre-validated and EVC-enabled bank / Demat account |

|

Net Banking |

· PAN linked with your bank account · Net Banking should be enabled for the preferred bank account |

- Using EVC from the bank account

The third option for verifying ITR is to generate an Electronic Verification Code (EVC) through one's bank account. You must have a pre-verified bank account in the income tax portal to be able to generate an EVC. Please note that pre-verification of a bank account is a must to receive an income tax refund.

On the e-Verify page, select "By Bank Account" and click "Continue." The EVC will be generated and sent to your mobile phone number and email ID registered to your pre-verified EVC-enabled bank account. Enter the EVC received on your mobile phone number and the email ID registered to your bank account and click on e-Verify.

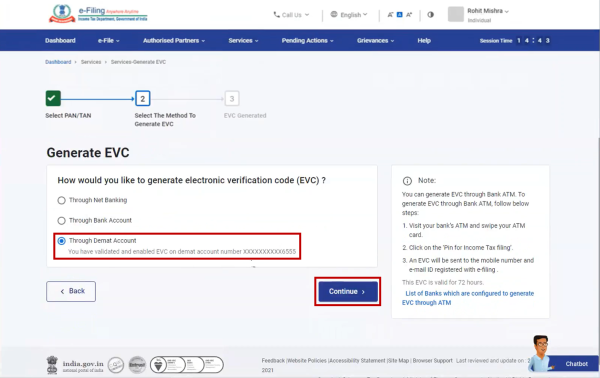

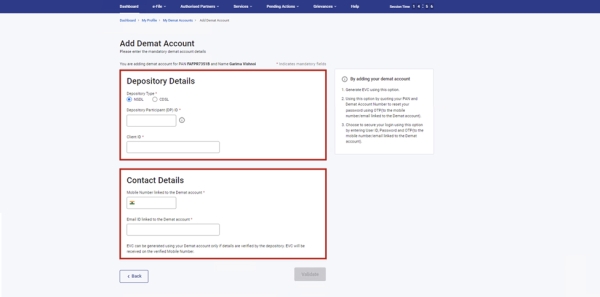

- Using EVC from the Demat account

The ITR verification process through a demat account is similar to the verification through a bank account as mentioned above.

On the e-Verify page, select "Through Demat Account" and click "Continue." The EVC will be generated and sent to your mobile phone number and email ID registered in your pre-verified EVC-enabled demat account. Enter the EVC received on your mobile phone number and the email ID registered with your Demat account and click on e-Verify.

- Use EVC from Bank ATM

This is an offline verification method. EVC can also be generated via bank ATM card. This facility is only available through limited banks viz: Axis Bank, Canara Bank, Central Bank of India, ICICI Bank, IDBI Bank, Kotak Mahindra Bank, and State Bank of India.

Visit your bank's ATM and swipe your ATM card; Enter the ATM PIN and select Generate EVC for Income tax filing. An EVC will be sent to your mobile phone number and email ID registered in the e-filing portal. Please note that your PAN must be registered with the bank.

Go to the 'e-verify returns' option. Select the ITR to verify it and select the option "I already have an Electronic Verification Code (EVC). Enter the EVC code and click on e-Verify.

- Physical sending signed ITR-V/Acknowledgement receipt

If you cannot verify your ITR using any of the above electronic methods, you can send a signed copy of your ITR-V (Acknowledgement receipt) to the Tax Department. If you want to file an ITR-V for verification of your tax return, please remember the points below.

- ITR-V is a one-page document that must be signed in blue ink. It must be sent either via ordinary post or speed post. You cannot courier ITR-V.

- Address of CPC Bangalore for speed post: “CPC, Post Box No - 1, Electronic City Post Office, Bangalore - 560100, Karnataka, India”.

- You are not required to send any supporting documents with the ITR-V.

- You will receive an SMS notification on your registered mobile phone and email ID once your ITR has been received by the Tax Department.

This intimation is only for the ITR-V receipt, the intimation for tax return processing is separate.

POPULAR POSTS

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

by Shan, 2025-12-05 11:49:44

Zoho Mail vs Gmail (2025): Which Email Platform Is Best for Businesses, Startups, and Students?

by Shan, 2025-10-09 12:17:26

PM Modi Launches GST Bachat Utsav: Lower Taxes, More Savings for Every Indian Household

by Shan, 2025-09-24 12:20:59

$100K H-1B Visa Fee Explained: Trump’s New Rule, Clarifications & Impact on Indian Tech Workers

by Shan, 2025-09-22 10:11:03

India-US Trade Deal Soon? Chief US Negotiator Arrives in Delhi as Talks Set to Begin Tomorrow

by Shan, 2025-09-15 11:54:28

Modi Meets Xi: Trump’s Tariffs, Strategic Autonomy, and the Future of Asia’s Power Balance

by Shan, 2025-09-03 06:40:06

RECENTLY PUBLISHED

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Best Silver Investment Platforms for 2025: From CFDs to Digital Vaults Explained

- by Shan, 2025-10-23 12:22:46

Subscribe now

Subscribe now