SBI and 15 others sell Suzlon loans worth over Rs 8,000 crore to REC and IREDA

“It's a win-win situation, both for the banks and for the company. Banks dump a troubled account that shows no signs of recovery. Suzlon gets a better payment

- by B2B Desk 2022-06-03 05:34:50

A group of 16 banks led by the State Bank of India has sold more than Rs.8,000 crore in loans from Suzlon Energy to Rural Electrification Corp and India's Renewable Energy Development Agency (IREDA), cleaning up their bills a burden for nearly a decade and a half.

The loan sale was completed as the wind energy company was in the midst of its second bank-led restructuring, which began in 2020. The refinancing, led by REC and IREDA, would extend the tenor of Suzlon's loans and would also have a lower interest rate. than paying banks, said several people familiar with the outline of the agreement.

“It's a win-win situation, both for the banks and for the company. Banks dump a troubled account that shows no signs of recovery. Suzlon gets a better payment schedule and a cheaper interest rate, which makes the company's financial situation more sustainable," said a person familiar with the deal.

“It's a win-win situation, both for the banks and for the company. Banks dump a troubled account that shows no signs of recovery. Suzlon gets a better payment schedule and a cheaper interest rate, which makes the company's financial situation more sustainable," said a person familiar with the deal.

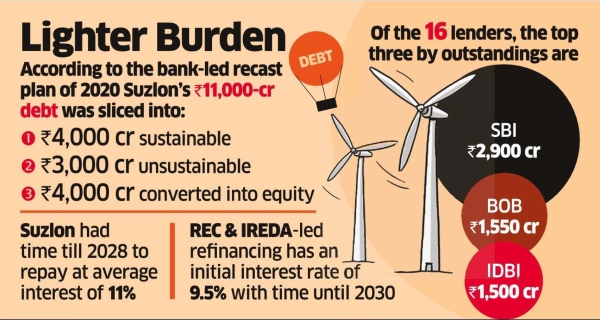

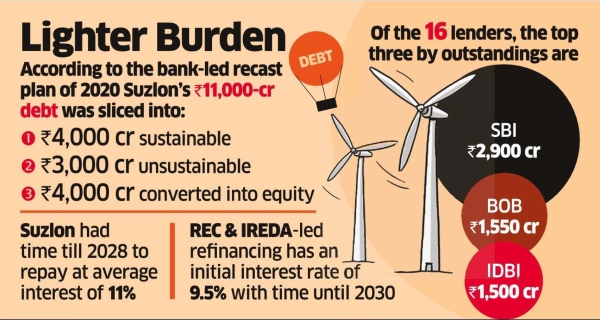

As part of the restructuring initiated by the banks in 2020, Suzlon's gross debt of Rs.11,000 crore has been split into sustainable (Rs.4,000 crore) and non-sustainable (Rs.3,000 crore) debt and a portion of this was converted into shares (Rs.4,000 crore).

“According to the restructuring plan, the company had until 2028 to repay its debt at an average interest rate of 11%. Now, the new refinance has a term until 2030 and an initial interest rate of 9.5%, which is a very good deal for Suzlon energy. In addition, with the commissions returned, the NPA label (Non-Performing Asset) that they had imposed on banks in the business, and some banks can afford to unwind provisions this quarter,” said a second person with knowledge of the transaction.

In a nota del 25 de mayo a las bolsas de valores, Suzlon había declared that the specialization of the energy sector of REC and IREDA los colocaría in a better position to respond to the specific needs of the group and to provide an operational flexibility adecuada para operar eficientemente the group. Company.

"We have completed our debt refinancing activities and replaced our 16 lenders with two new lenders who have specific experience in the energy sector. This move will support our future growth plans," the company said in response to ET questions.

REC and IREDA did not respond to an email seeking comment.

Under the terms of the agreement, the banks will continue to participate in the company through the conversion of optional convertible bonds (OCDs) and mandatory convertible preferred shares (CCPS). Banks are also not required to maintain ties to the shares they hold and are free to sell them on the open market at will.

SBI is the largest bank with unpaid fees of Rs.2,900 crore, followed by BoB with Rs.1,550 crore and IDBI Bank with Rs.1,500 crore in a consortium of 16 banks.

“The thing is, any refund from that account seemed fishy. Funding from project sponsors also took time. The banks made the best decision based on the information available. For now, it's at the REC,” said a third person with knowledge of the transaction.

Also Read: What is Intraday Trading - Learn how to do Intraday Trading!

The loan sale was completed as the wind energy company was in the midst of its second bank-led restructuring, which began in 2020. The refinancing, led by REC and IREDA, would extend the tenor of Suzlon's loans and would also have a lower interest rate. than paying banks, said several people familiar with the outline of the agreement.

As part of the restructuring initiated by the banks in 2020, Suzlon's gross debt of Rs.11,000 crore has been split into sustainable (Rs.4,000 crore) and non-sustainable (Rs.3,000 crore) debt and a portion of this was converted into shares (Rs.4,000 crore).

“According to the restructuring plan, the company had until 2028 to repay its debt at an average interest rate of 11%. Now, the new refinance has a term until 2030 and an initial interest rate of 9.5%, which is a very good deal for Suzlon energy. In addition, with the commissions returned, the NPA label (Non-Performing Asset) that they had imposed on banks in the business, and some banks can afford to unwind provisions this quarter,” said a second person with knowledge of the transaction.

In a nota del 25 de mayo a las bolsas de valores, Suzlon había declared that the specialization of the energy sector of REC and IREDA los colocaría in a better position to respond to the specific needs of the group and to provide an operational flexibility adecuada para operar eficientemente the group. Company.

"We have completed our debt refinancing activities and replaced our 16 lenders with two new lenders who have specific experience in the energy sector. This move will support our future growth plans," the company said in response to ET questions.

REC and IREDA did not respond to an email seeking comment.

Under the terms of the agreement, the banks will continue to participate in the company through the conversion of optional convertible bonds (OCDs) and mandatory convertible preferred shares (CCPS). Banks are also not required to maintain ties to the shares they hold and are free to sell them on the open market at will.

SBI is the largest bank with unpaid fees of Rs.2,900 crore, followed by BoB with Rs.1,550 crore and IDBI Bank with Rs.1,500 crore in a consortium of 16 banks.

“The thing is, any refund from that account seemed fishy. Funding from project sponsors also took time. The banks made the best decision based on the information available. For now, it's at the REC,” said a third person with knowledge of the transaction.

Also Read: What is Intraday Trading - Learn how to do Intraday Trading!

POPULAR POSTS

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

by Shan, 2025-12-05 11:49:44

Zoho Mail vs Gmail (2025): Which Email Platform Is Best for Businesses, Startups, and Students?

by Shan, 2025-10-09 12:17:26

PM Modi Launches GST Bachat Utsav: Lower Taxes, More Savings for Every Indian Household

by Shan, 2025-09-24 12:20:59

$100K H-1B Visa Fee Explained: Trump’s New Rule, Clarifications & Impact on Indian Tech Workers

by Shan, 2025-09-22 10:11:03

India-US Trade Deal Soon? Chief US Negotiator Arrives in Delhi as Talks Set to Begin Tomorrow

by Shan, 2025-09-15 11:54:28

Modi Meets Xi: Trump’s Tariffs, Strategic Autonomy, and the Future of Asia’s Power Balance

by Shan, 2025-09-03 06:40:06

RECENTLY PUBLISHED

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Best Silver Investment Platforms for 2025: From CFDs to Digital Vaults Explained

- by Shan, 2025-10-23 12:22:46

Subscribe now

Subscribe now