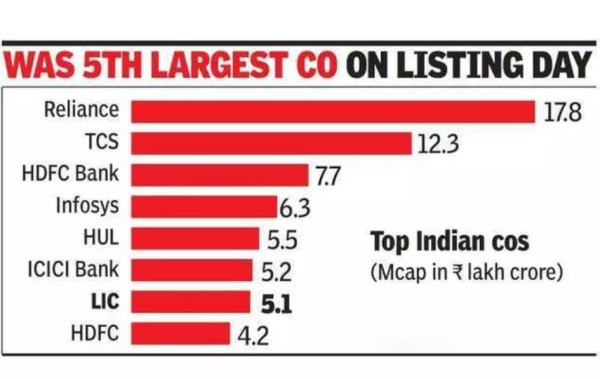

LIC's market capitalization drops to seventh place, behind ICICI Bank

LIC announced its quarterly results for the first time on Monday, revealing that quarterly profits in March were 18% lower than the same period last year. The c

- by B2B Desk 2022-06-01 05:26:35

LIC's market cap fell below that of ICICI Bank (Rs 5.2 lakh crore) to seventh on Tuesday as Dalal Street expressed disappointment with the results announced on Monday.

Shares of LIC fell 3% or more from Rs 25 to Rs 811, reducing its market capitalization to Rs 5.1 lakh crore. On May 17th when LIC was listed on the stock exchange, the company was the 5th largest company with a market capitalization of over Rs 5.5 lakh crore.

LIC announced its quarterly results for the first time on Monday, revealing that quarterly profits in March were 18% lower than the same period last year. The company reported full year net profit of Rs 4,043 crore, up 39% year-on-year.

LIC management, speaking at a news conference on Tuesday, said the fourth-quarter results were not indicative of performance as fundamental figures were not available for comparison purposes. LIC also said key data analysts being sought, such as new business value and added value, would not be available until late June.

According to LIC's Raj Kumar, MD, the decline is due to the fact that FY21 earnings were lumped together as there were no quarterly earnings in the first quarter. “We did not report quarterly results prior to listing and only started in the quarter ended September 2021. The comparison was not three months versus three months, but the whole of Exercise 21,” said Kumar. He added that even the first quarter of fiscal 23 earnings could not be compared to the first quarter of fiscal 22 as there were no earnings reported for that quarter.

Kumar said calculating the value of the new business is time-consuming because the company has 285 products and the value proposition of each for which the new software will be implemented must be calculated.

Kumar said the company earned Rs 42,000 crore from the sale of shares during the year, up 17% from Rs 36,000 crore a year earlier. He said the company is required to park half of its investable resources in government securities. He added that the company's growth engine for the current year will be unprecedented products, including ULIPs (unit-linked insurance plans) and term insurance. Kumar said the company was hit by higher claims due to Covid and the expiry of four high-value products with claims due in excess of Rs 5 lakh. "It is hoped we will not see any further waves but we have set up a reserve fund of Rs 7.4 billion to meet Covid claims.

Also Read: Top 10 FinTech companies in India - FinTech startups

POPULAR POSTS

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

by Shan, 2025-12-05 11:49:44

Zoho Mail vs Gmail (2025): Which Email Platform Is Best for Businesses, Startups, and Students?

by Shan, 2025-10-09 12:17:26

PM Modi Launches GST Bachat Utsav: Lower Taxes, More Savings for Every Indian Household

by Shan, 2025-09-24 12:20:59

$100K H-1B Visa Fee Explained: Trump’s New Rule, Clarifications & Impact on Indian Tech Workers

by Shan, 2025-09-22 10:11:03

India-US Trade Deal Soon? Chief US Negotiator Arrives in Delhi as Talks Set to Begin Tomorrow

by Shan, 2025-09-15 11:54:28

Modi Meets Xi: Trump’s Tariffs, Strategic Autonomy, and the Future of Asia’s Power Balance

by Shan, 2025-09-03 06:40:06

RECENTLY PUBLISHED

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Best Silver Investment Platforms for 2025: From CFDs to Digital Vaults Explained

- by Shan, 2025-10-23 12:22:46

Subscribe now

Subscribe now