Best Mutual Funds in India - To invest in 2022

The Top 10 Best Performing Mutual Funds in India Mutual funds are broadly categorized into equity funds, debt funds, and hybrid/balanced funds based on their e

- by B2B Desk 2022-05-13 10:28:32

What are the Best Mutual Funds?

Best mutual fund is formed when an asset management company (AMC) pools investments from multiple individual and institutional investors to purchase securities such as stocks and bonds.

The AMCs have fund managers who manage the pooled investment. These are financial professionals with an excellent track record of managing an investment portfolio. In short, mutual funds pool investments from different investors to invest their money in bonds, stocks, and other similar avenues.

Fund investors are allocated fund shares according to their investment amount. Investors may only buy or redeem fund units at the relevant net asset value (NAV).

The NAV of mutual funds varies daily based on the performance of the underlying assets. Mutual funds are well regulated by the Securities and Exchange Board of India (SEBI) and hence can be considered a safe investment option. A key benefit of investing in mutual funds is that investors can diversify their portfolio with a relatively smaller investment amount.

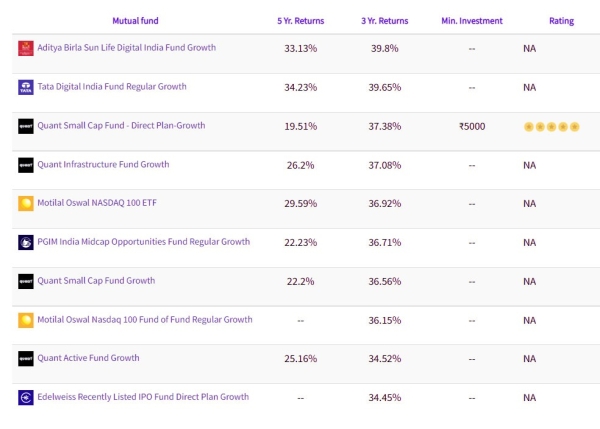

The Top 10 Best Performing Mutual Funds in India

Mutual funds are broadly categorized into equity funds, debt funds, and hybrid/balanced funds based on their equity exposure. If a mutual fund's equity exposure exceeds 65%, it is classified as an equity fund. If not, then it goes under debt funds. A hybrid mutual fund invests in both stocks and debt.

The following table shows the best equity funds:

The table below shows the best debt funds:

.jpeg)

The table below shows the best hybrid funds:

.jpeg)

Who Should Invest in the Best Mutual Funds in India?

Mutual funds should be considered by everyone as an investment opportunity at some point in their lives. Investing in mutual funds is one of the best ways to achieve your goals. Every mutual fund has specific goals to achieve. So if you plan to invest in mutual funds, you need to make sure your goals align with those of the fund in question.

Investing through a SIP eliminates the need to agree on a lump sum. Therefore, you can start your investment journey with a small amount. There are mutual fund plans that allow you to invest as little as Rs 100 per month through a SIP. This option is not available with most other investment options.

Every investment option involves a certain amount of risk. No investment is absolutely safe, including deposits. The risk level of mutual funds varies by type as it depends directly on the underlying assets. Therefore, you should only invest in a mutual fund if you are willing to accept the risk involved.

How to choose the best performing mutual funds?

Below are some of the parameters to consider when choosing the best performing funds:

Check the fund's track record

A top-performing fund typically has an excellent track record of delivering higher returns over the past three and five years. These funds would have outperformed their benchmark and peer funds. You need to analyze the fund's performance over recent economic cycles. In particular, review the fund's performance when markets were down. The performance of a top-performing fund is not heavily influenced by market movements. However, you must note that past performance is not an indication of future returns.

Check the financial ratios

It is important to assess the financial ratios such as alpha and beta before deciding if a fund under consideration is a top-performing one in its category.

Returns and risk always go hand in hand. Returns are the rise in the overall value of the capital invested. Risk is defined as the uncertainty associated with an investment, and this concerns the possibility of not receiving any or negative returns due to numerous reasons. Hence, any investor must assess the risk-return potential, and this has made the risk-return analysis possible by financial ratios.

Sharpe and Alpha ratios provide much-needed information. Sharpe ratio is indicative of the excess return that the fund has delivered on the addition of every unit of risk being taken. Hence, funds with higher Sharpe ratio are considered better than those with a lower Sharpe ratio. Alpha shows the additional returns that the fund manager has generated as compared to the benchmark. Funds with higher Alpha are considered better.

Check the list of expenses

The expense ratio is a crucial factor to consider when choosing a mutual fund plan. The expense ratio is the commission charged by fund houses to manage your investment. It is expressed as a percentage of the fund's return. It is deducted from the returns that an investor would obtain. It goes without saying that a higher expense ratio reduces investors' net returns. Fund houses cannot charge more than the limit set by the Securities and Exchange Board of India.

The expense ratio of a fund system must justify the returns provided. Frequent reshuffling of portfolio assets increases the cost of your investment (expense ratio) as the fund manager incurs higher transaction costs. Check the consistency of the expense ratio and make sure you are incurring reasonable expenses as the expense ratio. If you come across two funds with a similar asset allocation and past performance, you may choose to invest in the one with the lower expense ratio.

Investment Objective

Investments in any plan should only be made after carefully evaluating your life goals. Once a needs assessment has been done, you need to relate it to the goals of a mutual fund to see if investing in it will give you the desired result. Like people, mutual funds also have a particular objective, and it is up to investors to assess whether their objectives are aligned with the mutual fund program in which they are going to invest.

Fund history

You can base your mutual fund selection activity on fund history. Mutual funds with a longer track record are considered good. Also, a mutual fund is judged on its performance over a good period, especially when the markets were in a bad phase. This data will not be available for a newly launched fund. Investors should consider at least five years of fund history before making any investment decisions.

Fund manager performance

The fund manager plays an important role in the success of a fund. Fund managers manage investors' money; it is the fund manager's experience that enables him to make a profit. If a fund manager is able to recognize profitable investment opportunities, then the fund will earn good returns. Therefore, the fund manager must have a good track record.

Benefits of Investing in the Best Mutual Funds in India

money management expert

Since mutual funds are managed by a fund manager, the chances of making a profit are higher. Each fund manager is supported by a team of analysts and experts who research and choose the best performing instruments to include in the fund's portfolio. Therefore, you do not need to know the market.

Ability to regularly invest small amounts

One of the biggest advantages of investing in mutual funds is that you can spread your investments over time following the SIP or Systematic Investment Plan route. Through an SIP, you can regularly invest a lump sum as low as Rs 100. This alleviates the need to organize a lump sum to start your investment journey.

Diversification

By investing in mutual funds, you automatically diversify your portfolio across multiple instruments. Each mutual fund invests in a variety of securities, giving investors the benefit of exposure to a diversified portfolio.

You can redeem at any time

Most mutual fund plans are open. You can therefore redeem your investment fund shares at any time. This ensures that investors can enjoy cash and withdrawals at all times with ease.

Well Matched

All mutual fund companies are under the supervision of the Securities and Exchange Board of India (SEBI) and the Reserve Bank of India (RBI). In addition, the Association of Mutual Funds in India (AMFI), a self-regulatory authority consisting of the fund houses, also monitors the fund systems. Therefore, investments in mutual funds are safe.

Tax Efficient

If you wish to save tax under Section 80C of the Income Taxes Act 1961 you can invest in the Equity Linked Savings Scheme (ELSS) or tax savings funds. These mutual funds offer tax deductions of up to Rs 150,000 per year, saving you up to Rs 46,800 per year in taxes.

Risk in owning Best Mutual Funds in India

As mentioned above, the risk level of mutual funds varies by type. Equity funds carry the highest risk because they invest primarily in stocks of companies of all market capitalizations. These funds are slightly affected by market movements.

Here are the types of risks associated with stock funds:

Market Risk

Market risk is the risk that may result in losses due to poor market performance. Various factors influence market movements. To name a few; Natural disasters, virus epidemics, political unrest, etc.

Concentration Risk

Concentration usually refers to putting emphasis on a specific thing. It is never wise to focus your investments on one particular company. There is no doubt that concentrating your investments in one sector will prove beneficial when that sector is doing well, but when there are unfavorable developments, your losses will be magnified.

Interest Rate Risk

Interest rates fluctuate based on credit availability from lenders and demand from borrowers. Rising interest rates during the term of the investment can lead to a fall in the price of the securities.

Liquidity Risk

Liquidity risk refers to the difficulty of getting out of holding a security at a loss. This usually happens when the fund manager cannot find buyers.

Credit Risk

Credit risk relates to the possibility of a scenario in which the issuer of the security fails to pay the interest promised at the time the security was issued. You can assess credit risk by checking the credit ratings assigned by various rating agencies.

Taxation of the best mutual funds

Dividends paid by all mutual funds are added to your total income and are taxed according to the tax schedule to which you belong. The tax rate on capital gains realized on the sale of FCP units varies by FCP and holding period.

This is how mutual funds are taxed:

If you sell your equity fund units within a one-year holding period from the date of purchase, you'll realize short-term capital gains. These earnings are taxed at a flat rate of 15%, regardless of your tax rate. If you redeem your stock fund units after a one-year holding period, you realize long-term capital gains. Long-term capital gains (LTCG) up to Rs 1 lakh per year are exempt from tax. All LTCG above Rs 1 lakh per year are taxed at a flat rate of 10% and there is no indexation benefit.

How debt capital is taxed:

Capital gains realized from the sale of debt securities within a three-year holding period are called short-term capital gains. These earnings are added to your total income and are taxed according to your income tax schedule. After a three-year holding period, you'll realize long-term capital gains by selling your shares of the debt fund. These capital gains are taxed at a flat rate of 20% after indexation.

This is how balanced funds are taxed:

The tax rate on capital gains realized on the sale of mixed fund shares depends on your equity exposure. If the equity portion of a mixed fund exceeds 65%, it is taxed as an equity fund. Otherwise, the rules for taxing loan capital funds apply. So if you're investing in a hybrid fund, it's important to understand your equity exposure.

Also Read: Gold now accounts for 7% of foreign exchange reserves

POPULAR POSTS

Best Silver Investment Platforms for 2025: From CFDs to Digital Vaults Explained

by Shan, 2025-10-23 12:22:46

Best Investment Plans in India for 2025: A Complete Guide to Grow and Protect Your Wealth

by Shan, 2025-09-18 10:20:46

Which venture capital firms are the most active in funding Indian startups in 2025

by Shan, 2025-08-06 10:42:11

Top 5 Apps to Buy Digital Gold in India (2025): Safe, Simple & Secure

by Shan, 2025-08-01 10:24:51

10 Highest Dividend Yield Stocks in August 2025

by Shan, 2025-07-28 09:31:02

Exchange-Traded Fund (ETF): A Practical Guide to Smart Investing

by Anmol Chitransh, 2025-04-17 10:18:20

The Ultimate Guide to Commodity Trading: Strategies, Risks, and Opportunities

by Anmol Chitransh, 2025-04-02 07:06:01

RECENTLY PUBLISHED

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

- by Shan, 2025-12-05 11:49:44

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Subscribe now

Subscribe now