Cipla Q4 Results: Profit drops 12.4 percent year on year to Rs 362 crore, missing expectations

Excluding the impact of Covid-19 one-off inventory and other charges of Rs. 200 crore in Q4, the Adjusted EBITDA Margin for FYQ4 is 22 18% (Ebitda Rs. 960 milli

- by B2B Desk 2022-05-11 05:22:51

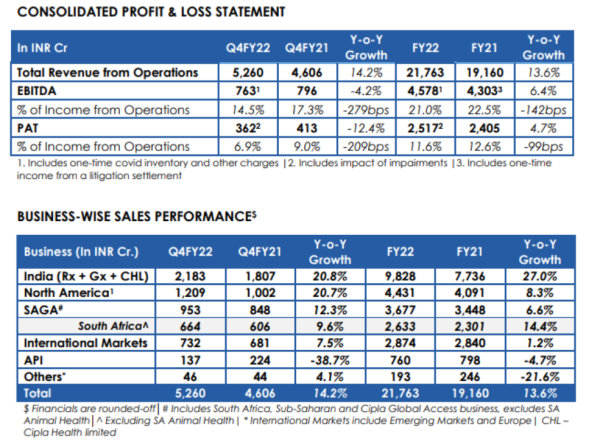

Mumbai-based Cipla reported a 12.4% fall in net profit for the fourth quarter of FY2021-22 to Rs.362 crore due to the impact of impairments. Quarterly sales rose 14.2% to Rs 5,260 crore and Ebitda fell 4.2% to Rs 763 crore.

For the full year, Cipla recorded a 4.7% increase in net profit to Rs.2,517 crore, while revenue and Ebitda rose 13.6% and 6.4% to Rs.21,763 crore and Rs.4578 million, respectively.

Excluding the impact of Covid-19 one-off inventory and other charges of Rs. 200 crore in Q4, the Adjusted EBITDA Margin for FYQ4 is 22 18% (Ebitda Rs. 960 million) and for the full year 22% (Ebitda Rs. 4,775 crore). .

Cipla's business in India saw strong year-over-year growth of 21% in branded prescription, commercial generic and consumer health and 15% year-on-year adjusted for the Covid-19 portfolio. The U.S. business reported $160 million in revenue and 17% year-over-year growth, driven by traction in respiratory and peptide assets.

Umang Vohra, MD and Global CEO of Cipla said seasonality affects the overall business mix. “Our One India business continued double digit growth during the quarter. We passed the $1 billion milestone in our nationally branded prescription business, driven by continued growth of our acute and chronic product portfolio. »

Vohra further added that the established respiratory franchise and the contribution of peptides have boosted the US run-rate to $160 million.

"Taking into account Covid-related and other one-off costs, our core operating profitability continues to be strongly supported by the strength of our business fundamentals. We continue to respond to the challenging entry cost environment through cost optimization and mixed management." "We are pleased with the complex launches in the second half of FY23, which will continue to strengthen overall business performance and profitability," he stated.

Revenue from the company's bulk drug (API) business declined 38.7% due to customer inventories and a one-time profit share on API delivery.

Also Read: Highest Paying Jobs in India in 2022

POPULAR POSTS

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

by Shan, 2025-12-05 11:49:44

Zoho Mail vs Gmail (2025): Which Email Platform Is Best for Businesses, Startups, and Students?

by Shan, 2025-10-09 12:17:26

PM Modi Launches GST Bachat Utsav: Lower Taxes, More Savings for Every Indian Household

by Shan, 2025-09-24 12:20:59

$100K H-1B Visa Fee Explained: Trump’s New Rule, Clarifications & Impact on Indian Tech Workers

by Shan, 2025-09-22 10:11:03

India-US Trade Deal Soon? Chief US Negotiator Arrives in Delhi as Talks Set to Begin Tomorrow

by Shan, 2025-09-15 11:54:28

Modi Meets Xi: Trump’s Tariffs, Strategic Autonomy, and the Future of Asia’s Power Balance

by Shan, 2025-09-03 06:40:06

RECENTLY PUBLISHED

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Best Silver Investment Platforms for 2025: From CFDs to Digital Vaults Explained

- by Shan, 2025-10-23 12:22:46

Subscribe now

Subscribe now