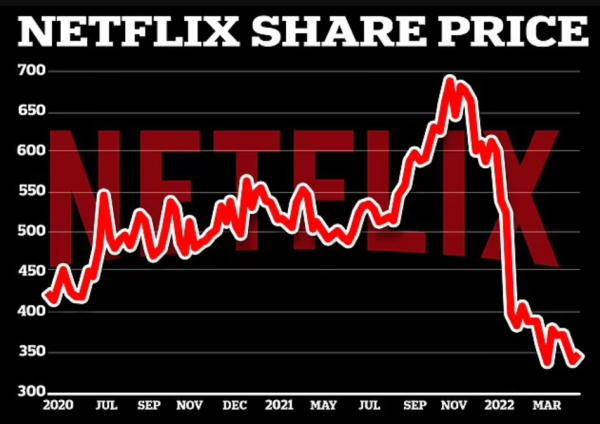

Bill Ackman abandons Netflix, suffering a $400 million loss as the stock plummets

In a brief statement announcing the move, Ackman said while the proposed business model changes, which include selling and finding non-paying customers, make se

- by B2B Desk 2022-04-21 05:39:56

Billionaire investor William Ackman cancelled a $1.1 billion mortgage on Netflix on Wednesday, insuring losses of more than $300 million, as the streaming service's shares fell following news of the loss of subscribers collapsed for the first time in a decade. Ackman's hedge fund Pershing Square Capital Management changed its mind with the 3.1 million shares it bought three months ago, while shares of Netflix fell 35% to $22.19.

In January, an investor pumped more than $1 billion into the streaming service in recent days after a subscription price filing sent shares plummeting. Now, in the second wave of negative subscriber news -- the company said it lost 200,000 -- the fund manager has urged the company to turn its back on the company that was lauded just weeks ago.

In a brief statement announcing the move, Ackman said while the proposed business model changes, which include selling and finding non-paying customers, make sense, the company is too unpredictable in the short term.

"Given that Netflix's business is inherently simple to understand, given recent events we are confident that we can predict with reasonable certainty the future expectations of the company," he wrote.

Pershing Square, which now has $21.5 billion invested, shares just over a dozen companies and a "high degree of individuality" in its portfolio companies, Ackman said.

Instead of waiting for things to be fixed at Netflix, Ackman suffered more than $400 million worth of losses, his family and friends said. After the sale, Pershing Square's portfolios are down 2% for the year, Ackman said.

Netflix said it lost 200,000 subscribers in the first quarter, even under projections that it would add 2.5 million subscribers. His decision in early March to end service in Russia after invading Ukraine caused the loss of 700,000 members.

Cash hedges helped Pershing Square weather the early days of the pandemic in 2020, and then again in recent months as interest rates began to rise. The past three years have been some of the best in hedge fund tech, including a 702% gain for 2020.

But Ackman also acknowledged Wednesday that he's learned from the hard times helping his own Valeant Pharmaceuticals fund, a fatal gamble that has often cost him $1 billion in losses.

“One of the lessons we have learned from past mistakes is to act more openly when we come across new investment information that doesn't tally with the original thesis. That's why we did it here," he writes.

Also Read: Save tax by investing in your kid's name

POPULAR POSTS

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

by Shan, 2025-12-05 11:49:44

Zoho Mail vs Gmail (2025): Which Email Platform Is Best for Businesses, Startups, and Students?

by Shan, 2025-10-09 12:17:26

PM Modi Launches GST Bachat Utsav: Lower Taxes, More Savings for Every Indian Household

by Shan, 2025-09-24 12:20:59

$100K H-1B Visa Fee Explained: Trump’s New Rule, Clarifications & Impact on Indian Tech Workers

by Shan, 2025-09-22 10:11:03

India-US Trade Deal Soon? Chief US Negotiator Arrives in Delhi as Talks Set to Begin Tomorrow

by Shan, 2025-09-15 11:54:28

Modi Meets Xi: Trump’s Tariffs, Strategic Autonomy, and the Future of Asia’s Power Balance

by Shan, 2025-09-03 06:40:06

Google Claims Gemini AI Uses Just ‘Five Drops of Water’ Per Prompt, Sparks Debate

by Shan, 2025-08-22 12:34:27

RECENTLY PUBLISHED

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Best Silver Investment Platforms for 2025: From CFDs to Digital Vaults Explained

- by Shan, 2025-10-23 12:22:46

Subscribe now

Subscribe now