Options In Stock Market- Learning the Easy Way

Contract Size: The size of a contract is the amount to be delivered in the contract choices. These quantities are determined for substance. If the contract

- by B2B Desk 2022-04-20 07:22:16

The option of a contract is to give the buyer the right, but not the obligation, to buy or sell the property at a fixed price.

Option agreement

-

Deposit or Payment:

The owner of this type of contract must pay a fixed premium amount for the successful implementation of the transaction. If the cardholder does not pay, he only loses the good. Usually, the premium will be deducted from the gross profit and the investor receives the balance. -

Price Strike:

This is a combination where an owner can choose to buy or sell security if they choose to exercise a contract. The price impact is fixed and does not change the term of the contract. It's important to remember the difference between a strike and a market. These changes are for the duration of the contract.

.jpg)

-

Contract Size:

The size of a contract is the amount to be delivered in the contract choices. These quantities are determined for substance. If the contract is for one hundred shares, the contract holder will buy or sell an option for one hundred shares. -

Expiration date:

Each contract has a specified expiration date. And this remained in force until the end of the contract. If the option is not implemented at this time, it will exit. -

Intrinsic Value:

The intrinsic value is the selling price minus the current price of the underlying security. Silver Call Settings have an inherent value. -

Assignment:

Do not buy, sell or trade insurance with a well-organized contract. A contract arises when the owner exercises the right to trade. In the event that the owner does not exercise his right to a termination, the contract is terminated and the obligation will be null. -

No obligation to buy or sell:

In the case of an option contract, the investor has the option of buying or selling the property until the expiry date. But you don't have to buy or sell. If the option holder neither buys nor sells, the option does not expire.

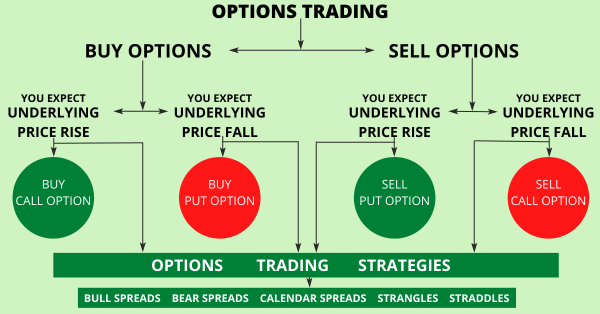

2 types of option contracts

- Call Option

- Put Option

For example: We have the ability to identify in front of us. The price of the trust will rise to Rs 2,390 and the merchant lets the stock price rise, in which case it will buy the option contract. Each option expires on Thursday of the month as well as indexes that expire on Thursday of the month. You can purchase the lots on the call option, supported on our 505 lot stock. But yesterday it was paid in full, which is equivalent to Rs 1206.950. In order to make things easier, the premium will be paid in this case, which is 2% of the total amount or 24139. If prices rise from 2390 to 2500, the buyer will be able to keep up with his profit and the unlimited options. Profit and loss are limited to the amount of the reward to be paid. This is exactly contrary to the seller's ballot, where losses are limited and profits are limited to the amount of the good.

Also Read: NHAI plans to monetize two more highways, which might bring in bids of up to 4,000 crore rupees

POPULAR POSTS

Rupee Forecast 2025: Key Drivers Behind INR Weakness Against the US Dollar

by Shan, 2025-08-11 07:32:23

August 2025 IPO Preview: Big Listings from JSW Cement, NSDL, Knowledge Realty & SME Stars

by Shan, 2025-07-30 11:51:27

Ola Electric Q1 Results FY26: Revenue Falls 61%, Net Loss at ₹870 Cr - MoveOS 5 in FocusOla

by Shan, 2025-07-14 12:22:55

HAL, BEL & Data Patterns: 3 Defence Stocks Riding India's ₹50,000 Cr Export Ambition

by Shan, 2025-06-26 10:00:16

India GDP Forecast 2025-26 Raised to 6.5% by S&P: Key Drivers & Global Risks Explained

by Shan, 2025-06-26 10:30:46

Dalal Street Outlook: 5 Key Market Triggers to Watch This Week

by Shan, 2025-06-16 12:32:04

What is the Bond Market & How Does It Impact Your Investments?

by B2B Desk, 2025-02-05 09:42:55

RECENTLY PUBLISHED

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

- by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

- by Shan, 2025-12-05 11:49:44

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Subscribe now

Subscribe now