How does futures in stock market work? understand here!

Predetermined price refers to the price at which the contract is made, both the buyer and the seller with their speculations determine the varying trend of the

- by B2B Desk 2022-04-12 10:29:23

In derivatives market there are 4 types of, namely, FORWARDS, FUTURES, OPTIONS and SWAPs. Futures in stock market are derivative financial contracts that obligate the parties to transact an asset at a predetermined future date and price. The buyer must purchase or the seller must sell the underlying asset at the set price, regardless of the current market price at the expiration date. There are 4 key elements of a future contract in stock market:

- Derivative financial contract: that means that futures are contracts that derive its value from an underlying asset that create a financial contract.

- Obligate the parties: the contract formed under futures contract obligates both the parties the buyer as well as the seller to perform their duties.

- Transact an asset: For futures contract in stock market there must be an underlying asset that can be anything like, shares, commodity, currency or the index itself.

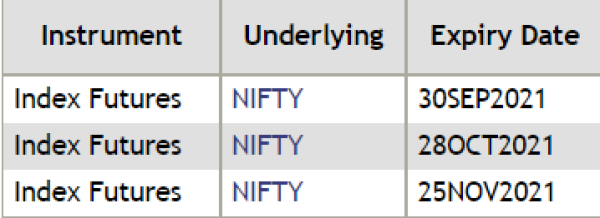

- A predetermined future date and price: A derivative contract has an expiry period. The underlying asset does not have an expiry period, in stock market there are 3 series of futures contracts available that are for the 3 upcoming months. The date for the expiry in Future contracts is always the last Thursday of the month. For the month of September, the futures live will be September futures (near month), November futures (next month) and December futures (far month).

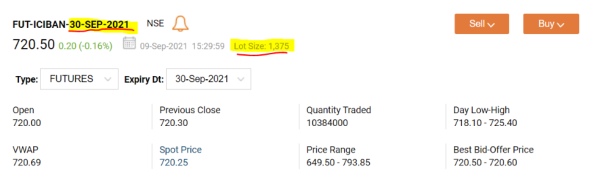

Predetermined price refers to the price at which the contract is made, both the buyer and the seller with their speculations determine the varying trend of the market. And the contract on its expiry will be honored at the locked price of the contract. For example, the future in stock market of ICICI bank 30-sep-2021, stands at 720.50 as the bid price on 9th September 2021 and the buyer speculates the prices to go up. He buys the future of ICICI bank 30-sep-2021, at a price of RS 720.50 with a lot size of 1375. That is equal to RS 9,90,687.5 but here margins come into the role to buy the futures. On the expiry date that is 30-sep-2021 the price of ICICI bank stands at 800(assumed, not a recommendation) at I sell the contract that is referred to as squaring off the contract. The profit in this case sands at 800-720.50=79.50, the net profit stands at 79.50*1375=1,09,312.5 but the same amount is the loss for the seller. As he had sold the same future for 720.50 speculating the market value will go down but instead the market value went up and he has to buy the same at the value of 800. Both the parties are in an obligation to fulfill the contract.

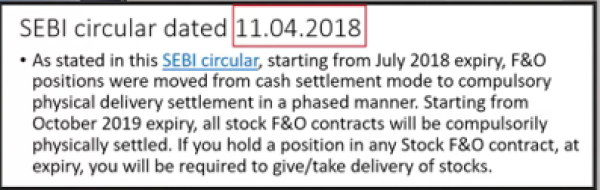

But according to the SEBI circular dated 11th April 2018, the contracts in a future will take place in a delivery-based system in a phased manner. If by the expiry date the contracts are not squared off then the parties in the contract have to take the delivery of the shares by paying the whole amount of the contract then further sell the same physical assets in the market. In our example, in a simplified manner on the date of expiry of the future contract in the stock market, the buyer has to pay the whole amount that will be the lot size.

Also Read: Should you buy the dip, or wait out volatility?

POPULAR POSTS

Rupee Forecast 2025: Key Drivers Behind INR Weakness Against the US Dollar

by Shan, 2025-08-11 07:32:23

August 2025 IPO Preview: Big Listings from JSW Cement, NSDL, Knowledge Realty & SME Stars

by Shan, 2025-07-30 11:51:27

Ola Electric Q1 Results FY26: Revenue Falls 61%, Net Loss at ₹870 Cr - MoveOS 5 in FocusOla

by Shan, 2025-07-14 12:22:55

HAL, BEL & Data Patterns: 3 Defence Stocks Riding India's ₹50,000 Cr Export Ambition

by Shan, 2025-06-26 10:00:16

India GDP Forecast 2025-26 Raised to 6.5% by S&P: Key Drivers & Global Risks Explained

by Shan, 2025-06-26 10:30:46

Dalal Street Outlook: 5 Key Market Triggers to Watch This Week

by Shan, 2025-06-16 12:32:04

What is the Bond Market & How Does It Impact Your Investments?

by B2B Desk, 2025-02-05 09:42:55

RECENTLY PUBLISHED

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

- by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

- by Shan, 2025-12-05 11:49:44

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Subscribe now

Subscribe now