PPF Scheme: Do You Really Need It? This Will Help You Decide!

The deadline can be extended Upon expiration of the account, the subscriber can withdraw the entire corpus. However, the account can also be extended indefinit

- by B2B Desk 2022-04-18 05:57:04

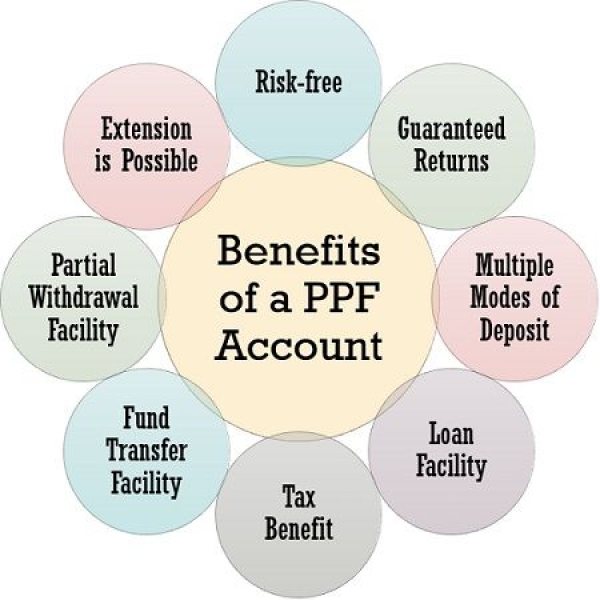

PPF scheme is one of the popular small savings plans, but many investors are not aware of its features. Mukesh Kalra lists 10 things to find out about this model.

Interest rate guaranteed but not fixed

The PPF interest rate is not fixed but linked to the 10-year government bond yield. The interest rate does not change overnight but is set at the beginning of the quarter based on the average bond yield over the past three months. Bond yields have risen over the past three months, so it makes sense that interest rates will rise as well. But rates for small savings plans were already above the prescribed formula. Therefore, one should not expect an upward revision of the PPF rate even if the bond yield exceeds 7.5%. Interest rates for millions of investors have not been reduced.

The closure is not 15 years old

PPF scheme is a long-term investment of 15 years. But this does not mean that your money will be blocked for a long time. 15 years from the date of opening the account. Every year, the closing time is gradually reduced. The fourteenth year is only one year. Therefore, the PPF account opened in April 2008 will expire in April 2023. The blocking period for depositing the account in April 2022 is only 12 months. Because partial withdrawals are allowed after the sixth year, some investors see the PPF scheme as an emergency fund.

The deadline can be extended

Upon expiration of the account, the subscriber can withdraw the entire corpus. However, the account can also be extended indefinitely in five-year increments. This extension can be made with or without contributions. To fund the instalment account, the subscriber must write to the post office or bank within one year of repayment stating that he wishes to continue investing in the PPF scheme account. In case of failure to notify the bank or post office, the account will be automatically renewed, but no further payments will be accepted. Interest is paid regularly on the balance and the investor can make one payment per year.

Partial withdrawals allowed

PPF scheme allows investors to withdraw money in emergency situations. After the sixth year, the investor can withdraw up to 50% of the balance at the end of the fourth year or the previous year, whatever is below. If the account has been updated without an additional price, the subscriber can withdraw any amount from the account. However, if the account has been updated with an additional deposit, the deduction limit is 60% of the account balance at the beginning of the renewal period.

Get cheap credit from PPF

It is also possible to loan PPF between the third and sixth-year period. The credit check was 25% of the balance at the end of the year. The interest rate on the loan is 1% above the current PPF rate. Based on the current PPF rate of 7.1%, the loan counter PPF interest at 8.1%. This can change if the PPF rate is changed. However, after the loan has been repaid, it has been closed on interest until the end of the payment period. PPF loan is allowed for 36 months. If the lender does not pay within this period, the loan increases to 6% above PPF.

Consider minimum and maximum investments

You must deposit at least Rs 500 and not more than Rs 1.5 lakh in your PPF account during the financial year. Minimum investment of Rs 500 should also be reserved for rolling accounts in excess of 15 years. If you store less than Rs 500 per year, the account will be inactive. A fine of Rs 50 is imposed for reactive inactive system. If you invest more than 1.5 lakh a year, even if it is an accidental loan, you will not earn an excess amount of interest. The maximum limit of Rs 1.5 lakh per year includes contributions to PPF accounts for minor children.

Invest before 5th month

The PPF is calculated annually, and the calculation is made monthly. Interest is calculated on the minimum balance between the 5th and last day of each month. If before the fifth day, he will earn that deposit also in the month. Otherwise, just like free interest loans to the government is monthly. If you check in investing, make sure to deposit it at least 3-4 days before closing. If your bank's credits are late or the amount is relatively holiday, your investment can fail and lose interest within a month.

Foreclosure of an account is a possibility.

An investor can also close their PPF scheme account if they need funds for higher education, medical care for themselves or their families, or if their immigration status has been changed. But this can only be done if the system is five years old. There are also exit fees. The balance of interest is subject to 1% below the rate in PPF. This penalty 1% may seem small, but it is for the duration of the account. If you earned 8% per annum on your PPF account for the last 12 years, the interest rate on the calculation will be reduced to 7%. Simply choose this option if it is absolutely necessary.

PPF-packed tax exemptions

PPF is full of tax exemptions. Contributions to PPF scheme are eligible for tax deduction under Section 80C up to a total limit of Rs 1.5 million. Although the interest generated by PPF is tax deductible, it must be included in individual income tax. Recesses are also tax-free and do not affect each tax debt. However, under the new rule introduced in 2020, withdrawals over 20 lakhs PPF can be submitted to 2-5% TDS if individual tax revenue in the past three years has not been filed.

Additional tax benefits

There are other PPF income tax advantages. According to the current tax law, if the resulting funds are deposited to the spouse, capital gains are combined with the income of the donor and according to which they are taxed. Because the PPF postage is toll-free, it doesn't increase your donor's tax liability even if your incomes are combined with their income. By opening an account in your wife's name, you can save an additional Rs: 1.5 million a year on this tax-free haven.

Also Read: Service exports hit a new high of $250 billion in FY22, according to Piyush Goyal

POPULAR POSTS

Best Silver Investment Platforms for 2025: From CFDs to Digital Vaults Explained

by Shan, 2025-10-23 12:22:46

Best Investment Plans in India for 2025: A Complete Guide to Grow and Protect Your Wealth

by Shan, 2025-09-18 10:20:46

Which venture capital firms are the most active in funding Indian startups in 2025

by Shan, 2025-08-06 10:42:11

Top 5 Apps to Buy Digital Gold in India (2025): Safe, Simple & Secure

by Shan, 2025-08-01 10:24:51

10 Highest Dividend Yield Stocks in August 2025

by Shan, 2025-07-28 09:31:02

Exchange-Traded Fund (ETF): A Practical Guide to Smart Investing

by Anmol Chitransh, 2025-04-17 10:18:20

The Ultimate Guide to Commodity Trading: Strategies, Risks, and Opportunities

by Anmol Chitransh, 2025-04-02 07:06:01

RECENTLY PUBLISHED

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

- by Shan, 2025-12-05 11:49:44

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Subscribe now

Subscribe now