Investing vs Trading: 7 Key Differences

Investors often have a long-term view of the market and its holding period, while keeping their positions open for years or even decades. Your goal is to catch

- by B2B Desk 2020-12-14 09:12:12

Investing refers to the purchase of financial instruments in different markets with the objective of increasing capital, generating income, or preserving capital.

Investors often have a long-term view of the market and its holding period, while keeping their positions open for years or even decades. Your goal is to catch up with the long-term growth of markets such as stocks, precious metals, currencies, energy commodities, or real estate.

Traders aim to spot short-term price movements

Trading, on the other hand, is more speculative and short-term in nature. Traders aim to detect short-term price movements and market discrepancies over a period of days or weeks. Some traders go into the short term, such as speculators and day traders who trade intraday market movements.

There are many factors that influence short-term price movements, including market news, political and social developments in specific countries, order flows, market positioning, and herd behavior. This can cause the market to differ from its fair value in the short term and present attractive trading opportunities that are then traded by short-term traders.

Active portfolio management

Investing in the markets does not have to follow a "buy and hold" approach. Many investors actively manage their portfolios on an annual, quarterly, or even monthly basis, depending on the current business cycle, interest rate expectations, or the performance of specific market segments.

Banks and large institutional traders can be active traders and investors. If there is no volatility in the markets and volatile trading opportunities do not diminish, banks turn to active portfolio management. Once volatility hits the markets again, switch back to active trading. They can do both.

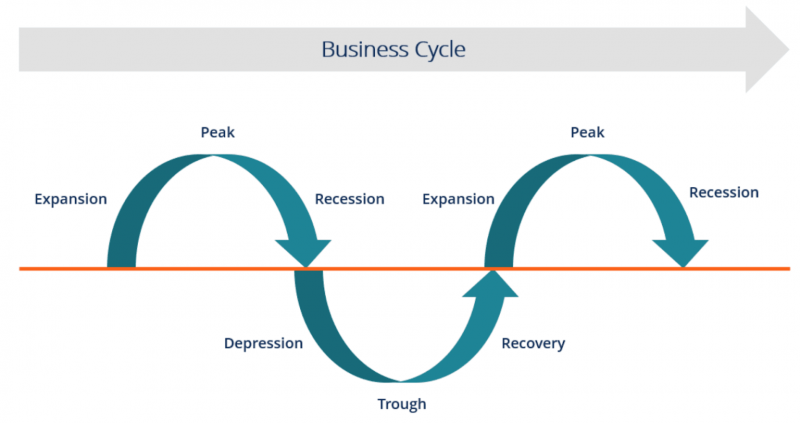

An example of active portfolio management that investors use is following the current business cycle and yield curve to define asset classes for fund allocation.

Business cycles have four phases: expansion, peak, contraction, and trough.

The average length of the business cycle has been five years in the United States in recent decades, but the recent quantitative easing by the Federal Reserve changed the normal business cycle somewhat.

In any case, expansion is followed by rising stocks and bonds, and at the peak, commodities also start to rise, and during the deflationary phase stocks start to fall and bonds start to rise.

The lower phase generally provides the best buying opportunity in the equity markets to investors who know how to read the early signs of an upcoming expansionary phase.

Buy and hold vs. active trading

The "buy and hold" investor does not manage their portfolio effectively. Instead, you simply buy a certain amount of stocks, bonds, precious metals, or currencies, and hold positions for several years.

The S&P 500, the world's largest and most important stock index, has generated an average annual return of 7.5% over the past decades. This is the return that the investor "buy and keep" aims to achieve or exceed.

By investing in certain sectors of the market that have a higher expected growth rate compared to other sectors, investors can increase their potential returns. However, by focusing your portfolio on a specific sector, you also increase your risk of exposing them to losses if the sector does not perform as expected.

Active trading looks at short-term trading opportunities that arise as a result of breaking news, market reports, political developments, changes in risk appetite, or significant technical levels.

Most of the time, active traders are not interested in the long-term direction of the market, as their goal is to take advantage of very short-term price movements.

Asset allocation models

Asset allocation models can significantly reduce long-term investor risk by investing in different classes.

Depending on your objective, some models are designed to preserve your capital, while others aim to increase your performance in the markets.

These are the most popular customization models:

- Capital preservation model -In the capital maintenance model, asset allocations are designed to reduce the potential for losses. These forms are also designed to be extremely liquid, allowing access to funds within 12 months. Capital conservative portfolios invest in US Treasury bills, investment grade commercial paper, municipal bonds, and money market bonds.

- Income-oriented model: Income-oriented portfolios are designed to provide a constant stream of income while minimizing the risk of loss. Investors looking to build an income-oriented portfolio should invest in high-quality corporate debt, real estate investment funds (REITs), bonds, and high-quality stocks with a proven track record of paying dividends (also called "dividend aristocrats" ).

- Growth-oriented model: In a growth-oriented model, the portfolio is designed to accelerate long-term capital growth by allocating most of the money to the equity market.

The main While growth-oriented portfolios tend to outperform other emerging market models, investors also face higher losses during recessions and downturns.

Differences between investing and active trading

Now, let's take a look at some of the key differences between investing and active trading.

-

Investors analyze long-term trends

Since investors aspire to stay invested in the markets for long periods of time, they have a long-term view of the markets. They see trends that take weeks or months to take shape and want to stay in the markets during the boom and bust phases of the business cycle.

When a recession begins, meaning that GDP is shrinking for two consecutive quarters, individual investors look to liquidate their positions and reestablish them at a later time when the economy starts to grow again.

Typically, the lower part of the business cycle is the best time to buy stocks and other asset classes. Whenever everyone else is selling, smart investors look to buy at a discount.

Some investors are not interested in bear markets if they take a "buy and hold" approach. This means that they will continue to invest in the markets even during recessions as they are focused on long-term market growth and have a very long holding period.

-

Traders focus on short-term movements

Unlike investors, traders focus on price action and short-term speculation. Some traders hold positions for a few seconds to take advantage of market momentum or quick breakouts. These traders are called speculators. They open dozens of deals daily and their goal is to make a small profit on each trade.

Daily traders open and close their positions on the same trading day.

Daily traders open and close their positions on the same trading day. Daily traders aim to profit from daily price movements that result from a variety of factors, such as market news, breakouts, and appetite for risk, to name a few.

Intraday trading is perhaps the most popular trading style among new traders, although it requires strict trading rules and discipline. Novice traders often enter the arena unprepared, which is why most retail traders lose money in the markets.

Trading is a business and beginners must learn to use trading tools to gain an advantage over other traders. Intraday trading without profitable trading tools will almost certainly lead to financial disaster.

Oscillation trading is another popular trading technique that involves spotting "swings" in the market - that is, strong directional moves, either up or down, that can take days or weeks to develop.

Traders use various tools to determine if the price can go up or down in the short term. Some of the tools include support and resistance levels, trend lines and retracement levels, fundamental analysis, market news, investor positioning, and risk appetite to name a few.

-

Investors try to reconcile or slightly outperform the market.

The primary goal of a long-term investor is to slightly match or outperform the market - the S&P 500 Index. The S&P 500 has achieved an average annual return of around 7.5% over the past few decades, which means investors can expect similar results investing in ETFs. (ETF) that tracks the market in general.

However, keep in mind that putting all your eggs in one basket can be risky, especially during recessions. This is why risk-averse investors should look to add government bonds to their portfolios or diversify into different markets, sectors, asset classes, or countries.

Active portfolio management on a monthly, quarterly or yearly basis can help investors outperform the market benchmark.

-

Traders depend on fluctuations in the markets.

Traders live on ups and downs. If there are no strong movements in the market, traders will have a hard time making money. This is a big difference between investing and trading.

Investors fear volatility. A 50% increase in volatility increases the risk in the investor's portfolio by 100%, so active investors must liquidate their positions.

The VIX is a good measure of the expected volatility in the S&P 500. Note the inverse correlation between the VIX (volatility scale) and the S&P 500. For active trades.

-

Traders can sell the market short

Traders can take advantage of the lower prices by short selling on the market. Short selling refers to borrowing specific financial instruments with a high probability of falling prices, selling instruments in the market at the current market price, and finally buying the same instruments later at a lower price and returning them to the lender (usually the intermediary).

Short selling is considered risky as traders are exposed to theoretically unlimited losses. The price of the instrument has unlimited upside potential, but is limited downward (the maximum price that can go down is $ 0).

Investors, especially buying and holding investors, attack the market with long (buy) positions.

-

Investors base their decisions on fundamentals

Fundamental analysis and long-term market forecasting are key inputs to an investor's decision-making process. This means that active investors must have a good understanding of what drives the markets at the fundamental level.

Investors who buy and hold often don't care because they hold their positions for a very long period of time. However, this also means that they are vulnerable to potential losses and reversals when the markets enter a downtrend.

Although fundamental analysis can also improve the trading performance of short-term traders, there are many successful traders who analyze the market only from a technical point of view.

-

Traders must actively manage their risks.

Traders must actively manage their risk in a single trade. To make a significant profit from short-term price movements, traders often benefit from leverage, that is, they trade position sizes much higher than their original trading accounts.

As a general rule of thumb, traders shouldn't risk more than 1-2% on a single trade and should aim for a risk return ratio of at least 1.5. This means that for any dollar of risk, the expected return should be $ 1.5.

Final words

Basically, trading refers to speculating on short-term price movements, be it up or down, while investing refers to a "buy and hold" approach over several years or even decades. However, some investors actively manage their portfolios based on the current business cycle stage and market fundamentals.

Traders depend on fluctuations in the markets. During phases of low market volatility, banks and commercial establishments move from trading to active portfolio management.

Also Read: Bain Capital in talks to invest Rs 1,500 crore in JM Baxi Group co

POPULAR POSTS

Rupee Forecast 2025: Key Drivers Behind INR Weakness Against the US Dollar

by Shan, 2025-08-11 07:32:23

August 2025 IPO Preview: Big Listings from JSW Cement, NSDL, Knowledge Realty & SME Stars

by Shan, 2025-07-30 11:51:27

Ola Electric Q1 Results FY26: Revenue Falls 61%, Net Loss at ₹870 Cr - MoveOS 5 in FocusOla

by Shan, 2025-07-14 12:22:55

HAL, BEL & Data Patterns: 3 Defence Stocks Riding India's ₹50,000 Cr Export Ambition

by Shan, 2025-06-26 10:00:16

India GDP Forecast 2025-26 Raised to 6.5% by S&P: Key Drivers & Global Risks Explained

by Shan, 2025-06-26 10:30:46

Dalal Street Outlook: 5 Key Market Triggers to Watch This Week

by Shan, 2025-06-16 12:32:04

What is the Bond Market & How Does It Impact Your Investments?

by B2B Desk, 2025-02-05 09:42:55

RECENTLY PUBLISHED

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

- by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

- by Shan, 2025-12-05 11:49:44

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Subscribe now

Subscribe now