RSU vs ESOP: A Comprehensive Guide for Employees

- by B2B Desk 2024-08-20 10:31:04

Offering stock options to employees is a highly effective talent retention strategy, but it's crucial to understand the differences between RSUs and ESOPs. Restricted Stock Units (RSUs) and Employee Stock Option Plans (ESOPs) are becoming increasingly popular among startups with limited capital.

Equity can be a valuable component of compensation packages, rewarding employees for their hard work and incentivizing them to stay longer with the company and invest in its continued success. While the fundamental principle behind RSUs and ESOPs is the same, the terms and conditions differ. Understanding RSU vs ESOP is essential to make the right choice for your organization.

Understanding how ESOPs work is crucial for both employers and employees

ESOPs grant employees the right to purchase company shares at a predetermined price in the future. This price is set by the company, and ESOPs come with a vesting schedule, which specifies how long employees must stay with the company before they can exercise their options.

This vesting requirement ensures that valuable equity is not given to employees who may leave the company shortly after receiving their options. For employees, ESOPs offer the chance to buy shares at a price below their market value on the vesting date. Founders may release ESOPs according to a pre-determined schedule.

For example, if an employee is granted the option to buy 1,000 shares starting in January 2021, with the option to purchase 200 shares each year over five years at $50 per share, and the market price is $80 per share when they are eligible to exercise, the employee benefits from this price difference. If the market price is below $50, the employee can choose to wait until the price improves. Note that ESOPs also have an expiration date; if the employee does not exercise their options within this time frame, the offer lapses.

Startups may issue ESOPs in stages, such as granting 25% of the total ESOP allocation each year over four years. If the employee remains with the company for the entire period, they can fully exercise their options at the end of the term.

In the context of RSU vs ESOP, understanding these aspects helps in making informed decisions about which equity plan best suits your needs.

Understanding how RSUs work is essential for both employers and employees

Restricted Stock Units (RSUs) offer a more straightforward equity incentive compared to ESOPs. Unlike ESOPs, RSUs do not involve predetermined pricing. Instead, companies grant RSUs based on conditions such as tenure or performance goals. This distinction is a key difference between **RSU vs ESOP**.

RSUs can be tied to performance metrics or simply the passage of time, and they become exercisable after a set vesting period. For instance, if an RSU vesting period is four years, the employee will receive the stock only after completing the full four years with the company.

For example, suppose you allocate 400 shares to an employee with a four-year vesting period. At the end of this period, the employee will receive the shares or, in some cases, a cash equivalent based on the current market value. Companies may either decide how the shares are distributed or give employees the option to choose. Similar to ESOPs, you can structure RSU awards to vest in stages, such as 25% each year over four years.

In the context of RSU vs ESOP, understanding these differences helps in determining which equity plan aligns best with your company's goals and employee incentives.

Types of Restricted Stock Units

Restricted Stock Units (RSUs) come in three main types:

Time-Based RSUs: These RSUs require employees to stay with the company for a specific period. Once this vesting period is complete, employees can access and sell their RSUs as they wish.

Performance-Based RSUs: These RSUs are linked to specific performance goals or milestones. Employees must achieve these objectives, such as hitting a sales target, to earn the RSUs.

Time and Performance-Based RSUs: These combine both conditions. Employees must fulfill the vesting period and meet performance milestones to be eligible to sell the stock.

Benefits of RSUs

Restricted Stock Units (RSUs) offer several advantages as employee retention tools. By providing employees with company shares, RSUs create a strong sense of ownership and commitment. When employees have a stake in the company’s success, they are often more motivated to excel in their roles. This alignment between personal performance and company performance can lead to enhanced productivity and job satisfaction, benefiting both the employee and the organization. Understanding RSU vs ESOP is key to appreciating how these benefits are realized in practice.

Benefits of ESOPs

Employee Stock Ownership Plans (ESOPs) also serve as powerful incentives for retaining talent. ESOPs grant employees ownership stakes in the company, fostering a deeper connection to the organization’s success. This personal investment encourages employees to contribute more actively to the company’s growth and success. By aligning employees' interests with the company's goals, ESOPs help drive performance and loyalty. When comparing RSU vs ESOP, it's important to recognize how each plan can uniquely motivate and retain employees.

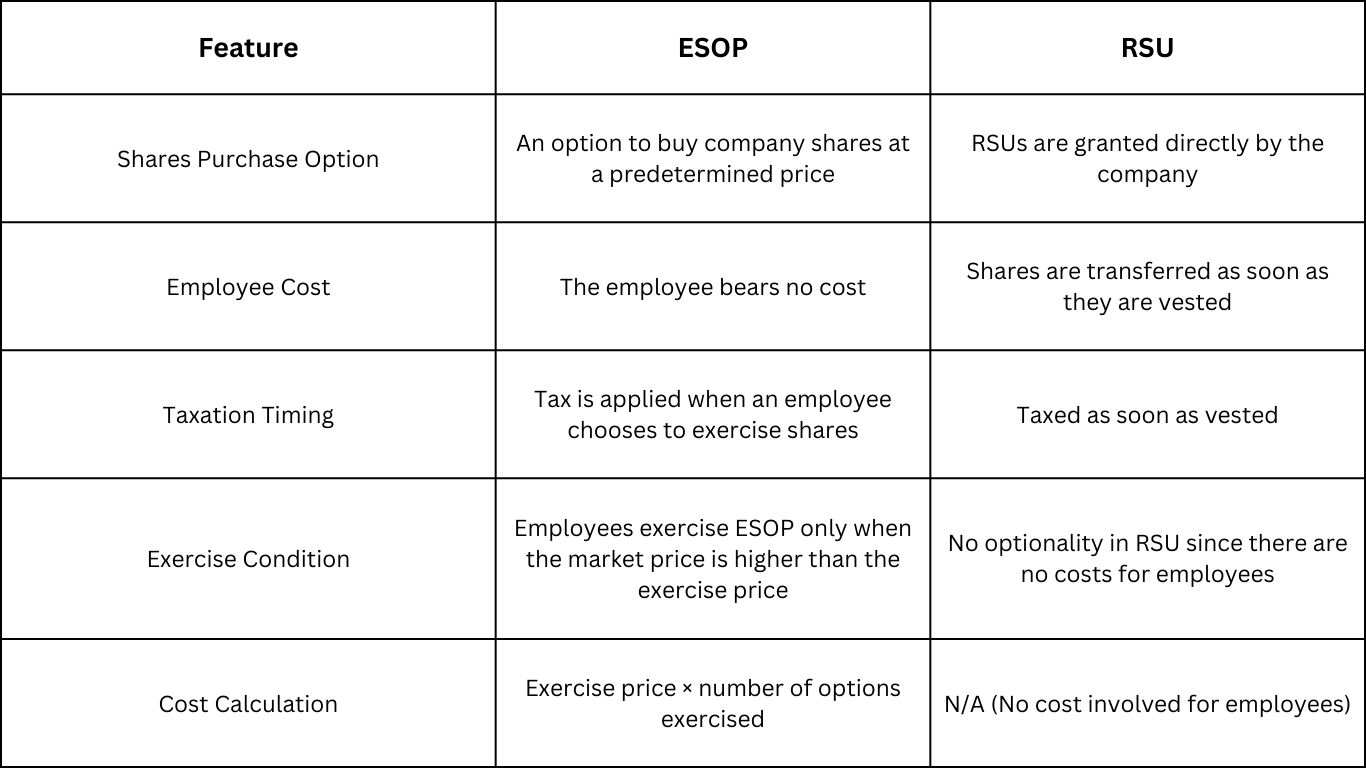

Difference Between ESOP and RSU

RSU vs ESOP – Which One is Better?

Choosing between ESOPs and RSUs can be challenging as both offer distinct benefits and drawbacks. Generally, RSUs are seen as less risky for employees because they come without any cost to obtain the shares. Conversely, ESOPs require employees to pay an exercise price, and if the stock price falls after the shares vest, employees might incur losses. This cost factor is a notable difference between RSU vs ESOP.

RSUs provide a level of security that stock options (ESOPs) do not. If the company's stock price drops below the exercise price of ESOPs, those options can lose value and potentially become worthless. In contrast, RSUs maintain their value from the time they are granted, even if their worth diminishes over time. Additionally, RSUs do not require any upfront investment from employees. The only situation where RSUs could become worthless is if the company goes out of business, which is less common compared to a decline in stock price during the vesting period.

Given these factors, RSUs are often considered a preferable choice over ESOPs if you need to choose between the two. However, it's important to remember that companies usually offer either ESOPs or RSUs, but not both, in their compensation packages. Understanding the specifics of the plan offered to you is crucial for making an informed decision about your total compensation.

In summary, the RSU vs ESOP debate highlights key differences that should be carefully considered. Knowing how each plan operates will help you make the best choice based on your personal situation and financial goals.

FAQs

Q. Which is better, RSU or ESOP?

A. ESOP allows employees to buy shares later at a fixed price, while RSUs grant shares for free under certain conditions. ESOPs involve costs for employees, while RSUs are free. Taxation differs for RSUs and ESOPs. Generally, RSUs are considered a safer investment option compared to ESOPs.

Q. Is it better to take RSU or stock options?

A. RSUs are an excellent form of compensation if you're offered them, but they also come with tax implications, as they are taxed as ordinary income as soon as they become vested. Stock options offer large potential upside as well as the choice around when to exercise and realize the taxes, if there are any.

Q. What is the difference between RSU and PSU?

A. Whereas RSUs will be granted at a steady, predictable rate, PSUs come with a higher degree of risk and potential reward. PSUs are preferred by shareholders, as performance typically aligns with share price growth.

Q. What is the difference between RSU and employee stock?

A. Simply put, RSUs represent an upfront promise of actual shares, while stock options represent the right to purchase shares at a fixed price. RSUs generally vest over time based on continued employment. They provide more certainty but higher upfront taxes for employees compared to stock options.

Also Read: Explore the Top Life Insurance Companies in India for Reliable CoveragePOPULAR POSTS

Best Silver Investment Platforms for 2025: From CFDs to Digital Vaults Explained

by Shan, 2025-10-23 12:22:46

Best Investment Plans in India for 2025: A Complete Guide to Grow and Protect Your Wealth

by Shan, 2025-09-18 10:20:46

Which venture capital firms are the most active in funding Indian startups in 2025

by Shan, 2025-08-06 10:42:11

Top 5 Apps to Buy Digital Gold in India (2025): Safe, Simple & Secure

by Shan, 2025-08-01 10:24:51

10 Highest Dividend Yield Stocks in August 2025

by Shan, 2025-07-28 09:31:02

Exchange-Traded Fund (ETF): A Practical Guide to Smart Investing

by Anmol Chitransh, 2025-04-17 10:18:20

The Ultimate Guide to Commodity Trading: Strategies, Risks, and Opportunities

by Anmol Chitransh, 2025-04-02 07:06:01

RECENTLY PUBLISHED

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

- by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

- by Shan, 2025-12-05 11:49:44

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Subscribe now

Subscribe now