What is Pre-Seed Funding? A Comprehensive Introduction for Startups

- by B2B Desk 2024-08-08 10:43:36

Many startups seek funding to boost and sustain their growth through various stages. If you're a first-time founder and your business is still in the early proof-of-concept phase or hasn't yet generated sufficient revenue, you might be able to secure pre-seed funding from investors. This initial capital can provide the necessary resources to refine your idea, build a prototype, or launch a pilot project. Securing pre-seed funding not only helps get your business off the ground but also demonstrates to future investors that you have the potential for growth and success.

What is pre-seed funding?

Pre-seed funding is an early stage of investment that occurs before a startup has achieved product-market fit or begun generating revenue. It happens at the very beginning of a startup’s journey, when founders are driven by innovative ideas and determination but haven’t yet developed their product.

Many promising ideas never come to fruition because entrepreneurs struggle to secure the necessary funds. Without pre-seed funding, founders often have to rely on their own savings, and even the most brilliant concept can falter if they can’t invest the initial capital required to get started.

Pre-seed funding addresses this issue by providing crucial early-stage capital, making the startup ecosystem more accessible. It shifts the focus from financial resources to the quality of ideas and the potential of the people behind them, leveling the playing field and giving more entrepreneurs a chance to succeed.

When to Begin Seeking Pre-Seed Funding

Deciding when to raise pre-seed funding depends on several key milestones your business may have reached. You might be ready to start seeking pre-seed funding if your business:

Has a Minimum Viable Product (MVP) With Potential: An MVP is an early version of your product that’s designed to test the waters. It’s the first iteration of what you plan to offer, and while it’s still being refined, it’s gaining traction. As you gather feedback and make improvements, your MVP evolves into a more developed product, catching the interest of both investors and potential customers.

Boasts an Experienced Founding Team: A strong founding team with industry expertise is crucial. Even if your team is relatively new, having a solid background and relevant skills can attract initial investors. Their experience and knowledge can demonstrate your business’s potential and increase confidence in your venture.

Offers a Product That Fits the Market: If your product resonates with your target audience, it’s more likely to appeal to investors. Showing that there’s genuine interest and demand for your product can make your business more attractive. You need to demonstrate that your product meets a need or desire within the market.

Is Starting to Attract Customers: Pre-seed funding can also be a good fit if you’ve begun to gain a small but growing customer base. This early traction shows that there’s potential for growth and that you’re capable of meeting increasing demand. Investors will be more interested if they see evidence of customer interest and early success.

Types of Pre Seed Investors

When seeking pre-seed funding, there are several potential sources of capital depending on your startup's situation.

Friends and Family

A “friends and family” funding round involves raising initial capital from your personal network. Investors in this category are often more interested in the founder’s potential than in the specifics of the business or industry. While this source of funding can be valuable, it’s not always accessible to every entrepreneur and may contribute to disparities in the startup world. If this route isn’t feasible, don’t worry—there are other funding options available, and many successful startups have flourished without relying on funds from their personal connections.

Angel Investors

Angel investors are typically high-net-worth individuals who invest their personal funds in early-stage companies. Many are former entrepreneurs who understand the challenges of starting a business and are willing to invest at the pre-seed and seed stages. To be classified as an angel investor, individuals generally need to meet certain financial criteria, such as having a net worth of at least 1 million USD or an annual income of 200,000 USD.

Angel Syndicates

Angel syndicates are groups of investors who pool their resources to make a single investment in a startup. They do this through special purpose vehicles (SPVs), which are legal entities that aggregate funds from multiple investors to back a company. This approach allows investors to spread risk and increase their investment capacity.

Crowdfunding

Equity crowdfunding involves raising small amounts of money from a large number of people, typically via online platforms. This method can attract a broad range of investors, including those who may not be accredited. Specialized crowdfunding websites help startups reach a wide audience, providing an alternative way to secure early-stage funding and gauge public interest in your business idea.

How to increase your chances of raising pre-seed funding

Raising pre-seed funding can be one of the most challenging phases for a startup, primarily because early-stage ventures often lack substantial traction or product proof. If you're having trouble connecting with potential investors, check out our guide on finding and engaging with them. Here’s how you can improve your chances of securing that crucial initial investment:

Craft a Compelling Pitch Deck

Your pitch deck is a vital tool for conveying your startup's vision and potential to investors. It should clearly outline the problem you're solving, your solution, and the expected impact. While it doesn’t need to cover every detail, it should succinctly highlight your startup's unique value proposition. For guidance on creating an effective pitch deck, refer to Forbes’ comprehensive guide, or consider hiring a professional to help you make a strong impression.

Conduct Thorough Market Research

With limited tangible products to showcase, detailed market research becomes your best asset. By understanding your target market inside and out, you can demonstrate to investors that there’s a genuine demand for your solution. Pre-seed investors are adept at probing the depth of market knowledge, so being well-prepared will help you make a more convincing case.

Showcase Your Expertise

It’s crucial to prove that you and your team have the skills and experience necessary to bring your vision to life. Highlight any relevant experience your team members have, whether it’s in the industry or related fields. Including this in your pitch deck or discussing it during meetings can build confidence in your ability to execute your plan. Having a knowledgeable team, especially in key areas like technology and business operations, is essential.

Prepare Thoroughly

Preparation is key to a successful pre-seed funding round. Start by identifying potential investors, including angel investors, startup accelerators, and venture capital funds that align with your industry. Make a list and begin reaching out to each one.

Additionally, determine how much equity you’re willing to offer in exchange for funding. Knowing how to value your startup is crucial in this negotiation. For assistance, refer to our guide on valuing pre-revenue startups. Be prepared for negotiations, as investors may have different perspectives on your company's worth compared to your own.

By focusing on these areas, you can significantly improve your chances of securing pre-seed funding and set a solid foundation for your startup’s growth.

Pre-Seed vs. Seed Funding: Understanding the Differences

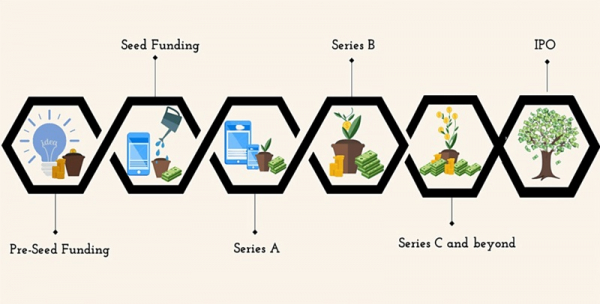

While both pre-seed and seed funding involve raising capital for early-stage products, they differ significantly in their focus and stage of development.

Pre-Seed Funding, is the earliest stage of investment, often centered around an idea rather than a developed product. At this point, the startup might not have a market-ready product or any significant customer base. Pre-seed funding is essentially a bet on the founder's vision and the potential of their concept. Because it involves higher risk—since there’s no proof that the product will succeed or even make it to market—securing pre-seed funding can be quite challenging.

Seed Funding, on the other hand, comes after pre-seed and is used for products that are already in development or have been launched. By this stage, the product typically has some traction, whether it's in the form of early customer feedback or initial sales. Seed investors are looking for evidence that the product has potential and that the market shows some demand. While still a risk, seed funding is considered somewhat less risky compared to pre-seed, as there’s already some validation of the product’s viability.

In summary, pre-seed funding focuses on investing in an idea before it has proven itself in the market, making it riskier and harder to secure. Seed funding supports a product that has begun to show signs of success and has a clearer path to growth.

FAQs

Q. What is pre-seed funding and how does it work?

A. This stage may come after even earlier funding stages, such as bootstrapping with a business owner's personal funds or initial angel investment rounds. Pre-seed funding essentially involves investing in an idea, as products typically aren't developed yet, and businesses may have nothing beyond a prototype.

Q. What is the difference between seed funding and Preseed?

A. Pre-seed capital, in a nutshell, is meant to fund early product development and prove a need in your niche market for your product. Companies are ready for seed funding after gaining traction and proving market needs.

Q. What is pre-seed funding India?

A. Pre-seed funding comes before the seed stage when the startup raises or arranges money to validate its problem-solution hypotheses, and demand. This is the money required to set the base for the business operations to start and ensure that the founder's business is viable.

Q. How hard is it to get pre-seed funding?

A. Even though there are multiple funding rounds after it, raising pre-seed money is perhaps the most difficult point in your startup's life regarding raising capital. This is often because novice startups have no idea where to meet new potential investors.

Also Read: Understanding Passive Funds: A Guide to Index Investing

POPULAR POSTS

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

by Shan, 2025-11-05 09:57:07

India’s Largest Unicorn Startups in 2025: Rankings, Valuations, and Trends

by Shan, 2025-09-18 10:32:48

Swiggy Launches Toing App in Pune to Serve Affordable Food Delivery — What It Means for the Market

by Shan, 2025-09-16 12:29:08

Trending Startup Ideas for 2025: Where Innovation Meets Opportunity

by Shan, 2025-09-05 11:56:43

19 Best Business Ideas to Start in India 2025: From Low Investment to High Demand

by Shan, 2025-09-03 10:58:15

Razorpay Business Model Explained: How the Fintech Giant Makes Money in India

by Shan, 2025-08-05 12:10:28

How CRED Reimagined Credit Card Rewards into a Billion-Dollar Fintech Empire

by Shan, 2025-08-04 12:28:03

RECENTLY PUBLISHED

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

- by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

- by Shan, 2025-12-05 11:49:44

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Best Silver Investment Platforms for 2025: From CFDs to Digital Vaults Explained

- by Shan, 2025-10-23 12:22:46

Subscribe now

Subscribe now