The Essentials of Unit Linked Insurance Plan: Benefits and Features

- by B2B Desk 2024-07-18 12:40:54

We all have various financial goals and long-term aspirations we aim to achieve. Whether it's saving for your dream car, buying a house, funding your children's education, or planning their wedding, having a solid financial plan is essential. To realize these dreams, it's crucial to set aside funds and ensure life protection, so your loved ones are financially secure even in your absence.

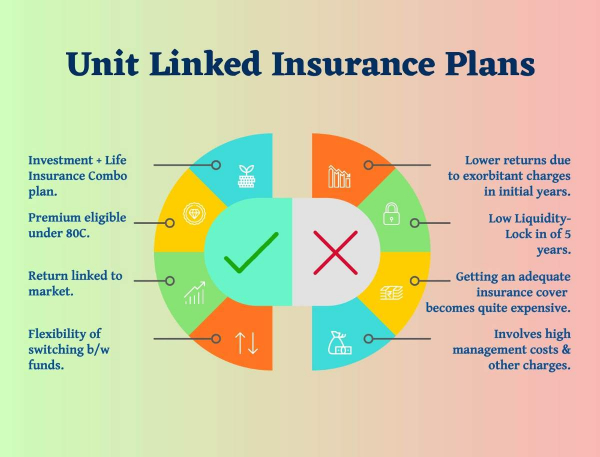

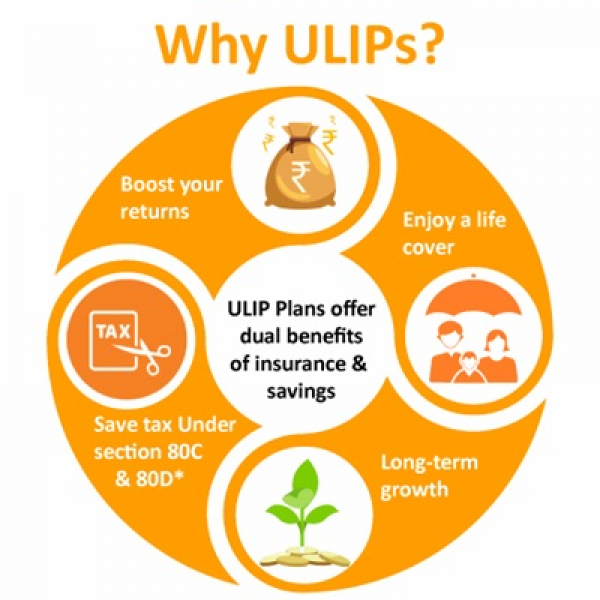

Unit-Linked Insurance Plans (ULIPs) are ideal financial instruments for those looking to save for the long term while also securing life insurance coverage. With ULIPs, policyholders pay a premium, and a portion of that amount is invested in their chosen funds, while the remaining part provides life insurance protection. In this article, we’ll explore how ULIPs work and highlight some of the top ULIP plans offered by leading insurance companies in India.

What Is a Unit Linked Insurance Plan (ULIP)?

A Unit Linked Insurance Plan (ULIP) is a dynamic financial product that integrates insurance coverage with investment opportunities in equities or bonds. When individuals enroll in a ULIP, they commit to regular premium payments. A portion of these premiums funds life insurance, while the rest is pooled with contributions from other policyholders and invested in a mix of stocks and bonds. This combination of benefits makes ULIPs a popular choice for those looking to secure their financial future while also enhancing their wealth.

How Does ULIP Works?

A Unit Linked Insurance Plan (ULIP) allows investors to simultaneously secure a life insurance policy and invest in mutual funds through a single plan. The investment made in a ULIP is known as the premium, which is divided into two components. One portion is allocated to investments in debt, equity, or a mix of both, depending on market conditions, while the other portion provides life insurance coverage.

The investment aspect of a ULIP functions similarly to mutual funds. Your funds are invested in equities, debt instruments, or a combination thereof, giving you the flexibility to choose a specific plan or switch between options. Like mutual funds, you receive units based on your investment amount, and each unit has a daily Net Asset Value (NAV) that indicates the value of the underlying assets.

ULIPs are overseen by skilled fund managers who study market patterns and make investment adjustments as needed. They consistently observe changes in the market and can adjust the investment plan when necessary.

Upon maturity of the policy, you will receive a total maturity amount, which includes the cumulative value of your investments across all selected funds. In the unfortunate event of the policyholder's death, the nominee is entitled to receive the greater amount between the fund value, the sum assured, or 105% of the total premiums paid up to that point.

Benefits of Investing in ULIPs

Investing in a Unit Linked Insurance Plan (ULIP) comes with a range of advantages. Here are some key benefits that make ULIPs a worthwhile option:

Encourages Regular Saving

By committing to a monthly ULIP investment, you cultivate a habit of disciplined savings. This consistent approach is vital for developing a robust long-term financial strategy. Timely premium payments not only help you accumulate wealth but also protect your family's financial future, making it an effective way to invest responsibly while ensuring security for your loved ones.

Provides Financial Protection

One of the standout features of ULIPs is their ability to offer life insurance coverage alongside various investment options. This dual benefit means you're not just accumulating wealth; you're also securing your family's financial well-being in case of unforeseen events. Investing in a ULIP ensures peace of mind for you and your loved ones.

Flexible Investment Options

ULIPs grant you significant control over your investments. You have the flexibility to switch funds at any time, allowing you to move your money between equity, balanced, or debt funds as market conditions change. Additionally, you can direct future premiums toward different funds and even top-up your ULIP with additional investments. In certain situations, you also have the option to make partial withdrawals to address financial emergencies.

Tax Advantages

Like many other investment and insurance products, ULIPs offer tax benefits. The premiums you pay and the returns you receive can be exempt from taxes under Sections 80C and 10D of the Income Tax Act, 1961, respectively. Furthermore, transferring money between funds within a ULIP typically incurs no additional tax liability.

Strong Growth Potential

ULIPs are increasingly popular due to their growth potential. By investing in market-linked instruments such as debt and equity funds, you have the opportunity to grow your money significantly over time, helping you achieve your long-term financial objectives.

Long-Term Rewards

Staying invested in a ULIP over the long term can lead to additional benefits, such as loyalty additions or wealth boosters. Committing to a long-term investment strategy can significantly enhance your financial rewards.

Tax Benefits of ULIPs

When purchasing a ULIP, you generally aim to achieve two main goals: to grow your wealth through investments and to secure life insurance coverage for your family. Additionally, ULIPs provide various tax benefits. Under the Income Tax Act, 1961, you can claim a tax exemption on premiums paid up to INR 1,50,000 per year. To qualify for this exemption, your sum assured must be at least ten times your annual premium. If this condition is not met, the maturity benefits may not be tax-exempt, and your premium tax benefits will be limited to 10% of the total sum assured.

Key Features of a ULIP Plan

Here are the essential features that define a Unit Linked Insurance Plan (ULIP):

Free Fund Switching

ULIPs provide a diverse range of investment options tailored to your risk profile and financial objectives. You can switch between different funds at any time without incurring additional fees.

Tax Benefits

ULIPs come with significant tax advantages under Section 80C and Section 10(10D) of the Income Tax Act, 1961. You can claim tax deductions on premiums paid, up to Rs 1.5 lakhs per year. Additionally, if your annual premium is below Rs 2.5 lakhs, maturity benefits are tax-free, and death benefits are also exempt from taxation.

Partial Withdrawals

After a mandatory lock-in period of five years, ULIPs allow you to make partial withdrawals from your investment. This feature can be particularly useful during emergencies or unexpected expenses.

Life Insurance Coverage

One of the primary benefits of ULIPs is the life insurance protection they provide. In the event of the policyholder's death, the nominee receives a death benefit, which typically includes the sum assured plus the current value of the units held in the policy.

Lock-in Period

ULIPs have a compulsory lock-in period of five years, encouraging policyholders to engage in long-term financial planning and investment.

Transparency

ULIPs promote transparency by clearly disclosing fund allocations and associated charges. This transparency helps you understand your investment better.

Loyalty Additions

Many top ULIP plans offer loyalty additions, which can increase the overall value of your policy over time, rewarding you for staying invested.

Maturity Benefits

At the conclusion of the policy term, you receive the total fund value along with your maturity returns. The payout can be received as a lump sum or in periodic installments based on your preference.

Professional Fund Management

Your investments in a ULIP are managed by skilled fund managers who make informed investment decisions backed by thorough analysis and market research, aiming to maximize potential returns.

Top-ups

ULIPs allow you to make additional contributions (top-ups) beyond your regular premiums, enhancing your investment potential and overall growth.

Rider Options

You have the flexibility to enhance your coverage by adding riders tailored to specific needs, such as:

Critical Illness Rider

- Accidental Death Benefit Rider

- Disability Benefit Rider

- Child Benefit Rider

- Waiver of Premium (WOP) Rider

ULIP Charges

It's important to note that ULIPs come with various charges, including premium allocation fees, fund management fees, and policy administration charges, which can affect your overall returns.

FAQs

Q. How do unit-linked insurance plans work?

A. ULIPs are a category of life insurance plans that provide you with the benefit of growth of your money along with a life cover`. They do this by investing a part of your premium towards a life cover` for you, and the rest in funds of your choice.

Q. What is the main advantage of a unit linked plan?

A. ULIPs provide the flexibility of premium payment. You have the option to move your money between equity and debt funds. ULIPs allow you to withdraw a part of your money whenever you need it. You can also choose where to invest, depending on your risk appetite.

Q. What is an example of a ULIP plan?

A. “A ULIP will pay at least 105% of the total premiums to your family upon your demise within the policy term.” For example: If you start investing Rs. 100,000 a year in a ULIP, your available life cover in the policy will be Rs. 10 lakhs (10 times the annual premium).

Q. Is ULIP better than FD?

A. The maturity amount of a ULIP is also tax-exempt. As a result, ULIPs are an excellent tax-saving instrument. Is ULIP better than FD? Yes, ULIPs are a better place to invest than Fixed Deposits.

Also Read: Types of ITR: Finding the Right Fit for Your Income

POPULAR POSTS

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

by Shan, 2025-10-30 10:06:42

GST Council Scraps Tax on Life & Health Insurance Premiums: What It Means for Consumers and Insurers

by Shan, 2025-09-04 08:37:28

Types of Insurance Policies in India: Choose the Best for Your Needs

by Anmol Chitransh, 2025-02-19 07:17:26

Types of Pet Insurance: All You Need to Know Before Buying It

by B2B Desk, 2025-02-10 10:47:01

60% of Health Insurance Claimants Face Discharge Delays, Push for Web Processing Solutions

by B2B Desk, 2025-01-03 08:54:35

What is Cashless Health Insurance and How Does It Work?

by B2B Desk, 2024-08-28 06:09:32

Top Cyber Insurance Companies in India: Protecting Your Digital Assets

by B2B Desk, 2024-08-23 12:23:41

RECENTLY PUBLISHED

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

- by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

- by Shan, 2025-12-05 11:49:44

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Best Silver Investment Platforms for 2025: From CFDs to Digital Vaults Explained

- by Shan, 2025-10-23 12:22:46

Subscribe now

Subscribe now