Understanding Shareholders vs. Debenture Holders: Key Differences Explained

- by B2B Desk 2024-07-18 10:58:57

Shareholders and debenture holders play crucial roles in the financial structure of companies. While both provide essential funding, several key differences distinguish them.

The primary distinction is that shareholders are owners of the company, with their ownership determined by the number of shares they hold. In contrast, debenture holders act as lenders to the company.

This means that shareholders maintain a long-term association with the company as long as it operates, whereas debenture holders’ relationship is limited to the period they hold the debentures. Their connection lasts from the time they invest until the company redeems the debenture, repaying the principal amount along with any interest due.

Before exploring the key differences between shareholders and debenture holders, let's take a moment to understand each role more thoroughly. Read on to learn more!

Who are Shareholders?

Shareholders are people or organizations who possess ownership in a company through owning shares. Ownership can also be held by other companies or partnership firms, not just individuals. Shareholders are frequently called the company's owners because they have a financial interest in the company. Their financial commitment enables them to engage in the company's development and achievement, typically leading to an increase in capital value and payouts. Furthermore, shareholders generally possess voting privileges, allowing them to impact significant corporate choices.

Who are Debenture Holders?

A debenture holder is an individual or entity that invests in a company’s debt instruments. Companies issue these instruments to raise funds from the public. When a company needs to borrow money, it offers debentures and pays a fixed interest rate to debenture holders on a regular basis. Once the borrowing period is over, the company repays the principal amount to the debenture holders, effectively redeeming the debentures.

Shareholder and Debenture Holder

A person who holds debentures is known as a debenture holder, while someone who owns shares is called a shareholder. Shareholders typically acquire their shares through stock market platforms like Kotak Securities, with each share representing a fraction of the company’s equity. In contrast, debenture holders invest in debentures, which function as a form of loan to the company.

Shareholders are co-owners of the company and hold a stake in its success, while debenture holders act as creditors by lending money. Shareholders are generally invited to attend the company’s annual general meetings, whereas debenture holders are usually not invited unless specific issues affecting their interests are being discussed.

The management of the company is overseen by a Board of Directors, elected by the shareholders. Debenture holders, however, have no role in the management or governance of the company.

Shareholders receive the Annual Report, which contains crucial financial documents such as the Balance Sheet, Profit & Loss Account, and Auditor's Report.

Interest on debentures is paid regularly, regardless of the company's financial performance, while dividend payments to shareholders depend on the company’s profitability. Although interest on debentures can sometimes be drawn from the company's capital, dividends cannot be funded in this manner.

Additionally, while the dividend rate on equity shares is not guaranteed, the interest rate on debentures is fixed. Debentures cannot be converted into shares, but shares can sometimes be converted into debentures.

Convertible debentures are an option, allowing debenture holders to convert their holdings into shares at their discretion. However, shares that can be converted into debentures are not typically issued.

Debentures are usually secured and backed by the company’s assets, whereas shares lack such collateral. In the event of liquidation, secured debenture holders are prioritized and paid before shareholders.

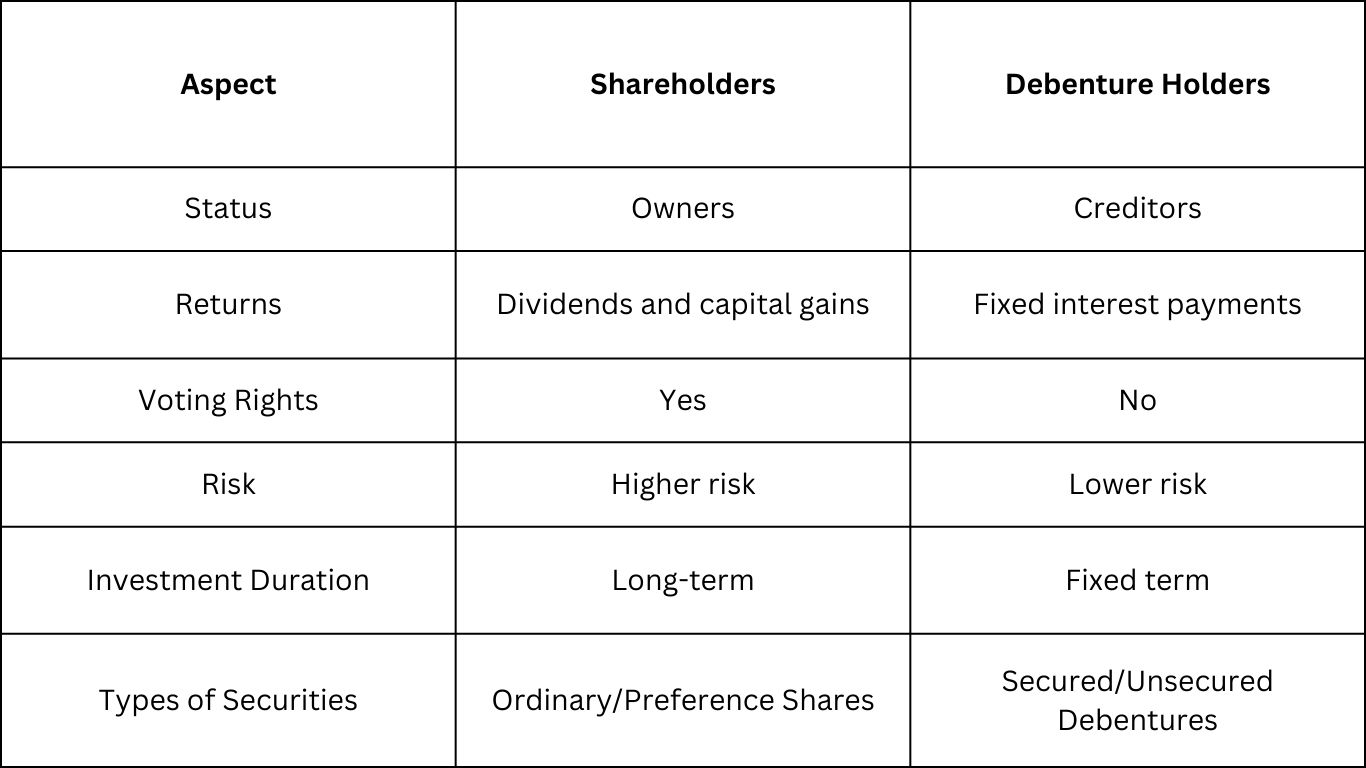

Difference Between Shareholders and Debenture Holders

Shareholders and debenture holders play crucial yet distinct roles within a company’s financial ecosystem. Understanding these differences is essential for anyone looking to invest in a business or grasp the dynamics of corporate finance.

Ownership vs. Creditor Status

Shareholders: Shareholders are the owners of a company. When individuals purchase shares, they acquire a stake in the company's equity, which grants them partial ownership. This ownership comes with certain rights, including the ability to vote on key company matters and participate in the company’s growth through appreciation of share value.

Debenture Holders: In contrast, debenture holders are not owners but creditors. They invest in the company by purchasing debentures, which are essentially loans that the company must repay over time. Debenture holders do not have ownership rights and their investment is secured by the company’s promise to repay the principal amount along with interest.

Types of Returns

Shareholders: The returns for shareholders come in two primary forms: dividends and capital appreciation. Dividends are paid out of the company's profits and can vary based on the company's financial performance. Additionally, shareholders benefit from an increase in share value over time, which can yield significant profits if the company performs well.

Debenture Holders: Debenture holders receive fixed interest payments, known as coupon payments, typically paid semi-annually or annually. This arrangement provides a predictable income stream, making debentures a more stable investment option compared to shares, although potentially offering lower returns in the long run.

Voting Rights

Shareholders: One of the significant privileges of being a shareholder is the right to vote. Shareholders can influence important corporate decisions, such as electing the board of directors, approving mergers and acquisitions, and making decisions about corporate governance. This voting power allows shareholders to have a say in the direction of the company.

Debenture Holders: Unlike shareholders, debenture holders do not possess any voting rights. Their involvement is strictly financial, and they do not participate in the decision-making processes of the company. This lack of voting power means debenture holders must rely on the company’s management to act in the best interests of all stakeholders.

Risk and Priority

Shareholders: Investing in shares comes with inherent risks. In the event of liquidation, shareholders are the last to be paid after all debts and obligations are settled. This means that in dire situations, such as bankruptcy, shareholders may lose their entire investment while creditors, including debenture holders, are prioritized.

Debenture Holders: Debenture holders enjoy a higher claim on the company's assets in the event of liquidation. This priority status generally makes debentures a safer investment option, as they are more likely to recover their investment compared to shareholders during financial distress.

Duration of Investment

Shareholders: Shareholders often adopt a long-term investment strategy, holding their shares with the expectation that the company will grow over time. This growth can come from increasing revenues, expanding market share, or enhancing profitability, ultimately leading to higher share prices.

Debenture Holders: In contrast, debenture holders typically invest for a fixed duration. Debentures have specific maturity dates, at which point the company is obligated to repay the principal amount. This fixed timeframe can appeal to investors seeking stability and predictability in their investment returns.

Types of Securities

Shares: Shares can be categorized into different types, primarily ordinary shares and preference shares. Ordinary shares come with voting rights and the potential for dividends, while preference shares usually offer fixed dividends and priority over ordinary shares in asset distribution during liquidation.

Debentures: Debentures can also be classified into secured and unsecured types. Secured debentures are backed by specific assets of the company, reducing the risk for investors. Unsecured debentures, however, rely solely on the company’s creditworthiness, which entails a higher risk for debenture holders.

Summary Table

FAQs

Q. What is the difference between a debenture holder and a share holder?

A. Shareholders are the owners of the company. Debenture holders are merely lenders to the company and are considered to be creditors. Shareholders actively participate in the decision making process of the company.

Q. Who is called the debenture holder?

A. a person or company that has lent money to another person or company by using a debenture: Payment of interest is made to the debenture holder at a specified rate and at clearly defined intervals.

Q. Can a debenture holder be a shareholder?

A. Debentures are part of a loan. A shareholder or member is the joint owner of a company; but a debenture holder is only a creditor of the company. Shareholders are invited to attend the annual general meeting of the company.

Q. Which is more risky debentures or shares?

A. Shares, debentures, and bonds are investment options with varying returns and performance. Shares represent company ownership, while debentures and bonds are debt instruments. Debentures are riskier, bonds are safer, and shares have high liquidity.

Also Read: BigBasket enters enterprise SaaS with supply chain platform

POPULAR POSTS

Best Silver Investment Platforms for 2025: From CFDs to Digital Vaults Explained

by Shan, 2025-10-23 12:22:46

Best Investment Plans in India for 2025: A Complete Guide to Grow and Protect Your Wealth

by Shan, 2025-09-18 10:20:46

Which venture capital firms are the most active in funding Indian startups in 2025

by Shan, 2025-08-06 10:42:11

Top 5 Apps to Buy Digital Gold in India (2025): Safe, Simple & Secure

by Shan, 2025-08-01 10:24:51

10 Highest Dividend Yield Stocks in August 2025

by Shan, 2025-07-28 09:31:02

Exchange-Traded Fund (ETF): A Practical Guide to Smart Investing

by Anmol Chitransh, 2025-04-17 10:18:20

The Ultimate Guide to Commodity Trading: Strategies, Risks, and Opportunities

by Anmol Chitransh, 2025-04-02 07:06:01

RECENTLY PUBLISHED

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

- by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

- by Shan, 2025-12-05 11:49:44

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Subscribe now

Subscribe now