Understanding the Endowment Plan: Meaning, Types, and Benefits

- by B2B Desk 2024-07-05 08:34:19

An endowment plan is a type of life insurance policy that offers both savings and protection benefits. It works by providing a guaranteed sum to beneficiaries if the policyholder passes away during the policy term, and a maturity benefit if the policyholder survives until the end of the term.

Under this plan, the policyholder pays regular premiums over a fixed period, typically 10, 15, 20, or 25 years. These premiums are divided into two parts: one part goes towards providing life insurance coverage, while the other part is invested by the insurance company.

Endowment policies are valuable for creating a financial safety net that supports short-term and long-term financial goals. They are designed to help individuals achieve their financial objectives over time while ensuring financial security for their families.

How Does an Endowment Plan Work?

An endowment policy serves dual purposes as a financial tool: it provides life insurance coverage for your family's financial security in case of an unfortunate event and helps you achieve your financial goals through returns on your investment.

These policies offer flexibility in premium payments, allowing you to choose monthly, half-yearly, yearly, or lump-sum payments based on your preference. Typically, the life cover provided is ten times your annual premium, offering substantial protection.

At the end of the policy's term, you receive a predetermined amount known as the maturity amount. This amount is fixed from the start of the policy, shielding it from market fluctuations. In the event of your unfortunate demise during the policy term, your loved ones receive the life cover amount along with any additional specified benefits.

For instance, consider the ICICI Pru Guaranteed Income For Tomorrow (Long-Term) Endowment Plan. If you opt for a 10-year premium payment and start receiving income from the 12th year, your beneficiaries will continue to receive the income if something happens to you after the 12th year. If any unfortunate event occurs during the first 10 years, your loved ones receive the sum assured (which is ten times your annual premium).

Similarly, the Tata AIA Life Insurance Guaranteed Return Insurance Plan combines savings with life cover. It offers options like joint-life coverage for spouses. Upon maturity, you receive the sum assured along with applicable bonuses. If you pass away during the policy tenure, your beneficiaries receive the sum assured and bonuses.

Endowment plans provide a structured way to save with the assurance of a fixed maturity amount, making them a comprehensive solution for both life insurance and wealth accumulation.

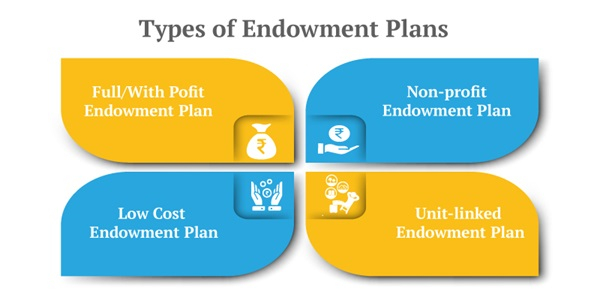

Here's a breakdown of different types of endowment policies:

Full/With Profit Endowment:

This type guarantees a sum assured to the insured, which serves as the death benefit. Additionally, the final payout is higher because it includes bonuses accumulated over the policy term.

Non-profit Endowment:

In this traditional policy, a sum assured amount is paid either as maturity benefit or as a death benefit to the beneficiary.

Unit Linked Endowment Plan:

This plan combines savings with life coverage and invests premiums in units of a chosen investment fund. Returns depend on the fund's performance, making it suitable for those willing to take on market risks for potentially higher returns.

Low-Cost Endowment:

Designed to build a fund for future needs, like mortgage repayments, these plans offer a targeted amount after a specified period. If the insured passes away during the policy term, the minimum sum assured is paid to the beneficiary.

Guaranteed Policy:

Endowment policies ensure a predetermined sum is paid to the policyholder or their beneficiaries, regardless of whether the policy matures or the insured passes away. Bonuses, however, are not guaranteed.

Child Plans:

Tailored for building a guaranteed corpus for a child's future needs, these plans often include a premium waiver rider. This rider ensures that if a parent dies during the policy term, premiums are waived off while the policy continues until maturity. The insurer pays the premiums, and upon maturity, the assured maturity benefit is paid out.

These endowment policies cater to various financial goals, offering both protection and opportunities for wealth accumulation, depending on individual needs and risk tolerance.

Endowment plans offer several key benefits that make them a valuable addition to your financial portfolio:

Attractive Returns:

Participating endowment plans provide attractive returns through bonus additions. Even non-participating plans offer wealth boosters, loyalty additions, and guaranteed additions, enhancing the death or maturity benefits.

Guaranteed Benefits:

These plans are ideal for individuals seeking security. The death or maturity benefits are guaranteed and not affected by market fluctuations. This ensures your savings remain secure, providing a guaranteed fund for your financial needs.

Tax Benefits:

Endowment plans are tax-efficient investment options. Premiums paid, up to 10% of the sum assured, are eligible for deduction under Section 80C of the Income Tax Act, 1961. The death benefit received, including bonuses, is tax-free. Additionally, the maturity benefit, including bonuses, is also tax-free under Section 10(10D). This makes endowment plans a dual advantage for tax savings and creating a tax-free corpus.

Insurance and Savings Combined:

Beyond building savings, endowment plans provide life insurance coverage. In the event of the insured's death, the plan pays out a guaranteed death benefit to the family. This financial support helps the family manage any potential financial loss.

Endowment plans thus offer a balanced approach by combining savings and insurance benefits, making them a versatile choice for individuals looking to secure their financial future while enjoying tax advantages.

Which Important Factors Should You Think About Before Buying an Endowment Plan?

When looking for the best endowment plans, consider these important factors:

Flexibility Options:

Ensure the insurer offers flexible payment options that suit your financial situation. Regular earners can opt for standard premium payments, while those with irregular income may prefer single payment or limited premium payment options.

Cost of Premiums:

Affordability is key. Choose a policy with premiums that fit comfortably within your budget for the long term. High premiums could strain your finances and may lead to discontinuation of the policy.

Insurer's Financial Stability:

Verify the insurer's financial strength and stability through independent ratings. It's crucial to entrust your investment to a financially secure insurer to ensure they can fulfill their commitments.

Claim Settlement Ratio (CSR):

The CSR indicates how efficiently an insurer settles claims. Opt for a company with a high and consistent CSR, as it reflects reliability and responsiveness in honoring policyholder claims.

Bonuses:

Look into how bonuses are declared by the insurer based on their investment performance. Bonuses add to the maturity benefits of the policy, so understanding how they are calculated and distributed is important.

Simple & Fast Claim Process:

Choose an insurer with a straightforward and efficient claim settlement process. Check if they offer multiple channels for claims submission, such as online, at branches, via SMS, or email. A hassle-free claim process ensures you or your beneficiaries can easily access benefits when needed.

Considering these factors will help you choose an endowment policy that aligns with your financial goals, provides peace of mind through robust insurance coverage, and offers efficient service in times of need.

FAQs

Q. What do you mean by endowment plan?

A. An endowment plan is a life insurance plan that offers a life cover1 and helps you grow your money. It provides returns that are fixed at the time of the purchase of the policy.

Q. Is an endowment plan a good investment?

A. Importance of an endowment plan. It is good to remember that an endowment plan is chosen for its assured returns over long-term savings. It also offers life coverage and a savings component that is a much better investment that basic term plans.

Q. What is the difference between term plan and endowment plan?

A. Term plans are for individuals who want to provide for their family in unforeseen circumstances. Endowment plans are for individuals seeking insurance coverage along with wealth creation or long-term savings. Term plans do not offer an option to make withdrawals from the policy.

Q. What is the maturity benefit of endowment plan?

A. Death Benefit: The Sum Assured plus all bonuses to date is payable in a lump sum upon the death of the life assured during the policy term. Maturity Benefit: The Sum Assured plus all bonuses declared up to maturity date is payable in a lump sum on survival to the end of the policy term.

Also Read: Understanding the MakeMyTrip Business Model: How It Works

POPULAR POSTS

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

by Shan, 2025-10-30 10:06:42

GST Council Scraps Tax on Life & Health Insurance Premiums: What It Means for Consumers and Insurers

by Shan, 2025-09-04 08:37:28

Types of Insurance Policies in India: Choose the Best for Your Needs

by Anmol Chitransh, 2025-02-19 07:17:26

Types of Pet Insurance: All You Need to Know Before Buying It

by B2B Desk, 2025-02-10 10:47:01

60% of Health Insurance Claimants Face Discharge Delays, Push for Web Processing Solutions

by B2B Desk, 2025-01-03 08:54:35

What is Cashless Health Insurance and How Does It Work?

by B2B Desk, 2024-08-28 06:09:32

Top Cyber Insurance Companies in India: Protecting Your Digital Assets

by B2B Desk, 2024-08-23 12:23:41

RECENTLY PUBLISHED

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

- by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

- by Shan, 2025-12-05 11:49:44

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Best Silver Investment Platforms for 2025: From CFDs to Digital Vaults Explained

- by Shan, 2025-10-23 12:22:46

Subscribe now

Subscribe now