What is margin trading facility and How do you trade on it?

- by B2B Desk 2024-06-04 10:38:49

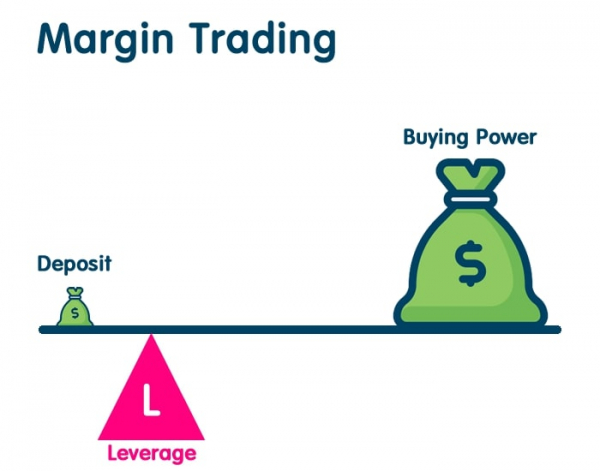

Margin trading, a characteristic of the stock market, permits investors to purchase a greater number of shares than they have the funds for. Investors can potentially earn greater profits by purchasing stocks at a premium rather than at the market price. Your lender will provide you with the funds to purchase the shares and, as with any other loan, pay you interest. As an investor, you will receive a return greater than your initial investment. Thus, you have the option to utilize your position in the market by investing in securities or funds, enabling you to acquire market insights. Margin trading, also known as leveraged trading, carries certain risks, but has the potential for significant profits if market fluctuations are correctly forecasted.

How Margin Trading works

After opening a Margin Trading Facility (MTF) account, the broker can provide funds that investors can utilize to purchase shares. The sum distributed is a

A loan can be given with cash or securities as collateral, with a minimum margin required.

What is margin trading facility? Imagine if an investor is interested in purchasing shares valued at Rs. He has 100,000, but he is missing the full amount. Nonetheless, he is able to contribute a partial sum towards the overall cost.

purchasing the stocks. This is the margin value.

Suppose that the margin in this instance stood at 20%. Next, the investor is required to provide Rs. 20,000 is equivalent to 20% of Rs. The buyer needs to pay Rs 1,00,000 to the broker before making the purchase, with the rest of the amount due later.

The broker will loan out 80,000. The broker will receive interest from the investor on the margin.

SEBI Regulations Regarding Margin Trading

Till now, margin trading in India was allowed only through cash, while offering shares as the collateral was limited. However, under the new regulations issued by SEBI in 2018, investors can leverage their market position through margin trading by offering shares as securities. Also, margin accounts can be offered only by authorized dealers, as per the rules laid down by SEBI.

What are the advantages of margin trading?

Short-term profit: Trading the stock market is suitable for investors who are looking to profit from short-term price changes in the stock market but lack investment funds.

If you have unused shares in your Demat account and want to use the available funds for trading, margin trading is a viable option. These assets can be leveraged to use MTF transactions in the stock market.

Using leveraged trading in the stock market can help you take advantage of small market fluctuations by using margin trading. Buying large stocks with small stocks increases your leverage in the stock market. Using leverage allows you to improve your position, making it easier to capitalize on small market changes.

High returns from investment: Margin trading is best in good market conditions. Margin trading costs increase returns compared to normal trading costs, thus increasing your returns.

ROE can be increased by increasing the rate of return on capital employed, or, by increasing your ROE. If you're covering a quarter of the expense and the price goes up by 5%, you'll get a 20% return on equity.

MTF: Investors often miss the opportunity to buy stocks because they don't have enough money to invest. So, in such scenarios, Margin Trading Facility can help you in earning money for investment.

What are the disadvantages of margin trading?

Increased losses: A major problem with margin trading is that you may have a greater loss than your initial investment. A decline of 50% or more in the value of assets purchased with loan funds will result in a loss of 100% or more in your portfolio, including interest and commissions.

Important balance: After buying a stock or security on the border, it is necessary to maintain a certain level of balance. The minimum purchase price is 25%, but it can be from 30% to 40% depending on the type of securities sold, which can vary between brokers. Having a large amount of money in an MTF will lock up a portion of your money.

Margin Call: If the value of your stock falls below 25% of the margin, you will receive a call. The investor must increase the balance in their account by buying stocks or adding money when the margin call is made, if they are not required by their sell to raise money or sell some of their assets.

Selling shares: If you don't meet a margin call, your stock will be liquidated. If you don't keep the balance, your seller can sell your property without your permission. Investors must pay a fixed interest rate and are advised to pay it off promptly to avoid high interest rates.

How to determine if margin trading is suitable for you

Margin trading is best for experienced investors who are comfortable with risks and understand how to use margin safely. New investors are better off using an investment account when learning about the financial markets.

You must be the type of investor who enjoys participating in the market; Margin trading is not a "buy it and forget it" activity.

FAQs

Q. What are the 4 types of margin?

A. Margin is of four types - Initial Margin, Maintenance Margin, Variation Margin, and Margin Call. Let's understand the role of each margin type in trading. Initial margin refers to the margin amount you need to maintain in your account to initiate a future transaction.

Q. Is margin trading and intraday trading same?

A. Definition: In the stock market, margin trading refers to the process whereby individual investors buy more stocks than they can afford to. Margin trading also refers to intraday trading in India and various stock brokers provide this service.

Q. What is the basic of margin trading?

A. Margin trading involves borrowing money from a broker to buy stocks, allowing investors to purchase more than their current funds permit. It is a useful feature provided by stockbrokers that help investors take a larger position and consequently boost their possible gains.

Q. Is margin trading tax free?

A. In line with their treatment of other cryptocurrency activities, there is the potential that margin trading gains/losses will be treated with income tax if the owner is a business entity, or capital gains tax if the owner is an individual.

Also Read: What is the Difference between Block Deals and Bulk Deals?

POPULAR POSTS

Rupee Forecast 2025: Key Drivers Behind INR Weakness Against the US Dollar

by Shan, 2025-08-11 07:32:23

August 2025 IPO Preview: Big Listings from JSW Cement, NSDL, Knowledge Realty & SME Stars

by Shan, 2025-07-30 11:51:27

Ola Electric Q1 Results FY26: Revenue Falls 61%, Net Loss at ₹870 Cr - MoveOS 5 in FocusOla

by Shan, 2025-07-14 12:22:55

HAL, BEL & Data Patterns: 3 Defence Stocks Riding India's ₹50,000 Cr Export Ambition

by Shan, 2025-06-26 10:00:16

India GDP Forecast 2025-26 Raised to 6.5% by S&P: Key Drivers & Global Risks Explained

by Shan, 2025-06-26 10:30:46

Dalal Street Outlook: 5 Key Market Triggers to Watch This Week

by Shan, 2025-06-16 12:32:04

What is the Bond Market & How Does It Impact Your Investments?

by B2B Desk, 2025-02-05 09:42:55

RECENTLY PUBLISHED

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

- by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

- by Shan, 2025-12-05 11:49:44

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Subscribe now

Subscribe now