Different types of trading in stock market

- by B2B Desk 2024-05-13 08:17:50

The market has become a significant way to make additional money, with different types of stock trading becoming more popular. Traders frequently adjust their tactics to align with their financial objectives and available investment options. Multiple brokers have launched easy-to-use mobile applications and trading platforms, offering a plethora of information to traders.

Studying various marketing strategies enables individuals to enhance their marketing efforts. This article offers in-depth details on the various types of trading options present in the stock market.

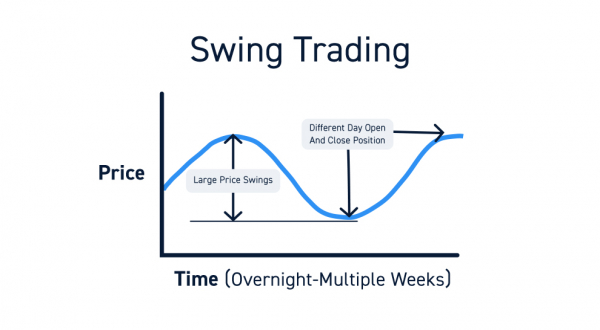

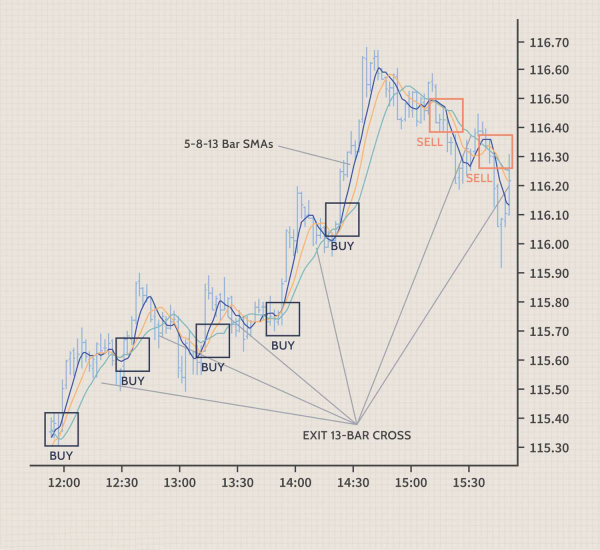

Swing Trading

A swing trading strategy appears when traders intend to take profits from short-term trends or fluctuations. Such trading requires that traders have a comprehensive understanding of price trends in the market. Identifying the right entry point can help traders ride the bullish wave and make big profits.

Positional Trading

Positional trading involves holding a trade for a long period ranging from weeks to months. Traders with a long-term view can engage in positional trading to profit from long-term price movements. The positional trading strategy is widely used in rising markets. One cannot benefit from this strategy in the sideways market. Positional trading requires research and study before purchasing a company's shares because it involves holding shares for the long term.

Scalping

Scalping, or micro-trading, is the practice of continuing to make small profits. The duration of the transaction is from a few seconds to a few minutes. This trading strategy requires a high level of skill and confidence in the trader's business knowledge. Investors can do tens to hundreds of transactions every day using this method. Then they try to make a profit by exploiting minute changes in stock prices.

Momentum Trading

Momentum traders try to make money in the stock market by riding the timing of equities. When the value increases, the goal is to sell for a higher profit. When the price of a stock falls, the strategy is to buy more and sell later when the price rises.

Intraday Trading

This is the most common type of trading done in the stock market by traders. Intraday trading refers to same day trading. Traders must buy, sell and sell their assets on the same day before the market closes. This method can be called "squaring off the trade". It is one of the most important trading methods for those who are looking for higher ROIs than other methods.

Conclusion

Having knowledge of various elements of stock trading enables investors to make well-informed choices in the stock market. Different skills and strategies are needed for each approach, whether it's day trading, swing trading, or long-term investing, with the goal of achieving quick income, moderate income, or steady growth respectively.

Investors can select a trading strategy that aligns with their objectives and preferences by taking into account factors like risk tolerance, time horizons, and market data.

FAQs

Q. What are the 4 types of trading?

A. There are four types of trading: day trading, position trading, swing trading, and scalping.

Q. What is F&O trading?

A. What is F&O trading? Future and option are two derivative instruments where the traders buy or sell an underlying asset at a pre-determined price. The trader makes a profit if the price rises. In case, he has a buy position and if he has a sell position, a fall in price is beneficial for him.

Q. Which trading is best for beginners?

A. Intraday trading is all about precise timing and market understanding. A good intraday trading strategy works only after technical analysis, practical execution, using indicators and proper risk management. So here we will intraday trading strategies. This strategy can be used by beginners to start trading.

Q. What is Nifty and Sensex?

A. What are Sensex and Nifty? In India, there are two stock exchanges; the Bombay Stock Exchange and National Stock Exchange. Each stock exchange needs to have an index to measure the performance of the market. Sensex is the Index for Bombay Stock Exchange (BSE), and Nifty is the Index for National Stock Exchange (NSE).

Also Read: The Impact of GST on the E-commerce Industry

POPULAR POSTS

Rupee Forecast 2025: Key Drivers Behind INR Weakness Against the US Dollar

by Shan, 2025-08-11 07:32:23

August 2025 IPO Preview: Big Listings from JSW Cement, NSDL, Knowledge Realty & SME Stars

by Shan, 2025-07-30 11:51:27

Ola Electric Q1 Results FY26: Revenue Falls 61%, Net Loss at ₹870 Cr - MoveOS 5 in FocusOla

by Shan, 2025-07-14 12:22:55

HAL, BEL & Data Patterns: 3 Defence Stocks Riding India's ₹50,000 Cr Export Ambition

by Shan, 2025-06-26 10:00:16

India GDP Forecast 2025-26 Raised to 6.5% by S&P: Key Drivers & Global Risks Explained

by Shan, 2025-06-26 10:30:46

Dalal Street Outlook: 5 Key Market Triggers to Watch This Week

by Shan, 2025-06-16 12:32:04

What is the Bond Market & How Does It Impact Your Investments?

by B2B Desk, 2025-02-05 09:42:55

RECENTLY PUBLISHED

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

- by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

- by Shan, 2025-12-05 11:49:44

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Subscribe now

Subscribe now