Why are gold prices so high? is this right time to invest in gold?

- by B2B Desk 2024-04-26 09:19:05

Gold prices surged to their highest in 2024, with gold futures soaring 14.49% since January 2, 2024. The price per ounce of gold has also hit several record highs, recently hitting an all-time high. In early March, prices soared to a then-high of 2,160 USD per ounce. Since then, the price has continued to trend upward, reaching the current price of 2,346.33 USD per ounce.

Evidence that gold prices are on the rise can be seen in 2023, when gold investments hit an 11-year high as institutional investors turn to gold amid stubborn inflation and high interest rates aimed at curbing it. So what is responsible for gold's upward trend? With gold prices soaring, is now a good time to buy gold?

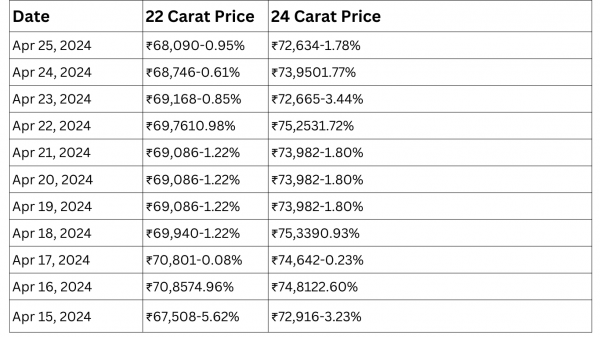

Here is the list of gold prices for the past 10 days

Why are gold prices so high in india?

Expectation of Federal Reserve interest rate cut

The Federal Reserve is expected to announce its first interest rate cut in June this year. Gold is generally inversely related to interest rates. Low interest rates reduce the opportunity cost of holding gold (which earns no interest or dividends), increasing demand and raising prices. Conversely, higher interest rates can reduce the attractiveness of gold as an investment, driving prices down. Now that interest rates in the US and India are expected to fall, gold prices may continue to rise.

Decline in the Dollar Index

The correlation between gold prices in India and the US Dollar Index (DXY) is frequently opposite. That means when one increases, the other usually decreases, and vice versa. In recent months, there has been a decrease in the dollar index. In March, it hit 102.5. However, what is the reason for the inverse connection? Let's comprehend.

Gold is traded in global markets in US dollars. Therefore, when the US dollar strengthens against other currencies, gold prices tend to fall in dollar terms. Conversely, when the US dollar weakens, gold prices tend to rise. This relationship is because a stronger dollar makes gold more expensive for holders of other currencies, leading to lower demand and lower prices, while a weaker dollar makes gold relatively cheaper and increases demand, leading to higher prices.

Gold's upward trend on the MCX

Gold prices on the Multi-Commodity Exchange (MCX) continue to trend higher due to geopolitical tensions and ongoing trade issues between the United States and China. Expectations that interest rate cuts will begin in June 2024 further support this optimistic outlook.

Is it right time to invest?

Experts recommend investors accumulate gold at this level as interest rates are expected to bring liquidity to the market.

The immediate support for gold is around INR 70,000 and the next support level is around INR 68,000. Investors should consider accumulating gold at these levels as interest rate cuts are expected to bring liquidity into the market, supporting the long-term outlook for gold. Overall, a 4-5% decline from current levels represents a profitable buying opportunity for investors.

Gold prices are up more than 5% from a record high of 1,000 pounds. The price is 73.958 USD per 10 grams due to profit taking, signs of easing tensions in the Middle East, oil prices falling below $90 again, and resumption of dollar and government bond purchases due to expectations of delayed interest rate cuts. US Federal Reserve Bank. Additional.

Going forward, we may see a further correction of around 2-3% between Rs. 100,000 and Rs. 68,500-69,000, I think this will be the ideal level to start buying gold again and accumulating for higher targets as the uptrend is still there. Key factors to watch in the upcoming session are inflation and other data from global markets, buying by ETF investors, and US dollar movements.

FAQs

Q.Which type of gold investment is best?

A.Individuals can also invest in solid gold by purchasing biscuits, bars, or coins. The making charges here are very low, and you get good returns while selling. However, one common risk factor in the possession of physical gold is storage and theft.

Q.Is gold better than FD?

A.Both FDs and Gold offer a solid foundation for wealth preservation. If you prioritize risk mitigation, FDs might be preferable. However, for those seeking historical value retention, gold stands as an attractive alternative.

Q.How to earn money from gold?

A.Can we earn interest on gold? Yes, you can earn interest on the gold lying idle in bank lockers through the gold monetization scheme. In this scheme, you can deposit your gold in different schemes (short, medium, and long-term) and earn interest on the value of the gold deposited.

Q.Which bank is good for gold deposit?

A.SBI lets their customer to deposit the gold that is lying idle under this scheme and in return get safety, earn interest and tax benefits.

Also Read: Top 5 best gold investments choices in India

POPULAR POSTS

Best Silver Investment Platforms for 2025: From CFDs to Digital Vaults Explained

by Shan, 2025-10-23 12:22:46

Best Investment Plans in India for 2025: A Complete Guide to Grow and Protect Your Wealth

by Shan, 2025-09-18 10:20:46

Which venture capital firms are the most active in funding Indian startups in 2025

by Shan, 2025-08-06 10:42:11

Top 5 Apps to Buy Digital Gold in India (2025): Safe, Simple & Secure

by Shan, 2025-08-01 10:24:51

10 Highest Dividend Yield Stocks in August 2025

by Shan, 2025-07-28 09:31:02

Exchange-Traded Fund (ETF): A Practical Guide to Smart Investing

by Anmol Chitransh, 2025-04-17 10:18:20

The Ultimate Guide to Commodity Trading: Strategies, Risks, and Opportunities

by Anmol Chitransh, 2025-04-02 07:06:01

RECENTLY PUBLISHED

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

- by Shan, 2025-12-05 11:49:44

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Subscribe now

Subscribe now