7 Biggest Mistakes to Avoid While Doing Intraday Trading

Trading in Illiquid Stocks Trading in illiquid stocks is a common mistake and one of the biggest mistakes day traders make, due to a lack of research. They mus

- by B2B Desk 2023-08-29 07:23:11

Intraday trading is a risky and challenging game. It's not just about managing risks and staying focused on current market trends.

Despite being focused and managing risks, several traders commit big mistakes that end up with huge losses.

Almost 90% of intraday traders lose money in intraday trading just by performing one mistake. Here are the seven biggest mistakes that intraday traders should avoid in intraday trading.

Not Performing Technical Analysis

There is no word called " surety" when trading in the stock market. However, the best thing a trader can do is to study and analyze the past performance of a stock or company’s past performance and take decisions accordingly.

This is the first step that beginners and experienced traders perform while trading. Analyzing the stocks and their history plays a vital role in Intraday trading.

It is the job of the trader to monitor the price, volume charts, and several other technical indicators to make effective decisions.

These indicators help traders whether the stock will follow the recent trend and for how much.

We all know how markets can move and can change the situation in seconds. However, using technical indicators at their best and learning the current trends is the safest bet intraday traders can achieve.

The biggest mistake several intraday traders make is rushing into choosing stocks to trade. When trading, always take your time and choose the right stocks.

Going By Tips Rather Than Learning To Self-Trade

It is very easy to get profitable tips from traders but making money from these tips is not easy. The best way to earn profit in intraday trading is by learning self-trade.

Getting advice from experienced traders can give you some profit but not always. A trader must learn about charts, understand their structure, and learn to trade independently.

Many intraday traders do not perform this risk, so they lose patience and do not perform intraday trading.

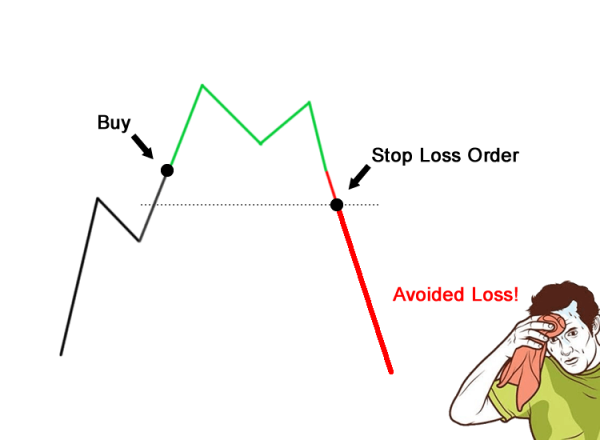

Not Setting Up A Stop Loss

Stop loss is a tool primarily designed for traders to save themselves from big losses. Many intraday traders use a stop loss because it gives them an idea of how much to lose when it comes to losses.

A stop-loss order is a type of order in which a trader instructs the broker to sell a stock as soon as possible when the market drops below a predetermined price during the trading day.

When the market falls, this order gets executed immediately, thus preventing the trader from losing. Day traders look to earn more profits due to their high-risk appetite.

Because of this, they forget to place a stop loss order when booking a buy order. As day traders, they must think about doubling their profits and be safe from big losses.

Remember, placing a stop-loss order does not take much time, and if the market goes down, the stop-loss order can save them by saving all their potential money.

Trading in Illiquid Stocks

Trading in illiquid stocks is a common mistake and one of the biggest mistakes day traders make, due to a lack of research. They must understand that stock liquidity plays a vital role in intraday trading.

Let us understand with the example given below:

Imagine a situation where a trader buys a particular stock early in the morning and hopes to sell it before the market closes with a profit, but ends up having no ready buyers for the stock bought.

This may result in the trader's sell order not being executed and the shares being delivered to you in their Demat account

This is why it is always important to place the trade-in companies with a lot of liquidity in their market shares.

Not Taking a 360-Degree View of the Market

Many intraday traders pick up on the trend and hold it until the end of the closing day, but it's not that simple. As fundamental investors, they need to dig deeper and analyze stock performance than a day trader does to understand the nuances of trade structure.As intraday traders, they need to understand the market trend and have a 360-degree view of the market to understand it better.

![]()

Develop a negative attitude or Being too emotional

The primary rule of intraday trading is not to get too attached to the profit and losses and get depressed if you lose money while performing intraday trading

A trader should always keep his emotions aside and should not let losses get in the way, and stopping trading completely will reduce his chances of realizing the negative aspects. However, you will develop a negative attitude towards stock markets.

They should always treat profit and loss similarly and focus on improving by following the rules to learn while doing intraday trading.

Ignore the trading plan and trading Diary

The trading plan and trading diary are essential things that intraday traders ignore. Let's take a look at the trading plan first.

The action plan includes and describes how day-to-day operations are conceived and implemented. This consists of profit and stop-loss targets, factors to consider, and the right trading hours to choose.

A trading plan is a complete book on the trading activity that the trader must follow meticulously.

On the other hand, the trading diary records all the traders that happened during a single trading day and the justification and the EOD analysis of performance.

The trading diary helps a trader find areas of weakness and improve gaps in their trading strategy gaps. If a trader does not give importance to the trading plan and trading diary, it will be difficult to achieve success as an intraday trader.

Also Read: BPCL to invest Rs1.5 trillion in transformative initiative, net-zero roadmap

POPULAR POSTS

Rupee Forecast 2025: Key Drivers Behind INR Weakness Against the US Dollar

by Shan, 2025-08-11 07:32:23

August 2025 IPO Preview: Big Listings from JSW Cement, NSDL, Knowledge Realty & SME Stars

by Shan, 2025-07-30 11:51:27

Ola Electric Q1 Results FY26: Revenue Falls 61%, Net Loss at ₹870 Cr - MoveOS 5 in FocusOla

by Shan, 2025-07-14 12:22:55

HAL, BEL & Data Patterns: 3 Defence Stocks Riding India's ₹50,000 Cr Export Ambition

by Shan, 2025-06-26 10:00:16

India GDP Forecast 2025-26 Raised to 6.5% by S&P: Key Drivers & Global Risks Explained

by Shan, 2025-06-26 10:30:46

Dalal Street Outlook: 5 Key Market Triggers to Watch This Week

by Shan, 2025-06-16 12:32:04

What is the Bond Market & How Does It Impact Your Investments?

by B2B Desk, 2025-02-05 09:42:55

RECENTLY PUBLISHED

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

- by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

- by Shan, 2025-12-05 11:49:44

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Subscribe now

Subscribe now