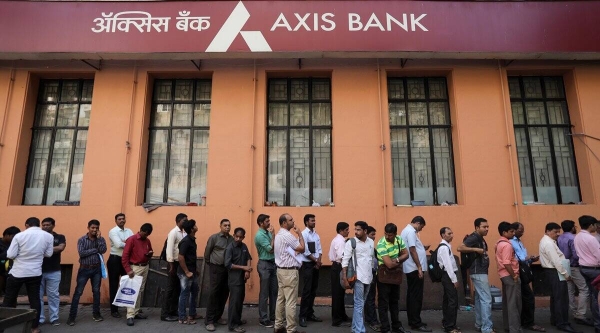

Axis Bank to acquire Citi Bank's consumer business by March 1

Axis Bank will acquire the Citibank's consumer business in India by Citibank N.A. (CBNA) and NBFC from Citicorp Finance (India) Limited (CFIL), according to its

- by B2B Desk 2023-02-28 05:08:58

Axis Bank will acquire the Citibank's consumer business in India by Citibank N.A. (CBNA) and NBFC from Citicorp Finance (India) Limited (CFIL), according to its regulatory filing.

In March last year, Axis Bank said it reached an agreement to buy Citibank's consumer business in India for 12,325 million rupees (1.6 billion dollars) in cash. Citibank's consumer businesses include loans and credit cards, heritage administration and retail banking operations. The bank's credit card portfolio is composed of wealthy customers with an average expense higher than the industry.

The bank had given a period of 12 months to complete this acquisition. In July last year, Axis Bank obtained the approval of the Competition Commission of India (CCI) for the same.

“Based on progress to date, we estimate a reasonable probability of completing the acquisition for March 1, 2023, which is within 12 months previously indicated by us, subject to the satisfactory completion of the usual and contractual terms. According to the terms of CBNA BTA and CFIL BTA, as mentioned above, ”said Axis Bank in its filing.

The agreement will see a portflio of 25 lakh credit card users, deposits of Rs. 50,200 crore deposits and assets of wealth management of Rs 1.1 crores for Axis Bank.

Axis Bank will acquire seven offices, 21 branches and 499 ATMs Property and operated by CITI.

The Axis Bank card balance grows 57 percent with 2.5 million additional Citibank cards, which makes it one of the top 3 card companies in the country.

Axis Bank announced a 62 percent increase in net profit for the third quarter of the fiscal year. The gains of the quarter ended on December 31 increased to 5,853 crores from 3,614 crores rupees of the previous year.

Axis Bank shares closed with a 1.44 percent rise to 845.15 INR in the Bombay Stock Exchange.

Also Read: Meta launches AI language model LLaMA for researchers

POPULAR POSTS

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

by Shan, 2025-12-05 11:49:44

Zoho Mail vs Gmail (2025): Which Email Platform Is Best for Businesses, Startups, and Students?

by Shan, 2025-10-09 12:17:26

PM Modi Launches GST Bachat Utsav: Lower Taxes, More Savings for Every Indian Household

by Shan, 2025-09-24 12:20:59

$100K H-1B Visa Fee Explained: Trump’s New Rule, Clarifications & Impact on Indian Tech Workers

by Shan, 2025-09-22 10:11:03

India-US Trade Deal Soon? Chief US Negotiator Arrives in Delhi as Talks Set to Begin Tomorrow

by Shan, 2025-09-15 11:54:28

Modi Meets Xi: Trump’s Tariffs, Strategic Autonomy, and the Future of Asia’s Power Balance

by Shan, 2025-09-03 06:40:06

RECENTLY PUBLISHED

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Best Silver Investment Platforms for 2025: From CFDs to Digital Vaults Explained

- by Shan, 2025-10-23 12:22:46

Subscribe now

Subscribe now