The RBI could raise the repo rate by up to 50 basis points

The policy rate could be increased by between 25 and 50 basis points, raising the rate at which the RBI lends to banks from the current 4.4% to 4.9%, according

- by B2B Desk 2022-06-06 05:20:43

The Reserve Bank of India, part of a chorus of global central banks to rein in inflation, is expected to raise interest rates this week, according to an ET survey. However, the magnitude of the increase is uncertain as it takes into account moving factors such as crude oil, government fiscal measures and the monsoon's impact on grain production to forecast future prices.

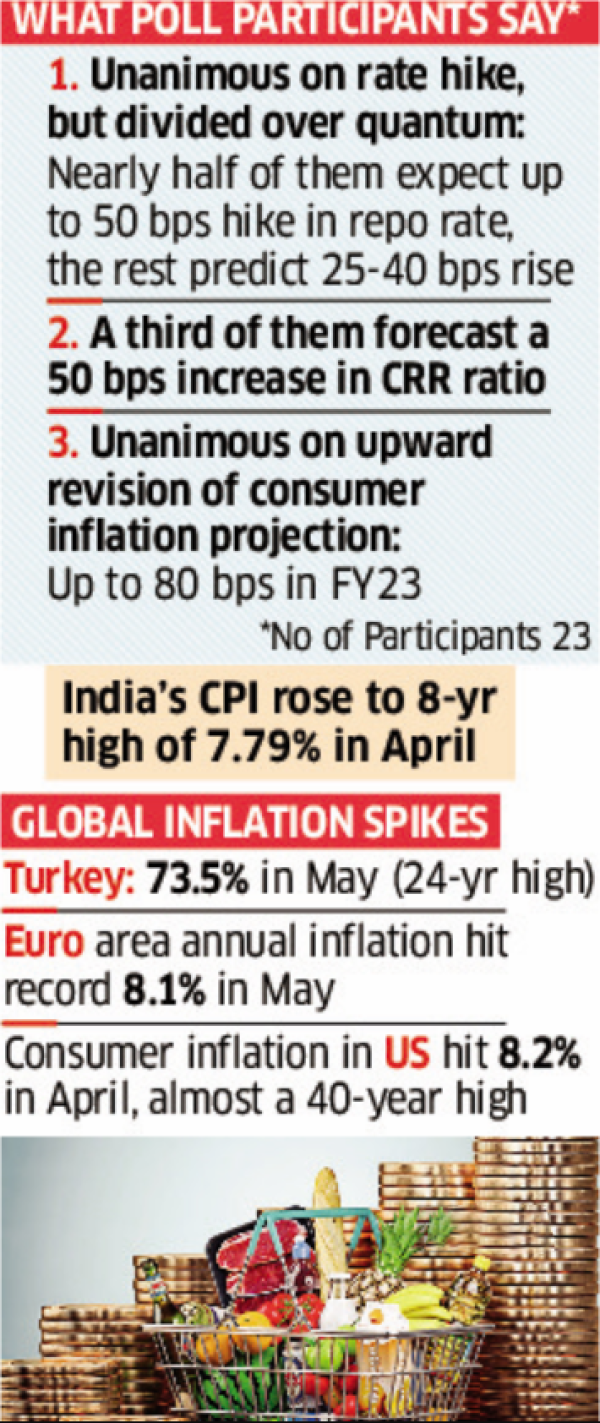

The policy rate could be increased by between 25 and 50 basis points, raising the rate at which the RBI lends to banks from the current 4.4% to 4.9%, according to the survey. Nearly half of the 23 market participants surveyed for the survey, including traders, economists, fund managers and directors of financial institutions, forecast an increase of 50 basis points, or half a percentage point more, while the others expect an increase of between 25 and 40 basis points.

The policy rate could be increased by between 25 and 50 basis points, raising the rate at which the RBI lends to banks from the current 4.4% to 4.9%, according to the survey. Nearly half of the 23 market participants surveyed for the survey, including traders, economists, fund managers and directors of financial institutions, forecast an increase of 50 basis points, or half a percentage point more, while the others expect an increase of between 25 and 40 basis points.

After the unexpected action on rates and liquidity in May, the RBI could redouble its efforts by also raising the cash reserve ratio (CRR), the proportion of deposits that banks hold with the central bank, to prevent the consumer price index exceeds its upper tolerance. 6% limit.

MPC decision on Wednesday

While the rate hike is a given, investors will keep a close eye on inflation expectations and the likely final rate in this bull cycle as the RBI still tries to fuel an economic recovery through higher investment.

The Monetary Policy Committee (MPC) could raise inflation forecasts and lower growth expectations, but the magnitude of those expectations would depend on reading the invisible hand of the government in managing tax rates to keep the price under control. "To strike the right balance between sluggish growth and expected moderation in inflation, the pace of rate hikes needs to be calibrated, especially after the core consumption tax cuts," said A Balasubramanian, CEO of Aditya Birla MF. "Aggressive rate hikes are unlikely to materialize. Also, the prospect of a good monsoon will start to weigh on consumer prices."

Also Read: After PFRDA rejects Chhattisgarh govt's request, CM urges Modi to refund Rs 17,240 cr collected under NPS

After the unexpected action on rates and liquidity in May, the RBI could redouble its efforts by also raising the cash reserve ratio (CRR), the proportion of deposits that banks hold with the central bank, to prevent the consumer price index exceeds its upper tolerance. 6% limit.

MPC decision on Wednesday

While the rate hike is a given, investors will keep a close eye on inflation expectations and the likely final rate in this bull cycle as the RBI still tries to fuel an economic recovery through higher investment.

The Monetary Policy Committee (MPC) could raise inflation forecasts and lower growth expectations, but the magnitude of those expectations would depend on reading the invisible hand of the government in managing tax rates to keep the price under control. "To strike the right balance between sluggish growth and expected moderation in inflation, the pace of rate hikes needs to be calibrated, especially after the core consumption tax cuts," said A Balasubramanian, CEO of Aditya Birla MF. "Aggressive rate hikes are unlikely to materialize. Also, the prospect of a good monsoon will start to weigh on consumer prices."

Also Read: After PFRDA rejects Chhattisgarh govt's request, CM urges Modi to refund Rs 17,240 cr collected under NPS

POPULAR POSTS

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

by Shan, 2025-12-05 11:49:44

Zoho Mail vs Gmail (2025): Which Email Platform Is Best for Businesses, Startups, and Students?

by Shan, 2025-10-09 12:17:26

PM Modi Launches GST Bachat Utsav: Lower Taxes, More Savings for Every Indian Household

by Shan, 2025-09-24 12:20:59

$100K H-1B Visa Fee Explained: Trump’s New Rule, Clarifications & Impact on Indian Tech Workers

by Shan, 2025-09-22 10:11:03

India-US Trade Deal Soon? Chief US Negotiator Arrives in Delhi as Talks Set to Begin Tomorrow

by Shan, 2025-09-15 11:54:28

Modi Meets Xi: Trump’s Tariffs, Strategic Autonomy, and the Future of Asia’s Power Balance

by Shan, 2025-09-03 06:40:06

RECENTLY PUBLISHED

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Best Silver Investment Platforms for 2025: From CFDs to Digital Vaults Explained

- by Shan, 2025-10-23 12:22:46

Subscribe now

Subscribe now