Steel stocks are expected to be hit by higher export tariffs

India exported 13.5 million tonnes (MT) of finished steel in FY22, compared to 10.8 tonnes in FY21, while domestic steel consumption over the same period was 10

- by B2B Desk 2022-05-23 05:05:39

Steel inventories are expected to correct in the near term as the application of export tariffs on certain steel products is negative for the sector, while a cut in tariffs on commodities and the resulting drop in steel prices would benefit sectors such as construction, capital goods and automobiles.

"Steel export tariffs are likely to lead to increased domestic supply, which will put pressure on prices," said Kunal Motishaw, an analyst at Reliance Securities. “Domestic steel companies such as Tata Steel, JSW Steel and Jindal Steel & Power are likely to be hit the hardest, with exports accounting for 15-28% of total sales.

India exported 13.5 million tonnes (MT) of finished steel in FY22, compared to 10.8 tonnes in FY21, while domestic steel consumption over the same period was 106 tonnes, compared to 94 tonnes in FY21 MT in FY22, while that of iron ore pellets was 11 MT.

On Saturday, the government decided to impose heavy export tariffs on key raw materials used in steelmaking, such as iron ore and pellets.

The iron ore export duty was increased from 30% for lump to 50% for all grades, while that for pellets was raised from previously zero to 45%, making export unprofitable. In addition, the government previously imposed a 15% export tax on hot and cold rolled steel products from the ground up.

On the import front, the government has reduced import taxes to 2.5% on some commodities such as PCI and coking coal, while cutting them from 5% to zero on metallurgical coal, coke and semi-coke.

“Domestic steel companies will have to bear the 15% export duties because export contracts are mostly fixed. As demand in the export market has weakened, this will add to the pressure," said Kamlesh Bagmar, Prabhudas' deputy research director. purple. "Lower import tariffs on inputs could boost margins, but the benefit won't be immediate as companies have 1-1.5 months of inventory."

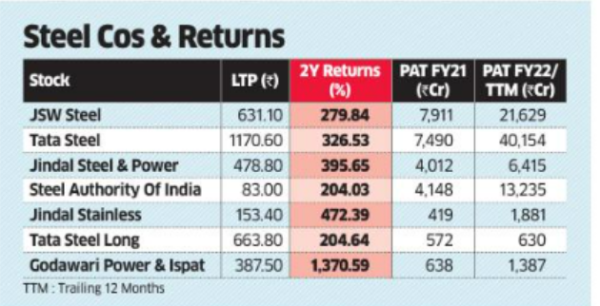

Shares in Tata Steel, JSW Steel, SAIL and Jindal Stainless have at least tripled and quintupled over the past two years, compared to an 80% rise in the Nifty Index.

After the Russo-Ukrainian War, world and domestic steel prices rose sharply in the face of rising input prices, mainly coking coal. Domestic hot rolled coil (HRC) prices increased from Rs 39,200 per ton in March 2020 to Rs 76,000 per ton in April 2022.

In her 2021-22 budget, Finance Minister Nirmala Sitharaman cut tariffs on semi-finished, flat and long products made of non-alloy, alloy and stainless steel uniformly to 7.5% from the previous 10% to 12.5%.

Indian steel companies have benefited greatly from lower tariffs and a surge in demand. Tata Steel recorded a net profit of Rs.40,154 crore in FY22 compared to Rs.7,490 crore in FY21. From FY21 to Rs.21,629 crore in FY22.

According to VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services, lower tariffs on steel inputs and the resulting lower prices would benefit sectors such as construction, autos and utilities, for which steel is a fundamental input.

Also Read: The best smartphones under Rs 20,000 in India in May 2022

POPULAR POSTS

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

by Shan, 2025-12-05 11:49:44

Zoho Mail vs Gmail (2025): Which Email Platform Is Best for Businesses, Startups, and Students?

by Shan, 2025-10-09 12:17:26

PM Modi Launches GST Bachat Utsav: Lower Taxes, More Savings for Every Indian Household

by Shan, 2025-09-24 12:20:59

$100K H-1B Visa Fee Explained: Trump’s New Rule, Clarifications & Impact on Indian Tech Workers

by Shan, 2025-09-22 10:11:03

India-US Trade Deal Soon? Chief US Negotiator Arrives in Delhi as Talks Set to Begin Tomorrow

by Shan, 2025-09-15 11:54:28

Modi Meets Xi: Trump’s Tariffs, Strategic Autonomy, and the Future of Asia’s Power Balance

by Shan, 2025-09-03 06:40:06

RECENTLY PUBLISHED

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Best Silver Investment Platforms for 2025: From CFDs to Digital Vaults Explained

- by Shan, 2025-10-23 12:22:46

Subscribe now

Subscribe now