How to invest in mutual funds? investment guide in 2022

Some of the types of mutual funds: Growth Plans or Equities: These funds invest in equities and the investment objective is to achieve capital gains over the

- by B2B Desk 2022-05-10 09:16:05

How do you invest in mutual funds?

5 easy steps to start investing in mutual funds online

- Understand your risk capacity and risk tolerance. This process of determining the level of risk you can take is called a risk profile.

- The next step is asset allocation. Once you have identified your risk profile, you should try to spread your money across different asset classes. Ideally, your asset allocation should include a mix of equity and debt instruments to balance risk.

- Third Next, you need to identify the funds that invest in each asset class. You can compare mutual funds based on investment objective and past performance.

- Decide which mutual funds you want to invest in and apply online or offline.

- Diversifying your investments and monitoring are important to ensure you get the most out of your investment.

Types of Mutual Funds

The types of mutual funds are generally classified based on the investment objective, structure and type of systems. When classified by investment objective, there are 7 types of mutual funds: equity or growth funds, pension or debt funds, tax savings funds, liquidity or money market funds, mixed funds, gold and exchange traded funds (ETFs).

According to the structure, there are two types of mutual funds: closed and open plans. When mutual funds are classified by their type, they can be divided into three types: capital, debt, and offset. There is an overlap in the classification of some systems, such as B. Capital growth funds, which may fall into a classification based on investment objective as well as a classification based on type.

Some of the types of mutual funds:

- Growth Plans or Equities: These funds invest in equities and the investment objective is to achieve capital gains over the medium and long term. They come with high risks as they are tied to very volatile stock markets but offer good returns over the long term. Therefore, investors with high risk tolerance consider these plans as an ideal investment opportunity. Growth funds can be further classified into diversified funds, sector funds, and index funds.

- Debt funds: Also known as fixed income funds, they invest in fixed income or debt securities such as debt, corporate bonds, commercial paper, government securities and various money market instruments. For those looking for a regular, stable, and risk-free income, loan funds can be an ideal option. Gold funds, cash, short-term plans, income funds, and MIPs are the subcategories of debt funds.

- Balanced Funds: These funds invest in a mix of debt and equity stocks. Investors can expect regular income and growth at the same time from these funds. They offer a good investment opportunity for investors willing to take moderate risks in the medium and long term.

- Tax Savings Fund – Those who want to grow their capital while saving on taxes can opt for tax savings plans. Investors may qualify for tax relief under Section 80C of the Income Taxes Act 1961 through tax savings funds, also known as equity-linked savings plans.

- Exchange Traded Funds (ETFs): An ETF is listed on an exchange and holds a basket of assets such as bonds, gold bars, oil futures, foreign currencies, etc. It offers the flexibility to buy and sell shares on the exchanges throughout the day.

- Open Plans – With an open plan, units are bought and sold on an ongoing basis, allowing investors to come and go as they please. Funds are bought and sold at net asset value (NAV).

- Closed Plans – In this type of plan, the unit capital is fixed and only a set number of shares can be sold. Once the new fund offering (NFO) has been approved, the investor cannot buy shares in a closed system, i.e., they cannot leave the system before the end of the term.

Costs associated with investing in mutual funds

The value of the fund is calculated from the net asset value (NAV), which is the value of the fund's portfolio less charges. This is calculated by the AMC after each working day.

The AMCs charge you an administrative fee which covers your salaries, brokerage fees, advertising and other administrative costs. This is usually measured using an expense ratio. The lower the expense ratio, the lower the cost of investing in that mutual fund.

AMCs may also charge a fee, which is basically a selling fee that the business incurs in the form of a selling fee. If you are unfamiliar with the fees involved, you could find yourself in a position where your returns on investment are significantly reduced due to overhead. Therefore, it's a good habit to read the fine print for details on expenses and fees associated with a mutual fund.

How to invest in mutual funds in detail

Before deciding to invest in a mutual fund, it is important to consider the following points. This will help you choose the right type of fund to invest in and build wealth over time.

- Identify your investment objective – This is the first step to investing in a mutual fund. You need to define your investment goals, which can be: buy a house, raise children, get married, retire, etc. If you don't have a specific goal, you should at least be clear about how much wealth you want to accumulate. for how long. Identifying an investment objective helps the investor evaluate investment options based on risk level, payment method, lock-in period, etc.

- Meet Know Your Client (KYC) Requirements – In order to invest in a mutual fund, investors must comply with KYC guidelines. To do this, the investor must present copies of the Permanent Account Number (PAN) card, proof of residency, proof of age, etc. according to the requirements of the fund house.

- Learn about available programs - The mutual fund market is full of options. There are systems for almost every investor need. Before investing, make sure you have done your homework by researching the market to understand the different types of systems available. Once you've done that, align it with your investment goal, risk tolerance, and affordability and see what works best for you. Seek the help of a financial adviser if you are unsure which system to invest in. Ultimately, it's your money. You should ensure that it is used for maximum performance.

- Consider risk factors: Remember that investing in mutual funds involves a number of risks. Programs that offer high returns often come with high risk. If you have a high-risk appetite and want high returns, you can invest in equity programs. On the other hand, if you don't want to risk your investment and are fine with moderate returns, you can opt for leveraged plans.

After identifying your investment goals, meeting KYC requirements, and exploring the different systems, you can start investing in mutual funds. A bank account is also essential if you are investing in a mutual fund. Most mutual fund companies require a physical or online copy of an IFSC (Indian Financial System Code) and MICR (Magnetic Ink Character Recognition) void check voucher from the bank.

Ways to invest in mutual funds

There are different ways to invest in mutual funds. They are:

- Invest offline directly with the fund house: You can invest in mutual funds by visiting the nearest branch of the fund house. Just make sure you have a copy of the following documents with you:

- Proof of address

- Proof of Identity

- Cancelled cheque

- A passport size photo

- Invest offline through a broker: A mutual fund broker or dealer is someone who will help you with the investment process. He will provide you with all the information you need for your investment, including the characteristics of the different plans, the documents required, etc. He will also advise you on which plans you should invest in. You will be charged a commission for this, which will be deducted from the total amount of the investment.

- Online via the official website: Most fund houses now offer the opportunity to invest in mutual funds online. All you have to do is follow the instructions on the fund house's official website, fill in the relevant information and submit. The KYC process can also be completed online (e-KYC), which requires you to enter your Aadhar number and PAN. The information is verified in the backend and after verification you can start investing. The online mutual fund investment process is simple, fast and hassle-free, which is why it is preferred by most investors.

- Via an app: Many fund management companies allow investors to make investments via a downloadable app on their mobile device. The app allows investors to invest in mutual funds, buy or sell shares, view bank statements, and check other details about their portfolio. Some of the mutual fund companies that allow investing through the app are SBI Mutual Fund, Axis Mutual Fund, ICICI Prudential Mutual Fund, Aditya Birla SunLife Mutual Funds and HDFC Mutual Funds. Some applications like myCAMS and Karvy allow investors to invest on a single platform and access details of all their investments from multiple fund companies.

Why should you invest in mutual funds?

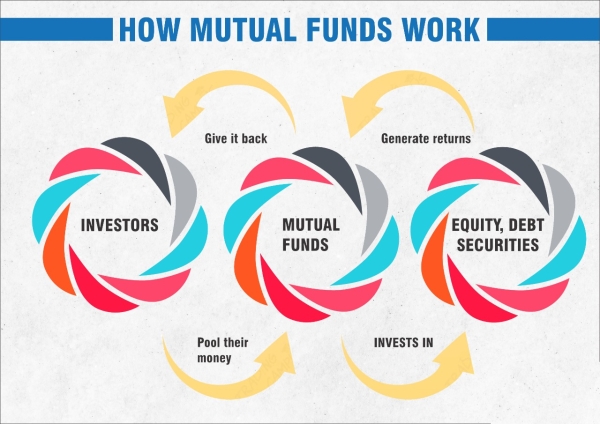

As mentioned above, mutual funds are professionally managed investment vehicles that grow your money over the long term. Mutual funds can invest in a variety of instruments like stocks, debt, money market, etc. and generate favorable returns on your investment. There are more reasons why you should invest in mutual funds and we've picked the best ones for you below:

- Professional Management: Mutual funds are managed by professional fund managers who research and follow the markets, identify rights, buy and sell them at the right time to get a favourable return on your investment. Fund managers also analyse the performance of companies before deciding to invest in their stocks. Also, when you buy shares of a mutual fund, the System Information Document (SID) contains the professional summary of the fund manager, including the number of years of professional experience, the type of funds managed and the performance of the funds managed. for him/her So you can rest assured that your money is in good hands.

- Higher Returns: Compared to term deposits such as term deposits (FD), recurring deposits (RD), etc., mutual funds offer better returns on your investments by investing in a variety of implements. Equity funds offer investors a great opportunity to earn higher returns, but at the same time carry high levels of risk, making them ideal for investors with a high appetite for risk. Mutual funds, on the other hand, offer lower risk and better returns than term deposits.

- Diversification: Perhaps one of the greatest benefits that mutual funds offer is diversification. By investing in a wide range of asset classes and stocks, mutual funds reduce risk by diversifying the portfolio. Even if one asset/stock is not performing well, the performance of other assets can compensate and you can still enjoy favourable returns on your investment. To further reduce risk, you can diversify your portfolio by investing in different types of mutual funds. Seek the help of a financial adviser if you are unsure of which funds to invest in and how to diversify or balance your portfolio.

- Convenience: Investing in mutual funds has become quick, simple and easy, with many fund companies offering online investing services. With just a click of a few buttons, you can start investing in a mutual fund of your choice. Even the KYC process can now be done online and investors can invest up to Rs 50,000 using the e-KYC feature. However, for investments above Rs 50,000, investors must complete the physical KYC process.

- Low cost: You can invest in a mutual fund from as low as Rs 5,000 (lump sum) and Rs 500 for a monthly SIP (systematic investment plan). Therefore, you do not have to wait until you have accumulated a large sum to start investing. Plus, when you invest in a direct mutual fund plan, you don't have to pay any additional commissions to brokers.

- Disciplined Investing: To cultivate the habit of investing regularly, mutual funds offer a facility known as Systematic Investment Plan (SIP). An SIP allows investors to invest small amounts on a regular basis, with a frequency that may be weekly, monthly or quarterly. A direct debit option can be set up for your SIP, where a fixed amount is automatically deducted from your bank account each month. A SIP offers a great way to invest regularly without having to invest manually each time.

Also Read: The LIC IPO received a strong response from all demographics; shares will be allotted to bidders on May 12th

POPULAR POSTS

Best Silver Investment Platforms for 2025: From CFDs to Digital Vaults Explained

by Shan, 2025-10-23 12:22:46

Best Investment Plans in India for 2025: A Complete Guide to Grow and Protect Your Wealth

by Shan, 2025-09-18 10:20:46

Which venture capital firms are the most active in funding Indian startups in 2025

by Shan, 2025-08-06 10:42:11

Top 5 Apps to Buy Digital Gold in India (2025): Safe, Simple & Secure

by Shan, 2025-08-01 10:24:51

10 Highest Dividend Yield Stocks in August 2025

by Shan, 2025-07-28 09:31:02

Exchange-Traded Fund (ETF): A Practical Guide to Smart Investing

by Anmol Chitransh, 2025-04-17 10:18:20

The Ultimate Guide to Commodity Trading: Strategies, Risks, and Opportunities

by Anmol Chitransh, 2025-04-02 07:06:01

RECENTLY PUBLISHED

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

- by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

- by Shan, 2025-12-05 11:49:44

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Subscribe now

Subscribe now