RBI raises repo rate by 40 basis points to 4.40% and CRR by 50 basis points, citing inflation concerns

Today's decision should be seen as part of the central bank's announcement last month of its phasing out of the easy money scheme, Das said. "Today's decision t

- by B2B Desk 2022-05-04 09:51:01

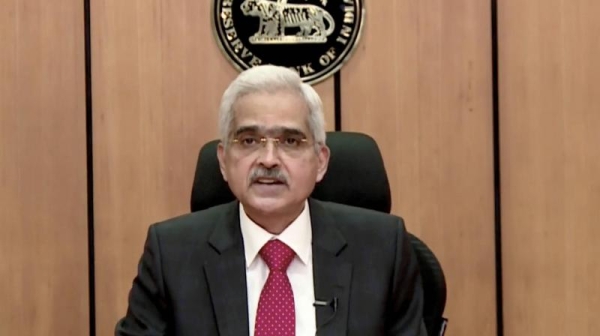

Reserve Bank of India (RBI) Governor Shaktikanta Das announced a 40 basis point hike in the policy rate and raised the cash reserve ratio by 50 basis points in an unscheduled announcement on May 4.

A basis point is one-hundredth of a percentage point. The revised repo rate is now 4.40% and the CRR is 4.5%.

Today's decision should be seen as part of the central bank's announcement last month of its phasing out of the easy money scheme, Das said. "Today's decision to increase the repo rate can be viewed as a reversal of the May 2020 rate action. Last month, we established a position on withdrawing the adjustments. Today's action should be viewed as consistent with this action.

The surprise move comes ahead of an expected rate hike by the US Federal Reserve and amid retail price inflation that remains consistently above the central bank's comfort zone.

It is the first unannounced statement by the RBI governor since the start of the pandemic in 2020. The announcement caught markets by surprise, propelling bond yields higher and putting pressure on stock indices.

Repo is the interest rate at which the central bank lends short-term funds to banks. The RBI has cut the repo rate by 250 basis points since February 2019 in a bid to revive growth momentum. The Monetary Policy Committee maintained a long-term dovish stance to support growth.

In this sense, today's announcement confirms the strong reversal of the interest rate cycle.

"I would like to emphasize that the monetary policy measures are aimed at containing the rise in inflation and re-anchoring inflation expectations," Das said. "It is well known that high inflation is detrimental to growth."

However, the governor added that monetary policy would remain accommodative and measures would remain calibrated.

Also Read: PM Modi invites Danish companies, pension funds to invest in India's infrastructure sector

POPULAR POSTS

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

by Shan, 2025-12-05 11:49:44

Zoho Mail vs Gmail (2025): Which Email Platform Is Best for Businesses, Startups, and Students?

by Shan, 2025-10-09 12:17:26

PM Modi Launches GST Bachat Utsav: Lower Taxes, More Savings for Every Indian Household

by Shan, 2025-09-24 12:20:59

$100K H-1B Visa Fee Explained: Trump’s New Rule, Clarifications & Impact on Indian Tech Workers

by Shan, 2025-09-22 10:11:03

India-US Trade Deal Soon? Chief US Negotiator Arrives in Delhi as Talks Set to Begin Tomorrow

by Shan, 2025-09-15 11:54:28

Modi Meets Xi: Trump’s Tariffs, Strategic Autonomy, and the Future of Asia’s Power Balance

by Shan, 2025-09-03 06:40:06

RECENTLY PUBLISHED

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Best Silver Investment Platforms for 2025: From CFDs to Digital Vaults Explained

- by Shan, 2025-10-23 12:22:46

Subscribe now

Subscribe now