Mindtree Q4 Results: Net profit increases by 49% year-on-year to Rs 473 crore; Rs 27 per share dividend declared

In terms of employees, as before 31 March 2022, Mindtree had 35,071 professionals and twelve-month revenue of 23.8%. "Our industry's talent for a year of rapid

- by B2B Desk 2022-04-19 09:02:42

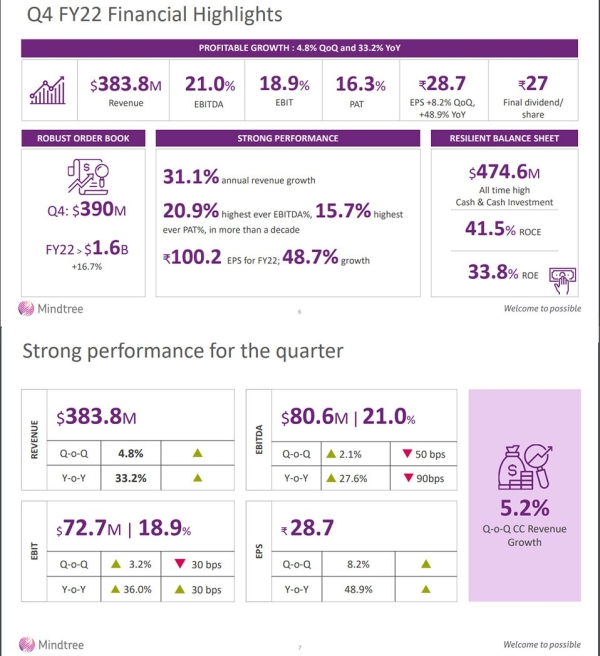

Information firm Mindtree announced on Monday that consolidated net profit for the quarter ended March 31, 2022 rose 49% year-on-year to Rs.473.1 billion, driven by extensive demand and mining activity. The company reported net profit of Rs 317 crore in the same quarter last year.

Bangalore-based company reported 37% increase in sales for the quarter to Rs.2,897 billion from Rs.2,109 billion in the same period last year. On a US dollar basis, net income increased approximately 45% year over year to $62.7 million, with revenue from the quarter increased by 32.2% year over year to 383.8 million. The company also announced that its Board of Directors had recommended Rs.27 a share to its final dividend of Rs.27 a share for the year ended 31 March 2022. The final dividend level of the company is subject to approval on March 23, the fourth year of the cycle. public meeting. The company said that it has 276 active customers as before March 31, 2022.

In terms of employees, as before 31 March 2022, Mindtree had 35,071 professionals and twelve-month revenue of 23.8%.

"Our industry's talent for a year of rapid business and technology change demonstrates the importance of our value proposition in business change and digital transformation on the scale," Depashis Chatterjee, CEO and MD of Mindtree said.

“Shield growth of 5.2% in steady currency was the fifth consecutive quarter of growth above 5% growth in steady currency. expanding mining services and customers, and expanding industrial companies.

Chatterjee also noted its 20.9% EBITDA margin and 15.7% VAT margin, the highest in that decade. "Our mission of creating a value share has been demonstrated by a profit share of Rs 100.2, the highest ever-adjusted bonus ratio, and annual revenues of Rs 37 per share, the highest in our history. Our range of passion and confidence in our clients will help our industry foundation drive profitable growth in the coming years.

Mindtree shares rose 3.44% on BSE on Monday to Rs.3,956.15 per share, mainly from software wallet giant Larsen & Toubro (L&T), L&T Infotech and Mindtree, which was on 11th March, according to Bloomberg merger data termination trading. We watch the report throughout the week.

However, the two IT service companies did not comment on developments. L&T acquired a 61% stake in Mindtree for over Rs 10,000 in 2019. L&T also has 74% stake in L&T. The combined market capital of the two technology companies is around Rs 1.66 billion.

A Bloomberg report, citing sources, said the proposed deal could be a share in the PAS deal, while it said the merger could be partly cancelled or postponed, citing one of its sources.

Also Read: CoinDCX becomes most valuable Indian crypto company

POPULAR POSTS

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

by Shan, 2025-12-05 11:49:44

Zoho Mail vs Gmail (2025): Which Email Platform Is Best for Businesses, Startups, and Students?

by Shan, 2025-10-09 12:17:26

PM Modi Launches GST Bachat Utsav: Lower Taxes, More Savings for Every Indian Household

by Shan, 2025-09-24 12:20:59

$100K H-1B Visa Fee Explained: Trump’s New Rule, Clarifications & Impact on Indian Tech Workers

by Shan, 2025-09-22 10:11:03

India-US Trade Deal Soon? Chief US Negotiator Arrives in Delhi as Talks Set to Begin Tomorrow

by Shan, 2025-09-15 11:54:28

Modi Meets Xi: Trump’s Tariffs, Strategic Autonomy, and the Future of Asia’s Power Balance

by Shan, 2025-09-03 06:40:06

RECENTLY PUBLISHED

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Best Silver Investment Platforms for 2025: From CFDs to Digital Vaults Explained

- by Shan, 2025-10-23 12:22:46

Subscribe now

Subscribe now