Your Guide to Choosing Small Business Insurance-Business2Business

What is business insurance and why do you need it? When accidents happen, you want to be protected. Business insurance protects your business from financial lo

- by B2B Desk 2020-12-30 06:18:34

When making financial decisions for your small business or start-up, it can be tempting to cut costs by only subscribing to business insurance that you are legally required to have. However, a single uninsured accident can cost more than your monthly premium; it can cost you your business. With so many types of commercial insurance available, it can be difficult to know which types you need. Small business owners must analyze their needs to make strategic decisions about the plans that are right for them.

What is business insurance and why do you need it?

When accidents happen, you want to be protected. Business insurance protects your business from financial loss in times of crisis or unexpected events. There is no one size fits all business insurance; Instead, there are several types of insurance that can protect your business, and the exact combination of policies you need depends on your unique circumstances.

"[Business insurance] helps with legal payments, claims, employee issues, and business property in case something goes wrong with your business activities," Phil Crippen can help cover the cost of compensation claims and legal fees as well. such as damage to your property or employee-related problems.

The benefits of insurance are often associated with financial and legal protection. Insurance can protect you from a variety of losses - for example, if an employee is injured, your office building catches fire, a customer tries to sue you, or your business partner dies. The right business insurance can help you get back on your feet and keep your business running.

"As an employer, you determine the appropriate insurance," said Seth Morton, MBA, licensed insurance agent and owner of Morton Insurance. "The insurance itself is simply an agreement by an insurance company to pay the insured for business losses. To determine what should be insured, the business owner must analyze its risks. Once the scope is defined, the owner can evaluate the cost of insurance against risk of loss ".

What does business insurance cover?

Business insurance can cover a variety of things, depending on the type. They range from basic to complete, so you will need to choose the coverage that adequately protects property, people, and business operations.

Morton listed 10 common aspects of a business that insurance can cover and protect:

- The life of business principals

- The lives of key employees

- The life of a group of employees

- Short and long term obstruction of owners and employees

- Liability for injuries to owners and employees

- Coverage of property and accidents of buildings and machinery.

- Liability and damage to commercial transportation assets

- Product liability

- Health insurance for employees for illness and injury.

- Workers' compensation for loss of income due to injuries

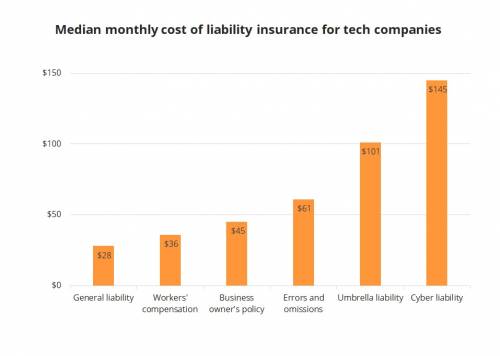

How much does business insurance cost?

The type of business insurance you buy determines your monthly costs. According to Progressive, the average cost of employment insurance is $ 53 per month for general liability and $ 85 for workers' compensation. Some business owners purchase a business owner's policy, which combines liability and property coverage in a single policy. The average cost of an employer policy is $ 80 per month.

Another factor that affects how much you pay each month is your type of business. For example, builders pay more for commercial insurance than accountants. The reason for the increase is related to work-related risks: There is a higher inherent risk of injury and potential damage if you run a construction business than if you run a small accounting business.

The workload, or the number of employees in your company, is also a cost consideration. Each employee represents a potential risk to your business, increasing your monthly premium.

Finally, the coverage amounts affect the cost. The higher the coverage, the more you pay. One way to offset the cost if you choose higher coverage is to get a higher deduction (which is the amount you pay out of pocket before the insurance company pays for a covered loss). Assuming there is a higher risk can lower your monthly payments. Many insurance companies offer you a discount option. The amounts can range from a few hundred dollars ($ 250) to thousands of dollars ($ 2,500).

In the case of a claim, business insurance is usually paid directly to the business. For example, if your business was damaged during a fire, you can file a claim. The officer assesses the damage and decides the cost to repair or replace the damaged property or items. Once you pay your policy deduction, the insurance company cuts a check on the company based on the policy criteria.

Types of business insurance

There are many types of commercial insurance available, and you will likely need a combination of several policies to protect your business. It is highly recommended that you speak with an insurance expert to define the specific policies required for your business. However, these are some of the basic types of insurance that most small businesses will need.

-

Business owner policy: A BOP is typically a combination of public liability coverage (for example, bodily injury, property damage, personal or advertising injury, medical payments, completed product operations, and damage to rental buildings) and insurance. On the property. You can also add a work practices liability insurance (EPLI) policy to your BOP to cover your employees.

- Business interruption insurance: Also known as business income insurance, it is one of the most common types of business insurance. Helps you recoup lost income and pay operating expenses (such as mortgages, rent, payroll, loan payments, and taxes) if your business is forced to close due to disasters such as fire, flood, theft, or building collapse. It can sometimes be combined with a BOP blowout preventer.

- Administrative Liability Insurance: Another comprehensive insurance package you may need is administrative liability insurance. This often combines insurance coverage such as liability for labor practices (basic protection for companies with employees), fiduciary liability, and directors and officers (D&O) liability (basic protection for companies with a board of directors).

- Workers' Compensation Insurance: If an employee is injured on the job, worker companies can cover their medical costs or lost wages. Often the law requires worker companies and disability insurance.

- Errors and omissions (E&O) insurance: If you provide professional services, you will need to obtain E&O insurance, also known as professional liability insurance. This type of coverage protects you in the event that a client or client claims that your services have caused them financial hardship. This is especially important for financial advisers and advisers.

- Product Liability Insurance: Small businesses often need product liability insurance to protect themselves from product liability claims. If your product causes damage or injury to a third party, or if your business faces a lawsuit related to the product, product liability insurance can help cover your protection and safety.

- Auto Insurance: If you or your employees use the vehicles for business purposes, you will need some type of auto insurance. Whether you need personal or business auto insurance depends on the type of vehicle you use, the purpose for which you use it, and the amount of coverage you need.

- Cyber insurance: Every small business owner should protect their data and technologies with electronic insurance. In the event that your company's technology has been compromised or data has been leaked, electronic insurance (data breach insurance or cyber liability insurance) can help cover the costs of damages.

These are just a few of the common types of insurance that small business owners should consider. You should seek professional help to find the coverage that best protects your specific business.

How to determine the types of insurance your business needs

The best insurance for your business depends on your unique needs. To determine what types of insurance you need, you will need to conduct a careful analysis of your business. It is always advisable to speak with an insurance expert to find the right combination of coverage to keep your business in legal compliance and financial protection.

Follow these four steps to determine what type of insurance your business needs.

-

Analyze your legal responsibilities and business assets.

First, you must carefully evaluate your business and assets to determine what you want to insure. What insurance are legally required and where do your additional responsibilities lie?

For example, Morton said that a machine shop may want employees to be insured for injuries, while a jeweler may want protection against theft. The owners of the large distribution company will insure the inventory, as well as the employees, as required by law.

"Every state has different requirements, and business owners should consult with the professionals in the state in which they work to determine what to insure," Morton said.

-

Analyze your risks.

Review your additional risks and responsibilities. This will help you decide which insurance will provide the right kind of protection. For example, if your business is located in the basement of an office building in an area prone to flooding, you likely want comprehensive flood insurance, while a business operating in a hazardous industry will likely want insurance that covers the risks of your employees getting hurt.

"Overall, a careful analysis of business processes, including human resources and facilities, helps determine where the risks are and what needs to be insured," Morton said. "Aside from what might be called insurance to operate a business, there is the question of succession planning. What is the plan if the owner dies or becomes disabled, and how is it financed? It is an area that business owners often overlooked and require professional help to set it up correctly. "

-

Determine how comprehensive the insurance you want is.

Depending on what you are insuring, you may need a basic level of insurance or comprehensive insurance that covers all aspects of a potential loss. You will have to consider how expensive the loss will be and assess the likelihood of it occurring. This will reduce the risk of overpaying for coverage you don't need or reduce the coverage that is necessary to protect you.

-

Choose a provider

Insurance providers are not all the same. Policies, premiums, and coverage vary, so do a little research to find the best one to protect your business. Pick a few of the top providers and compare them for policy coverage, cost, reliability, customer service, and how they handle claims. This will help you find the best insurance provider for your business.

To determine what business insurance you need, you will need to analyze your operations, assets, risks, and liabilities. Next, decide how comprehensive you want your policies to be and compare service providers.

Also Read: Top 10 trading ideas by experts for January 2021 series

POPULAR POSTS

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

by Shan, 2025-10-30 10:06:42

GST Council Scraps Tax on Life & Health Insurance Premiums: What It Means for Consumers and Insurers

by Shan, 2025-09-04 08:37:28

Types of Insurance Policies in India: Choose the Best for Your Needs

by Anmol Chitransh, 2025-02-19 07:17:26

Types of Pet Insurance: All You Need to Know Before Buying It

by B2B Desk, 2025-02-10 10:47:01

60% of Health Insurance Claimants Face Discharge Delays, Push for Web Processing Solutions

by B2B Desk, 2025-01-03 08:54:35

What is Cashless Health Insurance and How Does It Work?

by B2B Desk, 2024-08-28 06:09:32

Top Cyber Insurance Companies in India: Protecting Your Digital Assets

by B2B Desk, 2024-08-23 12:23:41

RECENTLY PUBLISHED

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

- by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

- by Shan, 2025-12-05 11:49:44

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Best Silver Investment Platforms for 2025: From CFDs to Digital Vaults Explained

- by Shan, 2025-10-23 12:22:46

Subscribe now

Subscribe now