What is IPO - Initial Public Offerings? Pros and cons of investing in IPO?

How an initial public offering (IPO) works In an IPO, a company decides to raise capital by issuing shares of its stock to the public. This is how the proces

- by B2B Desk 2024-02-29 09:32:07

An initial public offering (IPO) is a significant milestone in a company's journey from being privately owned to becoming a publicly traded entity. It is an exciting opportunity for investors to participate in the company's growth story from its early stages. In this comprehensive guide, we will explore what is IPO, how it works, the step-by-step IPO process, and everything you need to know about investing in IPOs in India.

What is an IPO?

An IPO, or initial public offering, is the process through which a privately held company makes its shares available to the general public for the first time. It transitions from a privately owned entity into a publicly traded company, allowing individuals and institutional investors to purchase its shares.

Types of IPO

There are two common types of IPO:

Fixed price offering:

In a fixed-price IPO, a company sets a specific price for its shares during the initial sale. Investors are aware of the stock price when the company goes public. Once the IPO closes, demand for shares becomes evident. Investors participating in this type of IPO must pay the full share price at the time of application.

Book building offering:

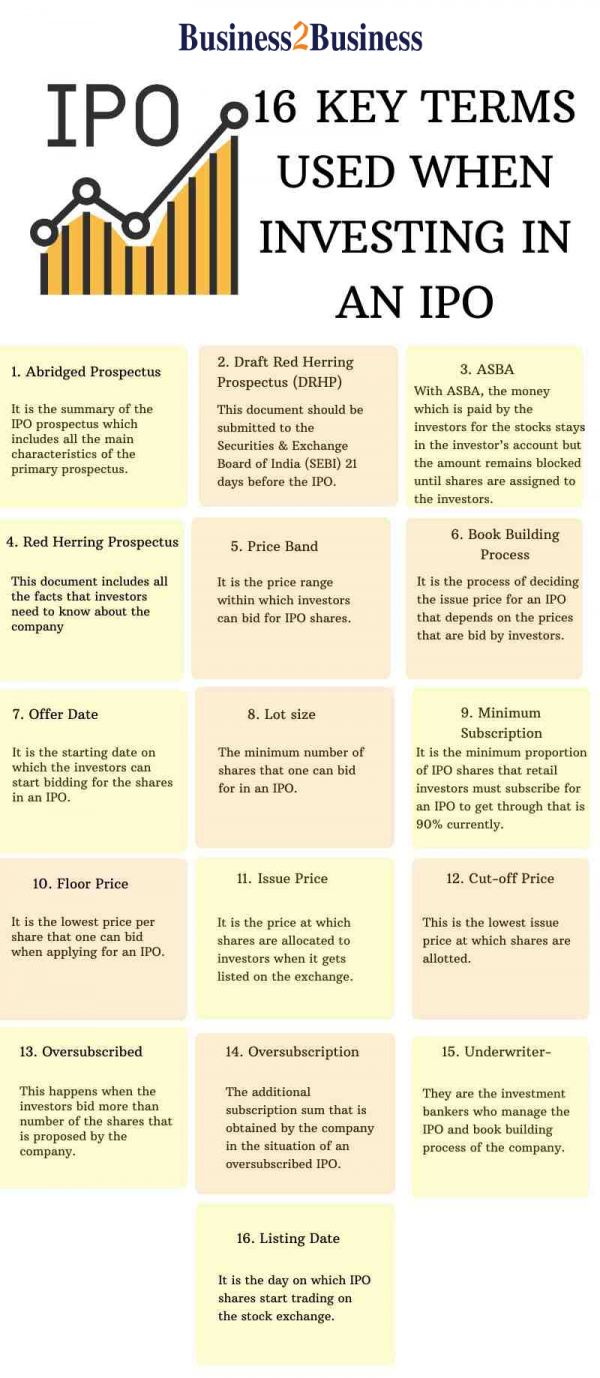

Book Building involves a company offering a price range (typically 20%) for its shares to potential investors. Interested investors bid on shares, specifying how many shares they want and the price they are willing to pay for each share. The price range includes the minimum price (lowest) and maximum price (highest). The final price of the shares is determined based on the offers submitted by investors.

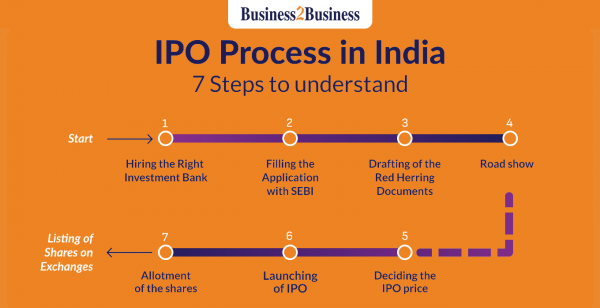

How an initial public offering (IPO) works

In an IPO, a company decides to raise capital by issuing shares of its stock to the public. This is how the process typically works:

-

Preparation phase:

Extensive due diligence, including financial audits and legal compliance checks, is conducted.

-

DRHP Display:

The company files a Draft Red Herring Prospectus (DRHP) with the Securities and Exchange Board of India.

-

Select the stock exchange:

The next step would be to decide the exchange where the company would list its shares, followed by applying for the selected exchange.

-

Roadshow:

The company, along with underwriters, conducts a roadshow to promote the IPO to potential investors.

-

Pricing:

Based on investor demand and market conditions, the offering price is determined.

The final prospectus, known as the Red Herring Prospectus (RHP), is issued with the offer price range.

-

Allocation:

Shares are allocated to various investor categories, including qualified institutional buyers (QIBs), non-institutional investors and Retail Individual Investors.

Bidders can apply for shares within the specified price range.

-

Listing:

The company's shares are listed on stock exchanges such as NSE and BSE.

-

Trading commences:

On the day of the IPO, the shares become available for trading in the secondary market.

Investors can buy and sell stocks at market prices.

-

Lock-up period:

Promoters and some shareholders are often subject to lock-up periods during which they cannot sell their shares.

-

Post-IPO reports:

The company is required to provide regular financial and operational updates to the stock exchanges and investors.

-

Stabilisation period:

In some cases, underwriters may engage in stabilization activities to support the stock's price during the early trading period.

The IPO process in India involves rigorous regulatory compliance and thorough investor scrutiny to ensure transparency and fairness in the capital markets.

What is the IPO timeline?

1. Open/ close date:

These are the dates when the IPO bidding process is open. Potential investors can apply or bid for shares during this period.

2. Allotment date:

On the allotment date, the IPO Registrar announces the allotment status to the public. It reveals who has been allocated shares and in what quantity.

3. Refund date:

The redemption date is when the application amount, which is temporarily frozen, becomes eligible for a refund for those who have not received IPO allocations. Select the date on which the refund process begins.

4. Credit to Demat account date:

This date varies depending on the company but is when investors receive the credited IPO shares in their Demat accounts. This happens before the official trading date of the stock.

5. Listing date (IPO listing):

The listing date is when a company's shares are officially listed on stock exchanges, making them available for trading on the secondary market. It is the point at which IPO shares become publicly tradeable.

Pros and cons of investing in IPO

Investing in an IPO offers early access to promising companies and the potential for high returns. However, it carries risks such as volatility, limited historical information, and susceptibility to market conditions.

Before investing in an IPO, it is important to understand the potential advantages and disadvantages that come with it.

Pros of investing in an IPO:

1. Early investment opportunity: IPOs provide an opportunity to invest in a company during the early stages of going public, with the potential to benefit from long-term growth.

2. Potential for high returns: Successful IPOs can provide a significant capital raise as the value of the company can increase after it goes public.

3. Access to promising companies: IPOs often include innovative or promising companies that were previously private, allowing investors to be part of their growth story.

4. Liquidity for founders and early investors: Existing shareholders, including founders and early investors, can monetize their investments by selling shares in the IPO.

5. Market Visibility: Going public can increase a company's visibility and credibility, which can positively impact its business relationships and growth prospects.

Cons of investing in an IPO:

1. High Risk: IPOs are inherently risky, as newly listed companies may lack a track record of profitability and face market uncertainty.

2. Volatility: IPO stock prices can be very volatile during the initial trading period, making it difficult to predict short-term price movements.

3. Limited historical information: Investors have limited access to historical financial data and performance metrics, making it difficult to conduct comprehensive due diligence.

4. The possibility that some IPOs may be overvalued, leading to price corrections after initial enthusiasm wanes.

5. Lock-up periods: Promoters and early investors are often subject to lock-up periods, during which they cannot sell their shares, which may affect the supply and demand dynamics of the shares.

6. Market Conditions: IPO success can be influenced by broader market conditions, and adverse market conditions may lead to the postponement or cancellation of the IPO.

Investing in an IPO requires careful consideration of these factors, as well as thorough research and risk assessment. While the potential for high returns can be attractive, it is important to balance the rewards and risks associated with it.

Why does a company offer an IPO?

Companies offer IPOs for several reasons:

- Capital Infusion: IPOs raise capital, which can be used for business expansion, debt reduction, or other corporate purposes.

- Liquidity for investors: Existing shareholders, including founders and early investors, can monetize their investments by selling shares in the IPO.

- Improve visibility: Going public can increase the company's visibility and credibility in the market.

How to invest in an IPO?

Investing in an IPO typically involves the following steps:

- Evaluate the IPO prospectus

Studying the prospectus, which contains essential information about the company’s operations, risks, and finances. It provides insights into the company's potential and helps you make an informed investment decision.

- Open a demat account

To participate in the Tata Technologies IPO, investors must have a Demat account. Bajaj Financial Securities Limited comes as a reliable option for investors looking to open a Demat account with rich features and complete security.

- Apply for the IPO

Once you have a Demat account and a trading account, you can apply for IPO through the broker's platform. You will need to provide the necessary details and specify the number of shares you wish to subscribe to.

Things to remember when investing in an IPO

When considering investing in an IPO, it is necessary to keep the following factors in mind:

Research the company:

Thoroughly study the company's background, financial health and prospects before investing in an IPO. Understanding the business and its growth potential is crucial.

IPO locking period:

Take note of the IPO lock-up period. This period restricts your ability to sell or trade IPO shares immediately after the initial investment. Please note the duration of this lock-in period.

Investment strategy:

Always have a well-defined investment strategy before participating in any IPO. Determine your financial goals, risk tolerance, and how the IPO fits into your overall portfolio. Planning your investment approach is essential to making informed decisions and managing your investment effectively.

Conclusion

Investing in an IPO can be an exciting opportunity to participate in a company's growth from its early stages. However, it comes with risks, and thorough research and consideration of various factors are essential. By understanding the IPO process, evaluating companies, and using reliable platforms like Bajaj Financial Securities Limited, you can make informed investment decisions in the dynamic world of IPOs.

Also Read: NTPC Green Energy and MAHAGENCO partner for development of Renewable Energy Parks in Maharashtra

POPULAR POSTS

Rupee Forecast 2025: Key Drivers Behind INR Weakness Against the US Dollar

by Shan, 2025-08-11 07:32:23

August 2025 IPO Preview: Big Listings from JSW Cement, NSDL, Knowledge Realty & SME Stars

by Shan, 2025-07-30 11:51:27

Ola Electric Q1 Results FY26: Revenue Falls 61%, Net Loss at ₹870 Cr - MoveOS 5 in FocusOla

by Shan, 2025-07-14 12:22:55

HAL, BEL & Data Patterns: 3 Defence Stocks Riding India's ₹50,000 Cr Export Ambition

by Shan, 2025-06-26 10:00:16

India GDP Forecast 2025-26 Raised to 6.5% by S&P: Key Drivers & Global Risks Explained

by Shan, 2025-06-26 10:30:46

Dalal Street Outlook: 5 Key Market Triggers to Watch This Week

by Shan, 2025-06-16 12:32:04

What is the Bond Market & How Does It Impact Your Investments?

by B2B Desk, 2025-02-05 09:42:55

RECENTLY PUBLISHED

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

- by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

- by Shan, 2025-12-05 11:49:44

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Subscribe now

Subscribe now