SEBI Introduces New Disclosure Formats for REITs and InvITs

Enhanced Governance Reporting Under the new format for compliance report on governance, SEBI has mandated that InvITs and REITs disclose crucial information on

- by B2B Desk 2023-06-27 07:53:53

The Securities and Exchange Board of India (SEBI) has recently announced the implementation of disclosure formats for compliance reports on governance and annual secretarial for emerging investment vehicles, specifically Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs).

Under the new format for compliance report on governance, SEBI has mandated that InvITs and REITs disclose crucial information on a quarterly basis. The disclosure requirements include:

Investment managers are now obligated to submit a quarterly compliance report to the stock exchanges within 21 days following the end of each quarter. The report must be signed by either the compliance officer or the chief executive officer of the investment manager.

SEBI has also introduced a new annual secretarial compliance report for InvITs and REITs. As part of this requirement, investment managers must appoint a practicing company secretary annually to assess compliance with applicable rules. The practicing company secretary is then responsible for submitting a report to the investment managers.

Key details included in the annual secretarial compliance report are:

To ensure accuracy, the investment manager is required to provide all necessary documents requested by the practicing company secretary for the preparation of the secretarial compliance report. The annual secretarial compliance report must be submitted in a new format to the stock exchanges within 60 days following the end of each financial year.

Both the governance compliance report and the annual secretarial compliance report will be included as integral parts of the annual reports of InvITs and REITs.

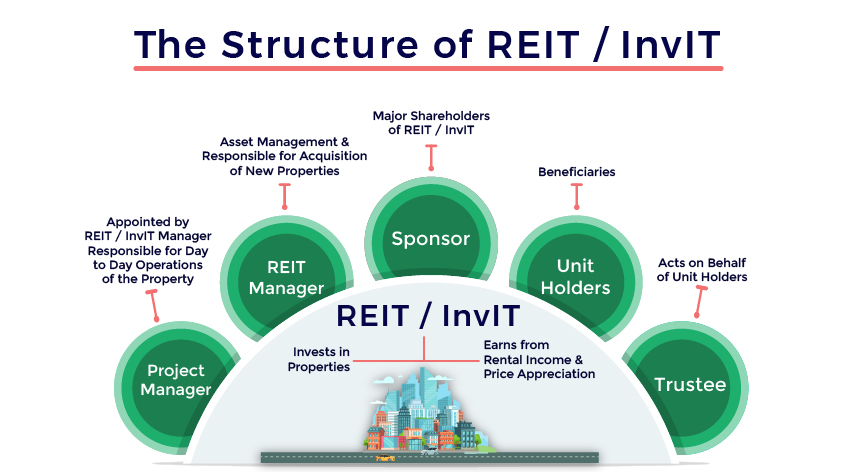

REITs and InvITs were introduced in India to provide investors with attractive investment options in the real estate and infrastructure sectors. These investment vehicles offer opportunities for diversification and allow investors to gain exposure to completed and rent-generating real estate assets. Additionally, privately placed InvITs can invest in both under-construction and revenue-generating assets, further expanding the range of investment possibilities.

Enhanced Governance Reporting

Under the new format for compliance report on governance, SEBI has mandated that InvITs and REITs disclose crucial information on a quarterly basis. The disclosure requirements include:

- Investment Managers: The names of the investment managers should be disclosed.

- Board Composition: The composition of the board of directors of the investment managers must be disclosed.

- Committee Composition: Details regarding the composition of committees need to be disclosed.

- Board and Committee Meetings: Information about meetings held by the board of directors and committees should be provided.

Investment managers are now obligated to submit a quarterly compliance report to the stock exchanges within 21 days following the end of each quarter. The report must be signed by either the compliance officer or the chief executive officer of the investment manager.

Annual Secretarial Compliance Report

SEBI has also introduced a new annual secretarial compliance report for InvITs and REITs. As part of this requirement, investment managers must appoint a practicing company secretary annually to assess compliance with applicable rules. The practicing company secretary is then responsible for submitting a report to the investment managers.

Key details included in the annual secretarial compliance report are:

- Regulatory Compliance: The report must outline the extent of compliance with regulatory norms.

- Deviations and Observations: Any deviations or observations made by the practicing company secretary should be disclosed.

- Actions Taken: Information about actions taken against the InvITs and REITs, as well as their promoters and directors, by SEBI or stock exchanges, must be disclosed.

- Previous Reports: The report should highlight the actions taken by the investment manager to address observations made in previous reports.

To ensure accuracy, the investment manager is required to provide all necessary documents requested by the practicing company secretary for the preparation of the secretarial compliance report. The annual secretarial compliance report must be submitted in a new format to the stock exchanges within 60 days following the end of each financial year.

Integration into Annual Reports

Both the governance compliance report and the annual secretarial compliance report will be included as integral parts of the annual reports of InvITs and REITs.

REITs and InvITs: A Lucrative Investment Opportunity

REITs and InvITs were introduced in India to provide investors with attractive investment options in the real estate and infrastructure sectors. These investment vehicles offer opportunities for diversification and allow investors to gain exposure to completed and rent-generating real estate assets. Additionally, privately placed InvITs can invest in both under-construction and revenue-generating assets, further expanding the range of investment possibilities.

These new disclosure formats by SEBI reinforces the importance of transparency and compliance within the REIT and InvIT sectors. By adhering to these requirements, investment managers can enhance their governance practices and provide valuable information to stakeholders, ultimately contributing to the growth and stability of the capital markets in India.

Also Read: NSE Indices launches India's first REITs and InvITs index with 6 Securities

POPULAR POSTS

Best Silver Investment Platforms for 2025: From CFDs to Digital Vaults Explained

by Shan, 2025-10-23 12:22:46

Best Investment Plans in India for 2025: A Complete Guide to Grow and Protect Your Wealth

by Shan, 2025-09-18 10:20:46

Which venture capital firms are the most active in funding Indian startups in 2025

by Shan, 2025-08-06 10:42:11

Top 5 Apps to Buy Digital Gold in India (2025): Safe, Simple & Secure

by Shan, 2025-08-01 10:24:51

10 Highest Dividend Yield Stocks in August 2025

by Shan, 2025-07-28 09:31:02

Exchange-Traded Fund (ETF): A Practical Guide to Smart Investing

by Anmol Chitransh, 2025-04-17 10:18:20

The Ultimate Guide to Commodity Trading: Strategies, Risks, and Opportunities

by Anmol Chitransh, 2025-04-02 07:06:01

RECENTLY PUBLISHED

How a Free AI Visibility Tool Helps Businesses Grow in the AI Driven Search Era

- by Aakash Ladha , 2026-03-06 10:40:04

Loan EMIs to Drop as RBI Slashes Repo Rate - Full MPC December 2025 Highlights

- by Shan, 2025-12-05 11:49:44

The Agentic Revolution: Why Salesforce Is Betting Its Future on AI Agents

- by Shan, 2025-11-05 10:29:23

Pine Labs IPO 2025: Listing Date, Grey Market Premium, and Expert Outlook

- by Shan, 2025-11-05 09:57:07

Top 10 Insurance Companies in India 2026: Life, Health, and General Insurance Leaders Explained

- by Shan, 2025-10-30 10:06:42

OpenAI Offers ChatGPT Go Free in India: What’s Behind This Big AI Giveaway?

- by Shan, 2025-10-28 12:19:11

Subscribe now

Subscribe now