All you need to know about the GST system | GST rates

The three types of GST are listed as follows: 1. CGST (Central GST): The CGST is collected by the Central Government when an intra-state transaction

- by aditi verma 2020-01-28 09:07:21

GST (Stands for the Goods and Services Tax) is the biggest tax-related reform that took place in the country since Independence. This reform is the reason behind the uniformity in the taxation structure of India. It aims to remove the cascading of taxes levied in the previous times.

The GST Council meets periodically for the purpose of revising the GST rates for various products. The council has a total of 33 members, including the State Finance Ministers. The Union Finance Minister is the head of the Council.

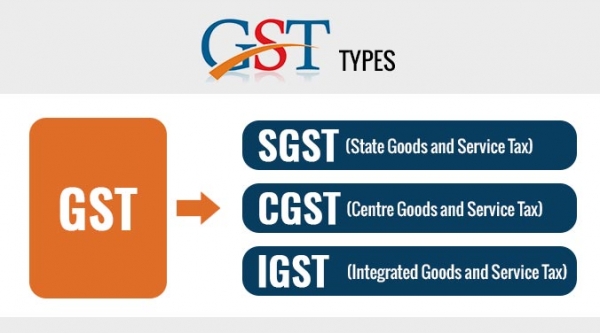

The three types of GST are listed as follows:

1. CGST (Central GST):

The CGST is collected by the Central Government when an intra-state transaction occurs. The CGST is levied in addition to the SGST.

2. SGST (State GST):

The SGST is collected by the States and Union territories when an intra-state transaction occurs.

3. IGST (Integrated GST):

The IGST is collected by the Central government in case the location of the supplier of the goods or services is in a different state than the place for consumption. The Integrated GST collected will be divided between the Centre and the State.

The latest GST rate revision was done in the 28th GST Council meeting held on 21st July 2018. The council revised the GST rates for 45 goods and 2 services during the meeting.

The government wanted to ensure that the GST rates are close to the original rates. But, in the case of a few commodities, differences in the rates were found due to the economic changes as well as customer preferences. Some items had been added in the high tax bracket of 18 to 28 percent but later it was realized that those commodities should be necessities and not luxuries. Hence, the GST rates were revised for some items like notebooks, etc.

The GST system has been implemented as a replacement for the former indirect tax system. GST rates comprise of the existing indirect taxes which included the Service Tax, Purchase Tax, Central Excise Duty, Value Added Tax, Entry Tax, Luxury Tax, Local Body Taxes, etc.

The edible items such as sugar, tea, and coffee are included in the 5 percent tax slab. Under the new GST regime, Milk is not taxed. It is being ensured that the basic food items are available to everyone. Sweets are also included in the 5 percent tax slab. The Tax rates on coal are also reduced from 11.69 percent to 5 percent so as to relieve the pressure on the power industry.

Currently, these are a total of seven categories of GST rates. These are exempt, 0.25%, 3%, 5%, 12%, 18% and 28%. The GST exempt goods and services are those goods and services that may have a higher GST rate on it but are exempted from GST temporarily. On the other hand, Nil GST refers to no GST or zero GST.

The GST Council has proposed a four-tier tax structure. As far as the essential food items are concerned, the GST rates have been decided as either nil or very low. This is done because the food items constitute 50 percent of the consumer needs and it helps to ensure that the inflation is kept under check. On the other hand, the negative items and luxury goods of business are expected to be taxed at a higher rate with the aim to maintain the revenue neutrality for both the state and central governments after the implementation of the new GST rates. Other precious metals might have an extra concessional GST tax slab because these metals are taxed at only 1 percent under the VAT currently.

GST Council had implemented the rate cuts on about 191 commodities leaving only 35 commodities in the highest tax bracket of 28 percent. This was implemented by July 2018. Some of these commodities include:

AC, Dishwashing machines, Digital cameras, Cement, Video recorders, Parts of automobiles, Motor vehicles, Tyres, Yachts, Aircraft, Aerated drinks. Other items include tobacco, cigarette, and pan masala.

The Government of India will introduce new tactics to bring in more products under the GST rate system. According to the Finance Minister, Arun Jaitley, some new products could be included under the GST alongside the reduction of GST rates on some of the other products. The Major goods that might come under the GST rates slab are as follows:

- Petroleum products including Petrol and Diesel

- Land

- Electricity

- Others

There have been a total of 37 GST council meetings conducted till October 2019. The meeting is chaired by the Finance Minister who aims to give clarifications and recommendations to make changes in the GST rates for various goods and services. In the 37th GST Council Meeting that took place on 20th September 2019 resulted in changes in the GST laws for MSMEs and the rates of certain goods and services.

The major decisions of the meeting include the waiver of GSTR-9A filing for the Financial Year 2017-18 and 2018-19. The introduction of the New GST Return System was also announced in the meeting that will be started from the month of April 2020.

Introduction of the GST system has many benefits for the economy of the country. Some of these include Enhancement of exports and investments, Uniform procedures for registration, filing of returns, payment of taxes, and tax refunds, Simplified tax structure with fewer exemptions, Regulation of Unorganised Industries, Lowered Tax Burden on Industry and Trade, taxpayers will have a common portal (GSTN), Common Procedures, Help the Government Revenue Find Buoyancy, Increase in manufacturing processes, and most importantly bringing uniformity in Taxation.

Picture Source: SAG Infotech, Business Today

Also Read: Zomato Buys Uber Eats | Flipkart Invests in Ninjacart | EbikeGo

POPULAR POSTS

March GST collection up 11.5% YoY at Rs 1.78 lakh cr, FY24 mop-up crosses Rs 20 lakh cr

by B2B Desk, 2024-04-02 07:10:53

GST officials serve tax notices worth ₹1 lakh crore to online gaming companies

by B2B Desk, 2023-10-25 09:38:27

GST Council meet on Oct 7, review likely on implementation of SGST law amendments by states

by B2B Desk, 2023-09-27 06:56:43

Rs 290 Crore GST Notice To LIC? How Insurance Behemoth Responded

by B2B Desk, 2023-09-25 09:03:19

Ultimate guide on GST compliance for SMEs : Importance and Guidelines

by B2B Desk, 2023-06-28 11:16:25

Simplifying GST Collection for E-commerce Businesses in India

by B2B Desk, 2023-06-20 11:28:48

GST collection hits all time monthly high of 1.87L Crores in April 2023

by B2B Desk, 2023-05-02 06:07:46

RECENTLY PUBLISHED

Hong Kong and Singapore ban MDH and Everest spices over cancer concerns

- by B2B Desk, 2024-04-23 08:46:04

Top 5 best credit cards in India that offer access to airport lounges

- by B2B Desk, 2024-04-23 11:14:13

Zomato raises platform fee to Rs 5 and pauses intercity delivery operations

- by B2B Desk, 2024-04-22 09:43:38

Nestle's potential regulatory trouble in India over sugar issue; brand clarifies

- by B2B Desk, 2024-04-19 08:53:55

Subscribe now

Subscribe now